It's time to stop feeling like you're drowning in your debt! Learn how to get out of debt fast so you can reach those financial goals and dreams even faster!

Debt is no joke! It can hurt your credit score and can make you feel trapped! Seriously, debt can make even the smallest decisions become hard or impossible. But debt is sneaky! When you first go into debt, it may seem like it's helping you… Giving you an opportunity to do something you may not have been able to do before. However, it becomes overwhelming if you don't pay it off quickly… We've been there, so we know exactly how helpless and scary it can feel!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Don't worry, there's a light at the end of that dark tunnel, I promise! I'll teach you how to get out of debt using three of my simplest and BEST budgeting principles. Plus, I've got some extra tips to help you crush your debt that much quicker! AND we've made some super handy free printable debt trackers for you to stay on track and focused. But first…

A LITTLE BACKSTORY

As many of you know, Bubba and I got ourselves into significant credit card debt when we were newlyweds, working to build a business. In a short amount of time, we found ourselves with $10,000 on just one credit card (about $15,000 in total outstanding debt), an SUV we couldn't afford, $0 in our bank accounts (thanks to a real estate investment gone wrong), and little to no income. It was…terrifying, to say the least.

In researching, I read all about how to pay cash for a house or car, or what 401K's to invest in. I also found loads of sites showing how to find good deals and coupons to clip. But I found no one online who spoke “Jordan.” No one to help me manage the day-to-day, real-life finances: how to clothe my kids, make my house a home, and date my husband without breaking the bank.

When it came to realistically managing day-to-day, real-life “lifestyle” finances and budgets, I forged the way on my own… and it worked.

HOW WE GOT OUT OF DEBT

Instead of focusing on the $500, $1,000+ dollars that we didn't have as much control over, I created systems for organizing my day-to-day dollars. I quickly learned that the way to get out of debt, even on a tiny income, didn't come down to the big numbers. Rather, it was the $1, $5, and $10 daily decisions that made all the difference.

We managed to get out of $15,000 of debt… in one year, on a $31,000 salary!

Today I'll share three of the biggest principles I used (plus a few extra tips) to help our family get out of debt. I love sharing these tips to help families. In fact, this blog and my Budget Boot Camp program (use the code FCFBLOG to get 10% off!), have helped hundreds of thousands of families tackle their debt and get their finances in order. And they can help you, too!

And wouldn't you know, it's simpler than you think!

HOW TO GET OUT OF DEBT

Alright, we're going to break it down for ya! Watch the video over how to get out of debt online HERE, or click to watch the video below:

Now, on to our best tips that will help you to get out of debt…

STEP 1: REDUCE YOUR SPENDING

The first step to getting out of debt is pretty straightforward, but sometimes hard to put into action! Reduce your spending. Seriously, it's as simple as that! If you can reduce your spending and cut out anything that's not essential, then you will immediately cut down on the amount of debt you're working yourself into! Plus, it'll give you a little extra moola to put towards your payments.

STICK TO THE 70% BUDGET RULE

The 70% budget rule is a simple concept that works no matter what your take-home income is! Basically, you figure out what 70% of your monthly take-home is and you keep all expenses within that 70%. Yes, it may be hard. Yes, it really will work!

Once you get that figured out, take 20% of your monthly take-home and put it all towards your debt using the snowball method. In other words, while still paying the monthly minimums, put all extra money toward paying off your smallest debt. Once it's paid off (yay!), take all of that money and put it toward your next smallest debt. Do this until all of your pressing debts have been paid off. You'll be amazed at how quickly you'll be able to tackle it!

We have a lot of great ideas on how to look at your finances, start a budget, and reduce your spending. Once you you know where your money is going, you're ready to take it to the next level!

DO A SPENDING FREEZE

A spending freeze is exactly what it sounds like…you freeze or withhold from spending any money for a specific period of time. Then put the money you would have typically spent during the freeze toward debt (or a specific savings or financial goal once you're debt-free).

I've heard of people doing spending freezes for an entire month or more. And for anyone who has successfully accomplished this, hats off to you! I personally recommend doing a spending freeze for just one week at a time to start.

Seven consecutive days, that's all! It's a short enough amount of time so you can do it with little to no preparation, but it's long enough where you will save a substantial amount of money in that time. You can do it! I've got even more details and specifics in my spending freeze post, along with a video, so be sure to check that out before you do your own spending freeze!

STEP 2: ORGANIZE YOUR MONEY

Once you reduce your spending, then it's time to get that money organized! Most of us have two accounts — one saving and one checking. Have you ever considered opening MORE accounts to help you organize your money better? I think that every family should have at least 7 bank accounts! It sounds CRAZY, right??

This is one of the most viral concepts I've ever had…and for good reason. This is one of the single easiest things we did to get out of debt fast. And you don't have to have lots of money to do it. In fact, we were living paycheck-to-paycheck at the time when this started working for us!

Organizing your money allows you to see exactly how much money you have in the bank and gives it a purpose. Once it's organized, then you know how much you have for your monthly budget and how much extra is available to throw at your debt.

STEP 3: TRACK YOUR SPENDING

Alright, so you've reduced your spending and you've gotten your money organized… Now what? Probably our favorite and best tip to get out of debt is to start tracking your spending! This makes you aware of exactly where every penny is going.

This may sound daunting, but you can divide up the spending responsibilities with your spouse. That'll really help take all the pressure off of just one person! Once you get that divvied up, it becomes a lot easier to track everything.

HOW TO TRACK YOUR GROCERY BUDGET

Did you know that second to a mortgage, the average American's grocery bill is their next highest bill?! Astounding, right? But think about how much your grocery bill can be every time you go to the store… and then how many times you go to the store each month.

Do you believe me now? Getting your grocery budget under control is easily the BEST thing you can do to get out of debt fast. Stop throwing your money down the garbage disposal, literally! It may sound crazy, but I suggest a grocery budget of $100/person each month, starting at $300 a month.

This means if you have a family of four, your grocery budget is $400. Break your monthly budget down into a weekly budget and it'll become so. much. simpler. to track! If the month has four weeks, then your family will have $100 to spend on groceries per week. That may seem like a challenge, embrace it!! See how far you can stretch your grocery budget!

Keep track of how much you're spending at the grocery store (on all consumables, like groceries, toilet paper and cleaning supplies). Try to stay under budget so you can apply any extra money you were spending weekly at the grocery store towards paying off debt.

Now you know my most important principles about how to get out of debt, let's go over a few extra tips to help you go that extra mile and tackle your debt even quicker!

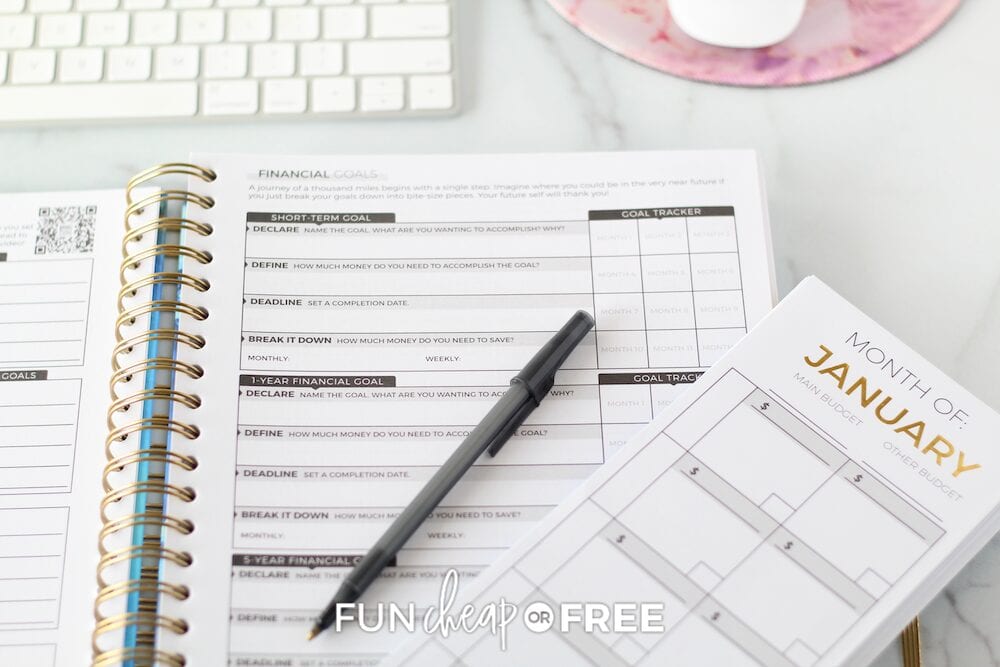

PUT THE BUDGET PLANNER TO WORK

Did you know I've designed my own Budget Planner to help keep track of all your finances?! It's been a game-changer, for sure. It puts all of my best principles into one super easy-to-use and organized place.

HOW TO GET OUT OF DEBT FAST

Okay, you've started applying the above principles to your finances, but you want to take it a step further and really see that debt drop. Here are a few more ways to get out of debt as quickly as possible!

INCREASE YOUR DEBT PAYMENTS

Did you know if you only pay the minimum required on your debt payment, you're probably barely even touching the principal? The debt keeps growing if you don't tackle it and pay it down quick! Here are some of the best ways to really get out of debt quickly.

- Pay MORE than the Minimum Payment – If you want to get out of debt fast, then start paying more on your principal each month! It doesn't matter if it's a little or a lot, anything extra will go a long way.

- Start a Side Hustle – Increase your income with a side hustle or gig job. Then, take whatever money you make from those and put it all towards your debt!

- Snowball your Debt – Start with your smallest debt and throw all of your extra money at it until it's paid off (while still paying the minimums on all other debt). Once that's paid off, take all of the money you were throwing at your smallest debt and put it toward the next smallest debt. Keep doing this until you've paid off your debt!

- Sell Things You Don't Need – If you have items lying around your house that you don't ever use, sell them! Have a garage sale or sell them on Facebook Marketplace. This could be anything from the decor you no longer use to your couches or car. Don't be afraid to get scrappy! Take all that money you earn and put it towards your debt.

- Make Some BIG Sacrifices – Want to know how to get out of debt the quickest? CUT OUT ALL POSSIBLE EXPENSES. We're talking haircuts, eating out, entertainment, and fancy food from the grocery store, to name a few. If you don't absolutely need it to survive, then don't pay for it right now! Yes, it will be hard. But it will only be for a little bit and it'll be worth it to become debt-free!

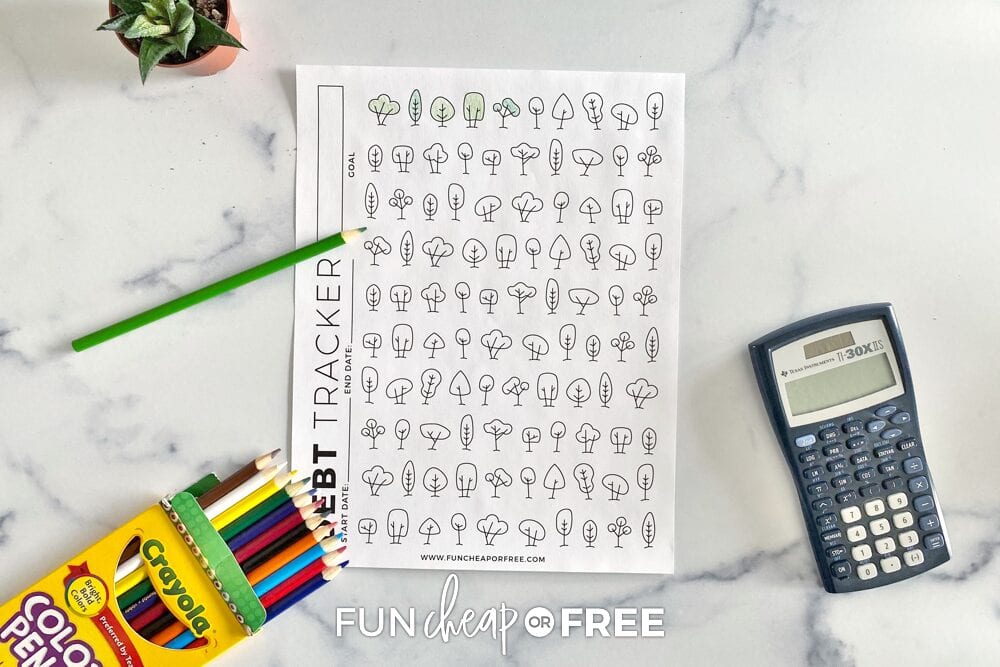

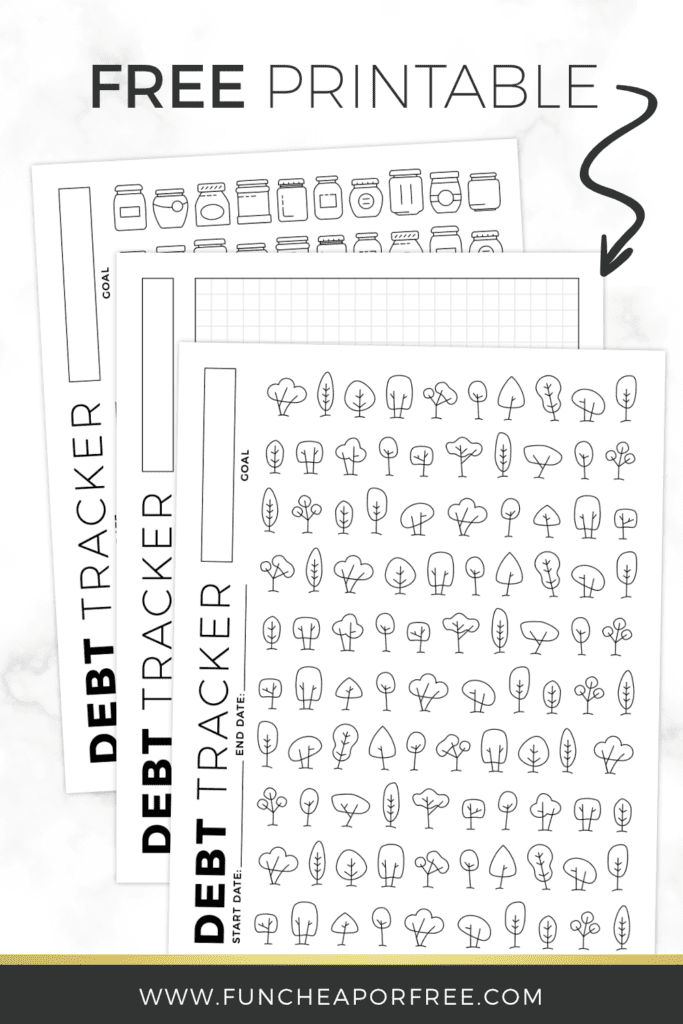

USE OUR FREE PRINTABLE DEBT TRACKER

While you're slaying that debt, it can be hard to stay on top of it all and feel like you're actually making progress. A debt tracker is the perfect way to keep up with everything! Lucky for you, we've made a few that will rock. your. world.

Simply figure out what your goal is and divide it by the number of trackers on the page. Once you pay off that amount, color in a tracker! It will feel SO good when you start visually seeing how you're paying off your debt. Feel free to break your debt down into a few months at a time if that helps you feel more accomplished. Just print off more debt trackers until you've crushed it all.

HOW TO STAY OUT OF DEBT

Once you're out of debt, you'll want to stay that way! Here is the number one principle you need to understand to make sure you never end up in that scrappy position again…

NEVER SPEND MORE THAN YOU EARN

Sounds pretty basic, huh? Develop smart, frugal habits to help you save money and reach your financial goals. Here are a few of my favorite frugal living tips to help save money!

- Make Savings Goals – Once you're out of debt, don't stop saving your money! Start building up an emergency fund and other small savings funds to help you be prepared for whatever comes your way!

- Become a Shelf Cooking Pro – Stop going to the store for every ingredient a recipe calls for and start shelf cooking, using what you already have! Developing smart meal planning habits and learning how to shop your fridge and pantry shelves will help you save so much money.

- Save Money on Bills – What? Did you know this was a thing?! We've compiled the best tips to save some moolah on your heating and electricity bills you definitely don't wanna miss out on!

- Live Frugally – Our family's frugal living is what helped to get us out of debt fast… So much so that we still live that way to this day!

I know some of those sound daunting, but they're guaranteed ways for you to get out of debt fast!

I EVEN TAUGHT RACHEL RAY HOW TO GET OUT OF DEBT!

Yes, you read that right! I went back and did another segment with my girl, Rachael Ray, about how to get out of debt (…in 3 simple steps, even)!

It was so fun (if you can't tell, I absolutely LOVE going on that show!).

They compiled clips from my debt segment that you can watch online or click and watch below:

If it's good enough for Rachael, then it's good enough to help you get out of debt! 😉

LET BUDGET BOOT CAMP HELP YOU GET OUT OF DEBT

If you need more assistance and hand-holding, Budget Boot Camp to do all the heavy lifting for you! All you need is a screen and you're set!

And don't forget, if you don't save at LEAST what you paid for the program, I'll refund every dime. Use the code FCFBLOG to get an extra 10% off, because I love you 😉

HOW TO STILL LIVE A LITTLE WHILE PAYING OFF DEBT

Just because you're on a journey to becoming debt-free doesn't mean you have to sit around the house, twiddling your thumbs for fun! We are living, breathing proof that you can still enjoy your life and find fun, free things to do in your area. Invite your friends over for a game night after dinner, have a free date night with your sweetie, easily find free things to do around you that are still super fun!

No more dropping loads of money to have fun, especially while you're paying off debt. Change your way of living and even once you're debt-free, you'll still be living the frugal life that keeps you where you want to be in your life!

Now, get out there and kick that debt in the teeth!

Don't miss out on these other great articles!

- Set some financial goals you want to hit once you get your debt paid off!

- Yay, you've reached your goals! Now what? Celebrate your successes and treat yourself!

- Looking to start a budget but don't know where to start? We've got your back!

XO,

Is your grocery budget of $100/person done with the plan of the whole family being at home for all meals and snacks? In other words, do you plan breakfast and supper at home, but plan for the children to eat at school? I am a homeschooling mom, so my family is home all day everyday. I’m wondering if I should increase my grocery budget based on that? If so, how much would you think is a good amount to increase?

Thank you for budgeting tips!! I am implementing the grocery budget. So easy!! Thanks

I’ve been using your tips and I’m so happy I started!

I love the idea to take your grocery budget and break it down into weeks. This is super helpful because people usually go grocery shopping once a week not monthly.

Getting ready for a spending freeze here too!

Spending freeze are my new fav. I love and look forward to the purging and cleansing feeling that follows after a good freeze!

I love how you take all the drama out of budgeting and make it so simple and attainable. It really is a breath of fresh air.

You’re so smart and make budgeting seem fun and actually doable! I have been using your grocery budgeting system and it’s saved us hundreds and hundreds of dollars. Thank you!!!

Trying hard to rid ourselves of debt, ugh! So much harder than it appears! Thanks for the tips!

Thanks to you my husband and I are well on our way to being debt free!! Hallelujah!

Thanks for sharing your tips! I can’t wait to try them out(and read your other posts!!) to help us finish paying off student loan and car loan debt!

This. Simple and easy techniques! I especially love the envelope technique. I used to think the cash envelope idea was phenomenal but it turned out to be sooo hard to work with. Your strategy makes it easier to follow through! Thanks!

I would love to win a budget boot camp! My husband and I are in significant amount of debt from his school. He graduates in a couple months! Pick meeeeeeee!!!!!

I love your tips!! I’ve always been a good saver but always love learning more about better ways to do it and pay things off quicker! Thanks for all your advice and for being so open and down to earth!!

Very interested in this boot camp! My husband and I are stepping up our game this year and need a little help! I feel like this could do the trick!

I love the idea of a spending freeze!

Love this!! I hoping my husband and I can implement these things into our lives

You are amazing!!! I love your money saving tips!

I’ve been following you and love your ideas! My mom taught me to be frugal in every way possible, too! I like learning new ideas!

My husband and I just paid off our debt with some of our tax return, but we seem to be in the same boat every year. Just paying off the last years debt. So we don’t get to do anything substantial with that tax money (savings, vacation etc.)

I’ve been following you for a while, and can’t wait to get your program!

Love the envelope trick!! Definitely incorporating that!

Watching your budgeting video on the I am Mom Summit was the best thing I have ever done (not kidding!) My husband and I have always been pretty smart with our money but I am guilty of spending way more than I should shopping online and throwing all the oreos, ice cream and whatever else I “need” into the grocery cart. My husband just graduated from Physical Therapy school last fall and we have over $200,000 in student loans (YIKES!!!!). I made him watch your youtube videos and we are in desperate need of Budget Boot Camp! HELP!

Love this. Hubs and I are working on our financial disaster now.

You always have the best advice! Thank you for sharing.

Jordan your financial tips absolutely amaze me, and you are such an inspiration.

Thank you!

Thank you for your time to provide this life changing information

Love all of these tips! You are such an inspiration

Thank you for sharing!! I have done a few spending freezes with you and love how much they help! I am amazed at how much will power I have- when I look at one week at a time!! Trying your simple budgeting technique and suggestions for a smaller grocery budget this month!

I would love to win your budget boot camp! Thanks for motivating & inspiring!

I really would love to do this ?

So informative! I’m really interested in reading more about having 7 back accounts:)

I keep a spreadsheet of my budget and love your family’s tips and guides, thank you! Looking forward to crunching and payingmy student debt off!

I love all your tips on getting out of debt- especially how it’s really the little things I spend money on everyday that make a huge difference!

My husband and I have been paying off our student loans for just 8 months and we’ve already paid off $7,000 of the $20,000 we owe by following the tips on your blog and Instagram! I LOVE following you and always feel inspired by your down to earth solutions. ❤️

Thank you for the encouraging words!! My family is working on paying off debt now and using our own variation of your system right now.

My husband and I are so ready to start implementing this! ?? Bye student loans… hopefully!!! We need this sooo badly!!

This has been very helpful! Thank you for all that you do! ♥️

My husband and I desperately need your help! We need a budget overall. Thanks for your tips and I’m going to talk to him about doing budget boot camp!

These are such great ideas!! I definitely will be using your envelope system! So much easier than the other, more complicated ones.

I really love that you point out- it’s not the big numbers, it’s the $1,$5,$10 decisions daily. I think that’s my biggest problem! Instead of putting those dollars toward our debt, I think, “I can treat myself a little.” But I ‘treat’ myself WAY too often! Those one and five dollars make a difference! I need to work on that; reign it in!!

SO excited to try these out! Thanks for all the great info!

Love the 7 bank accounts idea! My husband and I just opened our 3rd and even that has made such a difference!

I seriously am the worst at budgeting so I loved this post!!

I think it’s so true about the daily small amounts of money we spend! Those $5 to $20 purchases really add up!

I did a spending freeze a few weeks ago! It was amazing to see how much money I saved!

All such helpful advice!

Xoxo

This post was so helpful. Thank you for sharing all your tips. I love your envelope budgeting technique. So simple!

I lovvve how you said it’s usually the $1, $5, $10 that breaks the budget. I have also changed my thinking when you said it doesn’t do any good to have a savings (except for like real emergcy) when you have any type of debt. And I loooove love love how when you guys talk about money you go out to dinner so that you guys can’t raise your voices. —clearly I love everything you guys do.

I need to focus on those small every day decisions and try to save money that way! Great ideas!

We’re swimming in debt and I’m anxious to get it gone. Debt is outnumbered own fault, but I hat being tied to it. Thanks for these simple rules to start with.

I always tell myself I’m going to make and stick to a budget. Ummm…….still hasn’t happened.

I just started the envelope for groceries and other. I also have been doing one day a week spending freeze!!! Small steps but can’t wait to see the difference.

I love this! My husband and I are trying to get out of debt so we can buy a house and it’s terrifying trying to figure out where to start. This is sooo helpful!

So many great pointers! I love all of the free advice you give but it would be amazing to participate in the budget boot camp and see what you have to offer there!

We really want to get BBC. I am saving up for it. Thanks for your entertaining insta stories. I Look forward to watching them each day.

My husband and I are in a awful cycle of living beyond our means and going into debt and then paying it off when we luckily come into a chunk of money. I’m a nervous wreck about money all the time because I know it’s not sustainable…I love your practical approach. Looking forward to implementing your tips!

Thank you for all your helpful tips and advice on how to get out of debt. That is one of our goals this year. I like how you commented about it’s the small $1 $3 $5 that make a big difference. I am guilty of always saying “it’s only $1. I am setting a new goal, saying no to the little $1 things that we don’t need. Thank you!

Love these tips! Practical and applicable! Fingers crossed to win a budget boot camp giveaway to learn more of your practical processes!

I’m really enjoying these tips! I’ve recently started the week to week budget and it is really helping us! Thanks!

My husband is in his first year of medical school and we are livin off student loans. Already $90,000 in the hole :l Watching your videos and reading your posts have really inspired me to live more frugally and smart! It’s been fun to work together and use your tips to lower our grocery budget!

I hope I win this Budget bookcamp program it so would help me and my family out so much! Thanks for all that you do.

I want to try a spending freeze this coming week!! I also need to sit down and budget!!! I am so cavalier with my debit card swiping that I really have no clue how much I spend. How irresponsible and embarrassing!!

Although my future husband (2 months away, woohooo!!) and I have started implementing all your tips from your blogs, we would love to start your budget boot camp to make it that much more efficiant! Thank you for all your help so far!!!

I to have started noticing it’s all the little things that are adding up..it almost makes me sick adding it all up!

I really need to implement all of these in my families life! We are constantly stressed over budgeting and paying our debts off so we can afford a home of our own!

Love these tips! Definitely going to use them to help us get out of our debt ?…can’t wait to have financial freedom!

I love this. Simple 3 things that we can do to start getting out of debt. Thanks for the simple suggestions.

Great tips! I can’t wait to implement these and get my husband on board to start paying off some debt and saving some money!

Doable but effective, my kind of tips!

I just live all your tips they really are helpful.

I’m going to try a week long spending freeze! Seems doable.

I love the approach you have on this! I’ll be sharing all of this with my husband to tackle the debt we have and get in control of the day to day stuff.

Our goal this year is to get out of credit card debt. We have implemented some of your ideas but we need to be consistent each week. It’s so true, it’s the small transactions that add up quickly.

After watching your videos, I opened 7 bank accounts. I DOnt do a very good job of checking them, though! Time to recommit.

My husband and I just became debt free last summer. We have been trying to move on to saving our emergency fund and retirement and college savings. I have used your budget percentages for the last 3 months but feel like I could learn so much with the BBC! Im finding it challenging to stay encouraged that we will reach our emergency fund goals especially after focusing so hard on kicking our debt to the curb.

We currently don’t have any debt, but would love to apply these concepts to saving for a house!

Really good ideas. We are working hard to pay off student loans and can’t wait till we are done!!

I’ve started using some your tips. thank you. Now I want to get the boot camp. I’m starting to budget that out.

I missed the Rachael Ray show. Thanks for posting this.

Some awesome ideas that I need to implement pronto! Thank you!

I’m excited to do this! You make it sound so simple!

I love all of the great tips you shared here!

This is the best advise ?? “I quickly learned that the way to get out of debt, even on a tiny income, didn’t come down to the big numbers. Rather, it’s the $1, $5, $10 daily decisions that made all the difference.” ??

So true. I have seen time and time again that is the little expenses throughout the month that kill the budget. Thanks for ways to budget better.

I’m showing this to my husband in the morning!!! WE NEEEEEEED HEEEELLLLLLLLLLP!!!! ?? ? ????

Love these!! Can’t wait to start implementing them!!

Love this!

We just paid off 3 credit cards! It feels so nice.

Love this! Thanks for the tips! I need to do your budget boot camp, not because we are in debt, but because I want to put more in to savings, we want to adopt more children and don’t want to go in to debt doing it.

I would really like to try this! 7 bank accounts sounds like a lot but I’m sure it’s not as complicated once you get started. I am going to try really hard to do a spending freeze.

Thanks for making this so simple.

Great ideas and easy to implement!

I need help with budgeting. I make a food budget and try each month to follow your rules and still fail:( I know I’m doing it wrong and can’t figure out how to break the cycle

I’ve been an insta follower for a while and you make it look so simple. I’d love to try this to see if its as simple as you make it look.

I am so glad I found you!! You are the real deal and I just love the advice you offer!! Thank you so much!

The budgeting system is a game changer! I love how you explain how to borrow money side to side instead of from the following week.

Been following for a while and working on my 7 accounts! Thanks!

I’m a single parent, no credit cards, an a bachelor registered nurse, school debt paid off, in my mid 30’s and will have my home paid off this year ?

My fav is the envelope ✉️ you teach, I live to be organized!

Would love to learn the entire boot camp!!!

Oh and I have …… 14 accounts! It may be excessive but it keeps me organized!!

Going through this blog reminds me of how much I enjoyed your spending freeze. It’s a great challenge and accomplishment when you’ve gone a whole week without spending anything.

Great ideas, tips, and tricks. I love how simple you make it sound, but I know it will be some work. Thanks for your help.

I’m in love with your envelope system!! It’s so simple! I have tried many systems before but none of them ever stick. I have been trying to make my money behave for sometime. I’m hoping this year I can join your budget boot camp. I feel I could benefit from it. I enjoy any/all the tips you offer!! Your amazing and inspiring!!

In reality, can a single mom do the seven accounts and still manage the rest of the bills??

We love watching your insta stories and hearing your great tips! I’ll have to look more into your getting out of debt tips!

I’ve been trying to get my hubby on board with saving up our money for what seems like forever! He’s the type where if he has an extra dollar he’s going to find something for a dollar to buy. While I’m the opposite and hate spending money. He makes about four times more than I do a month so I feel bad trying to tell him how to spend his/our money all the time but he recently said we should start saving a part my check each month so that’s a start!

I love this! So basic and easy for anyone to understand and follow. I have definitely become more aware of my small daily purchases that are adding up since you posted about this. Thanks!!

Winning this BBC could be a major game changer. ❤❤

Loving your blog! Glad I found your Instagram ?

You came along right when we needed you! We are currently in the depths of our own FD and you give us real hope of getting out! We haven’t had the money to purchase BBC yet but home we can soon!

I love the ide of a spending freeze. Daunting- yes. But results in 7 days!! That is totally doable!!

Love it! Thank you thank you!

<3 Anneli

I’m going to start the envelope budget this coming week! Wish me luck!

I love how simple you make budgeting!

Thanks for another informative post!

I’m a new freeb (introduced to becoming a free from the I am mom summit). I’ve been watching YouTube videos of yours like crazy and have been so inspired! I actually just got done with the spending freeze. It was awesome and way easier than I expected. Since about September, I have been really trying to build up my food storage (still a lonnnnng ways to go), so I had a decent stockpile. I’m terrible at figuring out what to cook that I didn’t meal plan/find in a recipe book. So the morning I started, I went through all my food and made a list of 14 different dinners I could make from what I had on hand. So if I hadn’t run out of produce, milk and eggs, and having a birthday party for our daughter, we could have gone a lot longer. Thanks for your example and inspiration!

Love this!! Tried doing it last year and it really helped us. We’ve kind of fallen off the wagon but really need to get back on track!

Thanks for your help with everything. Not only do I love your advice from debt to cleaning and everything else but you brighten my day. Thank you thank you thank you.

I love how simple you made it seem. This is something I can do! I’m excited to start tackling our debt as taking our lives back.

We’ve done it!!! This month we stayed to 100$ a person/week! We kept track in February on an envelope like i saw you present i. The Rachel Ray show! I can’t believe how good it feels!! I know there’s days still left in February but i have a meal plan and know we will make it! Thanks for your help!!!

I’m not fully sold on the 7 bank accounts idea…yet! However, I do have 3 different savings account, an accelerated savings that has to stay below $1,000, a savings that $50 from each paycheck goes into and I honestly try to never touch and then a regular savings. I’m going to think more about the different savings but feel like it might give me too much anxiety keeping track of them all. I also have a HSA through my insurance. I got to brag a little about myself that I literally just paid off one of four student loans and one of my credit cards this month using the snowball affect!! Whoop whoop! Happy dance!

I will definitely be opening more bank acounts now. Very helpful blog post.

As a young newlywed this is so relatable! I love all of your tips.

This is brilliant. I am going to try it, and save money, and pay off debt off debt when I win Budget Boot Camp!

Spending freeze, 7 bank accounts, budgeting techniques… “Oh My” this has to be better than what I’m doing now!!! I would love to get my hands on Budget Boot Camp!!!

Thank you. These are great ideas!

I watched this on Rachel Ray and I can’t wait to try out a few of these! We just bought a house so it’s time to re evaluate the budget!

I’m not sure if we need 7 bank accounts in the UK but I understand the logic and I’m going to give it a go, Il let you know how many I need 🙂

My husband and I need this in our lives! The only debt we have is our house; but it’s a lot! I’m afraid you’re going to tell us that the only thing we can do is sell our house! Hoping for some good, positive answers! ??

Leaving a comment for the BBC giveaway!!!!! ❤️❤️

Awesome !

Seriously love all these ideas! So inspiring and motivating!

I have personally used these methods and love them.

Love the envelope hack!

Love this blog post! So helpful

Hi! You both are sunch an inspiration! My goal for 2018 is to get more intelligent about money and finance, most of all working hard to get a peaceful money-mind. I would love to try your budget boot camp and learn as much as I can from you and your life-experience leading up to today! Lots of love from Nina in Sweden ??

We just started following you and you and your story are seriously an answer to our prayers! We actually feel like we CAN get out of our ridiculous amount of debt, on a single budget, with two babies! It’s possible lol! We have been soaking up all we can from your IG, Blog, YouTube, and FB accounts, but have a looooot of learning to do still! I would LOVE to get you program to understand more!!! Thank you!

I really appreciate all these tips! Thank you!

This has helped me and my family so much! Thanks for sharing ?

We’re in this process. It feels never-ending but love how simple these 3 steps are. They feel achievable

I only have a few thousand in college debt but it is taking a toll on my credit score! This has helped me so much!

Such good tips. We are excited to do these!

Looks great! Can’t wait to put these tips into practice and be debt free.

So many legitimate and useful tips! Thank you for how much great {free} content you shared here. I spent quite some time reading your previous posts linked too. My husband and I are finally debt free!! ??? And we have been so grateful to hear some tricks to keep us on track to save. Currently striving for the 70%!!

We just opened a new checking account (with a new bank) as well as husband and wife accounts. I am excited to try this!

Your tips are amazing Jordan. My last month was much better!!

So much great advice!

Love the simplicity of this, but I know it works! I’m going to do a spending freeze this next week and I actually can’t wait!!

This is the greatest advice ever! Thank you so much for taking the time to teach your magic to us!

I love the idea of his and hers checking. I’m continuously getting frustrated with my husband over his little spending habits. He buys lunch or breakfast every day at work and those little things add up! We have discussed taking out cash for the week, but that burns up so fast! Love this idea! But will it hurt my credit to open more accounts?

Listening to you makes it sound so easy but I’ve yet to put anything into motion I would so love to win one of your Boot Camp giveaways. We have our own business with no regular income so it feels impossible to budget! Love what you do!

I’ve been using your budget advice and so far have paid off 1 credit card and 2 smaller loans.

This is great! I like the spending freeze and I like how you’re realistic about it (one week). I feel like this would be great easy first step if you got out of hand with spending each time. I like what you say about the smaller purchases bc they do creep up on you. I truly believe it was that, that got me so in the hole.

We are working on being better with more accounts. Just a little harder than I thought to get use to it. You guys are awesome!

These are great tips!

Very interested in trying out your program.

Such great resources! Thanks Jordan!!!

I wish they would do whole segments in case we miss seeing it. I enjoy watching you on tv but i wish you had more time so you weren’t rushed.

YOu have inspired us! We are trying to dig out of our FD. My husband just got a new job that includes a decent raise in our income. We have decided for the next 6 months (baby steps!) to really crunch down and live on a smaller amount to pay off all our credit cards! In those 6 months, if we push it, we will be able to! Then next up, our vehicles!

I’m excited to start paying off debt and hopefully be completely debt free by the end of the year! I am the worst at $1-$10 purchases lol

This is helping me keep focused so much as we are paying off dental school debt! Also helped me simplify my budget so I stay on target.

My family USC in the same predicament you and Bubba we’re in when you started… I need to get my hubby on board

We’re in the same boat paycheck to paycheck about 15,000 in cc debit… I need to get my hubby on board.

This is the month of our spending freeze! 2018 we are going to rock it!

This was helpful.

I am interested in learning more

My husband and I are going to start implemetning these techniques to help.get our budget under control. Youre very inspiring and motivational. Thank you for all that you do!

Thank you for sharing your tips! My husband and I are working towards being debt-free and these will come in handy. I have already started using multiple accounts per your suggestion!

You are truly an inspiration!

I love this so much. I want to get BBC but haven’t financially had the “extra” money for it lately. These tips and tricks are just amazing. I’ve already implemented the envelope trick! I love it

Love these ideas.

These are such great tips to get out of debt!

This is soooooo good, you should write a book, easy to read and to understand. Thanks for hacks ? wink wink

Thank you for all your info. I have been following you guys for a while but am finally starting to implement things into our life. Multiple bank accounts is one thing I have been wanting to do but scared so after reading/watching this post I feel more equipped to make decisions on which banks and which accounts. Love u guys and all u do!❤️

Best tips ever! keep it up!

I am Starting a budget for the first time, and was feeling overwhelmed!!! SO THANKFUL ? I have found your posts to help me get out of debt!!

You’re such an inspiration, Jordan! My husband and I have tried many, many get out of debt programs but none of them have made sense. We haven’t had the extra funds to be able to purchase BBC, so I’m hoping to win one of the free 20 programs! Thanks for all you do!

I need to hop on the envelope train. Thanks for breaking down all the steps. Tons of great info.

We have started using the simplest budgeting system ever and you are so right. It is so easy and we have saved so much on groceries already. At this rate, this time next year we will already be in our own home. Thank you so much for everything you do.

Your story encourages me to get our family out of debt before it gets too out of hand! ??

Thanks for sharing!

Love it

I have applied so many of these tips through watching your ig stories. You’ve been a lifesaver! Hope to win. Thanks Jordan! #freebsnation

Yes! I’m a single mama to a toddler and a full time student trying to succeed in my career. My goal is to be debt free by the end of this year on yes just one income. Thank you for the resources!

We’ve applied these steps and chugging along. You’ve been a lifesaver Jordan Page! Xx #freebsnation

Thanks for the resources and information, this past year was a tough and wasn’t sure where to start. Will be sitting down and implementing these ASAP!

What are your thoughts on consolidating credit card debt?

I am going to try several of these tips this year!

I would love to get out of debt and work to getting my house paid off so we don’t have the crazy stresses in life and can travel more. We are almost empty nesters (like 7 years away) and don’t want money stresses.

Great tips. I look forward to using!!

Love this tips. Especially the spending freeze. I think my husband would think I’ve gone crazy if I suggested it. Haha!

Great tips! I look forward to using them to get my family out of debt

Ready to tackle this!!!baby comes this summer and I want to be in a better place!

I’ve been doing the envelope system for a couple months now and it has changed how I see money. Now instead of wondering where my money is going, my money is working for me and I know exactly where it is going.

Just recently separated/divorced…… Basically cut the income in half and still have too many bills..I am in desperate need of a budget overhaul! Love the Rachel Ray segment, btw!

I was laid off at the end of last year and just found another job. Trying to catch up on the things that got behind. Trying to put some money aside so I can purchase the budget bootcamp! You are truly and inspiration to many keep up the awesome work!

Thanks for sharing this gem! My husband and I have been implementing these steps since November and have noticed a huge difference! We haven’t reached our goal yet, but I feel confident that we can with these rock solid principles. Thanks Jordan!

Love your advice! I’m working towards debt free and I think your program would help us so much! You speak to me!!!

I love hearing all of your budgeting/family tips! Thank you for doing what you do!

Awesome information and steps for getting out of debt!!! Thanks!

Needed this one! Thanks for all the great tips!

I recently became a budget counselor at my church, and I can’t wait to utilize some of your tips into my counseling appointments! My husband and I have 8 bank accounts, and I love that you back that up when we feel crazy for having that many!

Starting my freeze now!

Thank you for sharing these tips! They are so simple and helpful.

I came on here to leave a comment to win a budget boot camp program….and I really needed to read this. We legit cannnot afford your program so I pray we win this!

Omg I am not gonna lie I never read your blog but have been a YouTube folower for years, and on IG I saw your hive away thought I give it a shot and come read a post so I could comment boy did I pick a good blog read so much info. Love you Jordan

Great information! Thank you!

Yes!! These are great tips!

Really good advice as always!

Good information throughout the whole article….thanks for sharing!

I’ve been saving to purchase BBC winning it would be SO AWESOME!!

Do you know if you’ve had people in Canada use your course and find it applicable?

Love your information on getting out of debt!

This definitely speaks to me more than other programs I have looked at. I’m thinking seriously about doing BBC because of it.

Thanks so much for all of this wonderful info. My husband and I are struggling with so much debt right now and all of the ideas you have given me are helping us.

I’m putting my 21 year old son on a budget since he is spending all of what he makes! He needs to learn how to budget his money so he doesn’t go in debt when he moves put of our house.

Jordan this is such an awesome system. I’ve been following you for about a year. My husband and I don’t have much debt and have a pretty good savings but I would like more and more specific places our money goes, instead of just 1 savings account and a checking. Thanks for all the great tips!!

Thank you so much Jordan for taking the time to create this blog and the videos. It has been a blessing for me and I know it is a blessing for many!!! I really do appreciate it!!! Keep it up you are helping many families like mine!!!!!!!!

Thank you for sharing your life and tips! I’m reading this out loud to my family!

You’re amazing! Great advice!

Thanks for all the info! I am excited to try it!

I just love the simplicity of this method!!?

I really want to work on budgeting, we eat organic and it seems like we don’t have much control over our food budget either… I need to learn how to fix this!!!

I love your simple budget technique! I feel like sometimes I get overwhelmed but this should make it easy!

Love this so much! We are working so hard on becoming dept free!! Wish us luck!! ?

Debt not dept!! ?

You are so inspiring!

These principles are changing my life!!!

My husband and I have been using this program for 3 months now and it has allowed us to save an extra $700 a month! Thank you so much ?

This seems like something I could do!

I’ve watched 2 of these already- can’t wait to watch the others!

You guys are a life-saver! Wish I would have known these ten years ago ??♀️

Love the simplicity of the envelope method.

I am going to implement the 7 bank accounts and I am looking forward to doing a spending freeze.

Oh my gosh!!! This is SO helpful! ???? Thank you!

Loved all the great information.

Love your advice!

I love how simple you make this! I’m going to try the FREEZE spending, it’s amazing how much we spend in one week on littl things we don’t need!

I LOVE this! We recently started doing your shelf cooking concept and guess what? I am currently $160 under budget this month for groceries and I have done all my shopping trips. Now that is savings right there! I can’t wait to read more tips from you!

I’m looking for any and all tips on getting out of debt! Can’t wait for that freedom.

I love watching your videos. I have learned so much about getting our finances under control.

Such great tips! I need that extra push to help us get out of debt and be able to get a house! I need to make that dream a reality for us!

I can’t wait to show and tell my husband about you. As well as to follow all your tips and learn more.

I’ve heard great things about this from many people. I can’t wait to try it!

Such great advice, hoping to be able to do the budget boot camp soon!! We’ve lived paycheck to paycheck for way too long

Having 7 bank accounts is genius! That’s what I want to do next as I am trying to manage our money better.

I’ve already implemented several of your suggestions, we now have multiple accounts and I love it. The 100$ a week on groceries has proven to be harder than I anticipated though lol

Your tips came at just the right time for me. We recently took out a big car loan to get a bigger vehicle that would fit our growing family. Although our debt is pretty manageable, these tips are helping us to pay off our loan in less than half the time (which equals money in our pockets later!) Thank You!

Such good advice! We don’t have debt (besides our mortgage), but living on an educators salary with 3 kids, myself being a stay at home mom… these tips are so helpful for daily, monthly, yearly living!

I need to read through this with my husband! We are trying to get out of debt now and a lot of these would help! Thanks!

Commenting for the Instagram giveaway but I’ve been using your envelope budget idea for the last few months and LOVE it!

7 bank accounts sounds so daunting, but it’s a very interesting concept. I really like the 1 envelope idea! I think I see Budget Boot Camp in my future

Thanks for these simple steps to reduce spending and debt

I am loving all these tips!!! Real life and simple!

I can’t wait to get started. We need a Budget Plan that will work for us. This will simply our life tremendously. Thank you!!!

My husband and I have decided that this year we are going to get out of debt. I would love to take BBC but it just isn’t in the budget. Love all the free content available on this site.

Your brilliant, so simple yet why have we not thought of this ha ha. Thank You for all your videos your family is amazing.

Went from two incomes to one last year and your tips have helped us so much!

I LOVE your budgeting method. I found it and started implementing it in January. Total game changer. I love your point about the little $1, $5, and $10 purchases making the biggest difference. That was always my struggle. It has completely changed my mindset.

This has helped me so much! I am trying to live on the least amount of my income as possible! It’s fun haha

I will love to win this and begin our new journey!

I love all your ideas for getting out of debt. Thank you.

My daughter saw this picture and said “Hey Mom! Look she is rich!” Haha. :)Ava

We are excited to implement these tips and pay off our van this year and build up our savings!

Hi my Daughter is 18 and introduced me to you. I was a single Mom for most of her life I have worked at the same company for 19 years and have struggled with some health problems along the way. I have done a juggling act with my finances for years and was so inspired by watching the video my Daughter showed me. I am turning 40 this year (Yikes ?) and would like to make some career changes and my credit score and chaotic finances have me feeling overwhelmed. I would be honored to win your boot camp. I hope you have a wonderful weekend!

I love all your tips and tricks! They always seem so effortless and apply to real life.

This is such a great framework to work from. Really helped us view our spending and debt from the right perspective.

I already started implementing some of your tips and it’s made a big difference!

Can’t wait to get outta debt!

These are wonderful ideas! Thank you for sharing with us!!!

Such good advice!

These techniques have helped me so much. Thank you!

I feel like we have been stuck in a financial hole for a very long time. I would really like to implement this in our life. We are both tired of constantly worring about money all the FREAKING time.

Such helpful information!! Need to get started with these tips.

I saw you at pinners conference a few years back and you were talking about this envelope! I went home grabbed an envelope, scribbled all our stuffs down and just kept in my purse! it’s like cool quick gkance that reminds me to stay on track every time I grab something from my bag. Also those 7 bank accounts. Helped immensely! Love it! Love you!

Thank you for always freely giving away your tips & tricks! My husband & I are newly married, he lost his job & we too are living on my income alone. one day I’ll save up enough to be able to buy your program! Thank you for the free tips in the meantime. ❤️

I need more of your tips!

This sounds like the best budgeting program; my friend recommended it, and I would love to try it!

Currently using these tips we are on the way to financial freedom!!!!

Great tips! Now to put them to use. ?

Jordan, I love all of your financial tips that you share with us Freebs! I am excited and eager to try them out! One day I’d love to start BBC. ❤️

I love your simple budgeting method. I have used it and I love this simplicity. Worked wonders for tracking my weekly schedule expenses.

Love this! I need to apply this to my family!

Love this! About to binge on your whole debt workshop! Hope I can win your giveaway! Thank you!

It is daunting to think about how to pay off all debts, but this makes it so simple haha! Thanks!!

I can’t wait to try the envelope budgeting it actually makes me excited to budget?! ?

Love these ideas! Simple and doable which is great for a busy and large family. Thanks for the ideas and putting them into “Jordan” words which are easier for me as well!

Thanks for putting these in one post! Easy reference to pin! 🙂

I absolutely love Jordan and her tip for life….. thank you for doing what you do

Your life is seriously goals in my life. Thank you for being open to hard topics.

Paying off debt is so hard. My husband opt-in and works from home to be with our daughter but since we didn’t claim enough money, we owe taxes last year which we’ve been paying monthly. This just pushes us back further on paying off our debt. You are inspiring and we really want to get on your program.

We are working hard to get out of debt and love the tips we get from Jordan & Bubba ❤️

My husband and I make decent money and when he finished college and we had more money we kind of went a little crazy with remodeling our house and buying things. I would like to rein us in and pay off some things so we have more money in savings.

I want to learn your ways! My husband and I REALLY need to get healthy financially and I believe this is the program to change it all.

All of these tips are amazing!!! ?

I’ve just found you and started to slowly watch and read your posts, but already you e helped many things… we just paid off our truck yesterday AND saved $1,000 into our emergency savings along with budgeted out with this months paycheck a fun couples activity out of state. I got discounts on the trip and feeling really good about our direction. Thank you!

I love this! I’ve felt the same way about all the budgeting stuff out there. It just doesn’t seem to work for us! Excited to give this a try!

I don’t feel overwhelmed by debt, but I’d love to proactively save more than we do. I’n going to try these ideas!

Love your blog and instagram feed!

I need to show my family this! ?

We don’t have a ton of debt, but we are working so hard to get rid of what we can. I love all the advice you give!

I have watched this video and read the related posts about a dozen times! So much good information here! I could definitely benefit from a little more hand holding through the re vamp process of our finances, but this has given me such a great start! I’m so grateful! Currently coming up on the tail end of our first spending freeze, and planning to head over to the bank later today to set up additional accounts! Thank you for all that you do!!!

I’m going to try a spending Freeze this week! I can do anything for 7 days. So why not that??

I love your budget tips! I find the simpler the better! Thanks for your hard work!

I’m so excited to try these tips. Thanks so much!!

I love the little nuggets of information but, as bright as I am supposed to be lol, these finances are winning. I need step by step instructions. I’m so glad I ran across your site and will definitely be signing up! Budget Boot camp to the rescue!!

Thanks for your investment of time and energy into helping others learn what you have learned.

I can’t wait to start budget bootcamp! My husband said once I save the money we can do it!! I hate having debt as a newly wedded couple and I can’t wait to start making these changes!

I can’t wait to try some of the techniques you shared in this post!! Thank you! P. S. You’re amazing!!!

This was seriously so helpful!

Omgosh I need to win your budget boot camp give away! Btw- yippee for your 100k followers ?I need to win because I went from a 844 credit score to a while knows now after a horrific accident see the today show interview I did with Matt Lauer after I woke from a coma. I went from a very healthy 6 figure salary to disability (recovering from a TBI-from accident) & now going through a divorce due to domestic violence ? but would love, love, love your bootcamp to budget better & learn all your amazing tricks ? love you & your cute hubby (tell him he needs to end your Tuesday question answers with him dancing- makes my day- maybe even his toe touch!)

I’m intimated to open 7 accounts.

It sounds like a ton but it really isn’t. I was like 7? Yuck sounds like it would be confusing. But if your married you already have 6. A joint checking and savings, and your individual checking and savings. And you’d just need a health account.

My husband and I are currently working on paying off debt so we can start investing in our future, I’m going to start the spending freeze and using envelopes next week!

I Love this!! How amazing! You totally changed my mind set about money. Before we would just buy whatever we wanted… Mostly small purchases and splurge at the grocery store and waste soooo mich foos. Now I am aware of every penny being spent. I think before I spend. I save for stuff i really really want. We spend $100 a week on groceries. We are building our food storage. We are saving alot of freaking money!!!! Woo hoo!!!

My husband and I have decided to pay off his law school loans before we buy a house and would love any help you can offer.

I have loved the envelope system and can’t wait to check out the budget boot camp!

I really like the spending freeze idea! I have already sent your blog to 3 people in the last 2 weeks after reading about it. I’m in health and in my program we do a detox or fast to reboot our metabolism so I loved your idea of detoxing or rebooting your mental state on spending. Thanks for being awesome!!

Love your personality and how simple you spell things out! I need to learn your ways and put them into action!

I’ve been a behind the scenes fan for awhile. I’ve talked about gettin your budget boot camp for about 6 months but every time I commit, someone breaks an arm or has an eyebrow cut open with a tooth. (True stories) I realize that the time will never be perfect, but I would like to get to the point where we have an emergency budget. I set the goal that I want to be debt free, completely debt free, in 5 years. I have taken on a job and my hubby has taken on some extra ones, but somedays I feel like we are still running in the same circle. With 6 jobs between the 2 of us, plus being a stay at home mom, we are exhausted and find ourselves on edge with our kids and each other. I often tell myself “this can’t be our life. This isn’t what I daydreamed about when I was planning out my life.” I know we need help, but help is money that can go to other things and round and round it goes. I committed to 2018 being a different year. And I am grateful that my friend introduced me to your blog! Thank you for being vulnerable enough to share what worked for your family and giving me hope!

Love the spending freeze Idea! I have honestly never heard it before and it sounds totally doable!

Thank you for the tips!

I love your advice and find it inspirational! Thank You

Honestly, the 30% rule has been life changing for me. I have no idea why it took that little tip to get me in gear, but thanks!!!

You are AMAZING!!! Thank you for all of this helpful budget info! I’m so inspired!

So GOOD!!! Our family has fallen off the budget wagon for a while. IT’s TIME TO GET BACK ON!!!!

Thank you, Jordan for all that you and Bubba do and share with us!!

I want to try your boot camp

We used the snowball method years and years ago and it totally works!! The church actually recommends the same method, if you didn’t know that.

My husband and I are so close to getting out student loan debt paid off! It’s my goal to get it paid off this year (aka the year we turn 30). I’ve been loving the envelope system! It’s made things so much easier!

I so appreciate the time you have put in to do what it takes to get out of debt and using your knowledge to help people! Thank you we need this so much. I have not doubt we can do it! Doing a spending freeze ASAP!

I’ve been watching all of your budgeting videos on YouTube all week. I’ve got my budget planned, & we’re starting on March 1st! I’m stoked to finally pay off some debt! (The hubs, not so much.. ?)

Jordan,

Thank you for all the excellent advice! This is one post that I plan to bookmark and return to over and over!

Thanks again for the work you do!

I’ve used your tips to pay off our car, my student loan, and we will pay off my husband’s student loan this year. We paid (and will pay) off our student loans 10 years early!!

These really are such simple principles but can be so hard to implement! I’m working on my spending discipline and I’m excited to see if the 7 bank accounts helps develop that! ? Thanks friend!

We use your envelope system! I learned about it from your blog when I still lived in Utah, like 7 years ago.

I love your story ans your SIMPLE tricks!

We use credit cards for all purchased to help prevent hacks. We pay all the statement balance off each month. Would you consider that debt since we are still having to pay it off the next month?

To help on my grocery budget.. because I LOVE grocery shopping. I do grocery pick up. ? best thing that ever happened. I can see my total BEFORE I have to pay. I’m not tempted by things I don’t really need, it saves me so much time and the coupons are online as well. I can easily check the pantry for things I need while I’m shopping. I haven’t gone over my grocery budget once in a year since I started.

Good tips! Thank you for these!

100k giveaway!

Love your ideas on getting out of debt! This is something we are currently using to get out of Dental school debt

Pure gold! Thank you for sharing your wisdom!! ????

Can not wait to apply these tips!! Thank you!

So flipping freaking inspiring. I want this story. Give me all the inspiration.

I’d love to implement some or all of these tips!

I love your ideas. I have started the envelope method. Work in progress, but I’m doing good!

Jordan! Thank you for offering this program as a giveaway. As a college student with no clue on dealing with finances and how to keep a budget, I would be super excited to win this program and start getting out of debt now.

I really want to do this program, but don’t know how to get my husband on board! We have so much student loan debt it’s terrifying! Commenting to try and win a free program!

Great advice!

Hey Jordan! First of all, I adore you! I’m following you on all of your social media, but your Insta stories and YouTube are probably my fave. Your most recent video from the mom conference inspired me to get my husband on board and whip our wallets into shape!! We just want a life that we love living and more for our daughter, Stella. She deserves the world!! I asked for budgetbootcamp.com for Christmas, but it just wasn’t in the cards for us this year. I would love to be one of the winners for you hitting 100k! CONGRATS!! You go, girl. Never stop doing what you do best: inspiring other moms. xx! Meg

I love these tips. I’m definitely going to try a spending freeze. I think that will help especially with the random Target and grocery store buys.

I love that you make it sound so easy anybody can do this!!

I love this and would be so excited to win budget boot camp. I have wanted our family to join for awhile now, but it doesn’t make sense to put it on a cc when the whole point is to get out of debt.

Working our way in this direction! Thanks for the inspiration. ❤️

Watched you on RR and loved it! I’m gonna try your tips!

I can’t wait to use this method! The weekly budget will be a game changer for me.

$52K down in 2 years thanks to some of your advice and others! Forever thankful and always wanting to learn more! The exchange rate is the only reason i haven’t purchased boot camp!!

We need to do a spending freeezee!!!!

I have been following you for a while now and absolutely love you guys! I am a young mom to 2 toddlers and a wife who also works full time and homeschools my kids. and I feel a ton of pressure every month to pay all the bills and make sure my kids have what they need!?it’s so stressful! We need a change and I think your program is the answer! I can’t wait to put your program to work for my family! Thanks for all do to brighten my day!

Your tips have helped me SO much in the short few weeks since I found you. When I found your blog I became so pumped and inspired to start saving money the right way! Someday soon I’m hoping to learn even more from you budget boot camp program. Thanks again!

I want to try these 3 simple steps!

Thanks for your tips. I really need to do this!

I love your budget envelope technique!! It’s been so helpful! And all those return envelopes that come in junk mail is what I use so I don’t even pay for envelopes!!

I NEED this boot camp!

Thank you so much for all the awesome information you share! I don’t have any debt other than my house, but I really want to save more and not live paycheck to paycheck. I really appreciate all the I for you share!

That sound so simple when you are explaing,but I’m so hard to convince my husband to try it.

Thank you so much for your tips! They will make a huge difference for us as we pay of student loans and try to get in a house

Thank you for these tips, they will help us as we try to pay off student loan’s and get into a house

Starting our journey today. Got my envelopes in hand! lol

You guys have really helped open my eyes on where to start getring debt free!

We are sooooooo close to paying off a $15,000 loan we got last July because of you ???

These are such great tips! Budgeting is something we don’t always fight about but sometimes it’s hard to see eye to eye on. looking forward to putting thee into practice.

You are seriously changing our family’s life! We are in debt because of medical bills and, let’s be honest, some really bad choices. I ran across you on youtube while looking for ways to cut our grocery bill. GAME CHANGER. We’ve watched several videos and are now looking at our finances totally differently! We are actually saving money EVERY week that is going toward the debt and saving for a family vacation. NEVER THOUGHT THAT WOULD HAPPEN! My husband lost his job at the coal mine a couple of years ago. They just shut down one day. Leaving a lot of families high and dry. When he was finally able to find another job his pay was only about 1/3 of what it had been. His current job is about half of what he made at the coal mine so, in the past couple of months we have been following your videos and blogs. We are finally starting to see some sunshine again! Thank you!!!!! We are realizing, it IS possible to get out of debt! We have a LONG way to go, but at least we know we can do it!!! Now we are saving up to get budget boot camp!!!

LOVE LOVE LOVE!! Plus you make me laugh!!!

Awesome! Thanks for the great tips! Can’t wait to get out of debt!!

Excited to try this. Showing this to my husband tonight.

The 7 banks accounts has been kind of a challenge for us. But i am trying to follow your methods so we can be debt free! Thanks!

Life. Changing. Thank you so much!

I’m using these tools and already see a difference! I’ve reached the videos on YouTube several times! I can’t wait for the opportunity to join your boot camp!

These are great ideas! I personally love the separate bank account idea cause I love having things organized and easy to view and understand…so that is something I want to try doing for sure! But definitely going to try imlimenting all of these – thank you!

Thankyou so much for making this post! It makes paying off debt less intimidating and more realistic.

My husband and I run two separate homes… long story. If we manage to sell one home and get moved, I’d like to get back on track.

Wow, you make it seem easier and a little less scary. This should be a mandatory class in high school. If I don’t win I’m getting this for my birthday!

I 100% agree that it’s about the $1, $5, $10 daily decisions that make the biggest difference. I’m trying to focus on mindful spending in the the little areas!

Thank you for speaking “Jordan”! ?

I love this! I’m in college right now and I took on two jobs (aside from my hubby’s job) to pay off my car debt! Every time we get extra cash, we put it towards the car! I can’t wait to try your methods out!

I love/don’t love the idea of a spending freeze but find it oh so challenging and necessary! Challenge accepted! Thanks for your info.

Thanks for all of these tips! I love the spending freeze, we have tried that in our home for a week or more and it’s helped us make bills we weren’t sure we could!

Hi Jordan, I am recently out of college only making $29,000 a year and have over $50,000 in credit card and student loan debt. I will definitely start using these techniques to pay off my debt faster!

We’ve just started following a few months ago and already have seen success! Thanks to you we’ve been able to figure out how much to live off of and how to actually budget!

So in debit with triplets girls. Pick me please.

I love the idea of a spending freeze and I want to try it! Do you have suggestions for those of us with traveling husbands? He has to spend money on tipping his shuttle driver and eating out, etc. If it were up to me, I would have him pack his meals but it really is hard to do that for 3 or 4 days. Thanks!

Love the idea of the bank accounts!!!!!

Looking forward to implementing these!

Amaze balls!

I love your envelope system! Going to keep reading all these tips.

I would love to learn about this and implement it into my life.

I need this program!!! Thanks for all the suggestions!

Good budget advice

I have never thought how important it is to borrow side to side but not from the next week. I like that!

This is such a good intro video xx

It’s definitely the little things that kill our budget. I’m terrible at meal planning and end up getting fast food way too much. Loved seeing you on Rachel ray!

I love everything about this! I’m excited to sit down with my husband and go though it piece by piece. My biggest ah-ha is that it’s in the small, day-to-day decisions where it has the biggest impact. Thanks Jordan!

Going to try the simple budget trick!

SIMPLIFY SAVES LIVES!!!!

Thank you for being so real! I cant wait to implement these in my life. …..hoping to convince the hubby as well that we need to do this!

I love your budgeting envelope system! So simple which is what I need in my life!

You make it sound so easy! I definitely need a spending freeze.

Love your advice! Keep up the awesome work!

I liv the envelope budget idea!!! Sooo gonna try this!

I LOVE these tips! We’ve been implementing them and see a huge difference!

I totally agree that it’s those small purchases daily that make the difference toward being debt free! I know what I “need” to do, but it’s hard denying those daily life pleasures (like coffee and CFA!)

So fun to see you on Rachel Ray!

Yay! These are such great ideas! Thank you so much for sharing. I look forward to reading more of your blog and getting more money saving advice!

I love your tips! It’s so motivating! You make it seem so simple. Thanks!

Great ideas. Thanks!

Can I just say I love you! As in you are so relatable and have a positive energy about you that is contagious when I read any of your posts here or on Instagram. I first heard about you when my sister bought your program. I saw her doing some of it with her husband and she seemed to love the ideas so I had to look up what this budget boot camp was all about and started following you. Still have a ton to learn about budgeting but your ideas have really helped me. Thanks for being so real and relatable. Love your work!

My husband is in grad school and I’m a SAHM so the debt is piling up and it feels so icky. I’m looking forward to paying it off and will definitely be using all your advice. I’m a noob when it comes to finances but the seven checking accounts is like blowing my mind right now. Anyway, thanks for sharing your knowledge with the world! I love how personable and relatable you are, makes me feel like I can do it. ??

I almost can’t believe it. My husband and I didn’t know how much money we were wasting on food until we did plan ahead meals and stuck to a $100 budget. That saves us $200 a month! I also opened up my 6 banks accounts which has made a huge difference in my savings with the 70% rule…I’m actually excited to save money now that it’s so organized! Thank you for making these tips available!

As a newlyweds we my husband and I are looking to get out of our apartment and into a house by next year, and just by reading through this post I actually feel like we can make it happen! Thank you for the great tips!

Grateful for all of the care and attention put into every detail of this advice!

Thank you for pointing out that if you want to get out of debt quickly, you should start paying more on your principal each month. My relative claimed he wanted to be debt-free as soon as possible. I’ll hire a professional consultant to assist him in figuring out how to get out of debt.

I have read so many articles regarding the blogger lovers but this article is truly a good post, keep it up.