Today I'm sharing a secret that has changed my life and will definitely change yours as it helps you determine WHERE your money should go. Come learn all about the 70% budget rule!

When I work with families or individuals, an overwhelming issue Freebs want help with is figuring out, based on their income, how much money to spend versus save. They want to know how to be able to afford vacations and FUN while still paying bills and being financially responsible.

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Well, the time has come to give you my secret sauce.

MY BIGGEST SECRET — THE 70% BUDGET RULE

I'm going to share one of my simplest (but most effective) secrets with you. I'm a bit nervous about it, for I feel once I do, no one will need me any more (waah!). But I love you, so I'm going to share it anyway… 😉

The 70% budget rule is a financial principle that not only works, but it will work FOREVER. With a little adjusting, this will help you throughout your life to know exactly how much to spend, save, and invest… No matter your income, debt, where you live, or stage of life.

When Bubba and I finally saved up enough and had a stable enough income to move into our home, we were on cloud nine… until Bubba had to take a 40% pay cut a few months after closing. Womp womp. The good news is that the 70% budget rule helped us stay on track. No derailing, no panicking, no living off of credit cards. We knew exactly what to do. Though we had to work hard, it didn't ruin us like our F.D. (Financial Disaster) nearly did.

Knowing how much to spend and save makes all the difference!

Doesn't that sound dreamy? Well, as dreamy as any kind of budgeting system can be, anyway… Let's get to it. I now introduce to you…

THE 70% BUDGET RULE

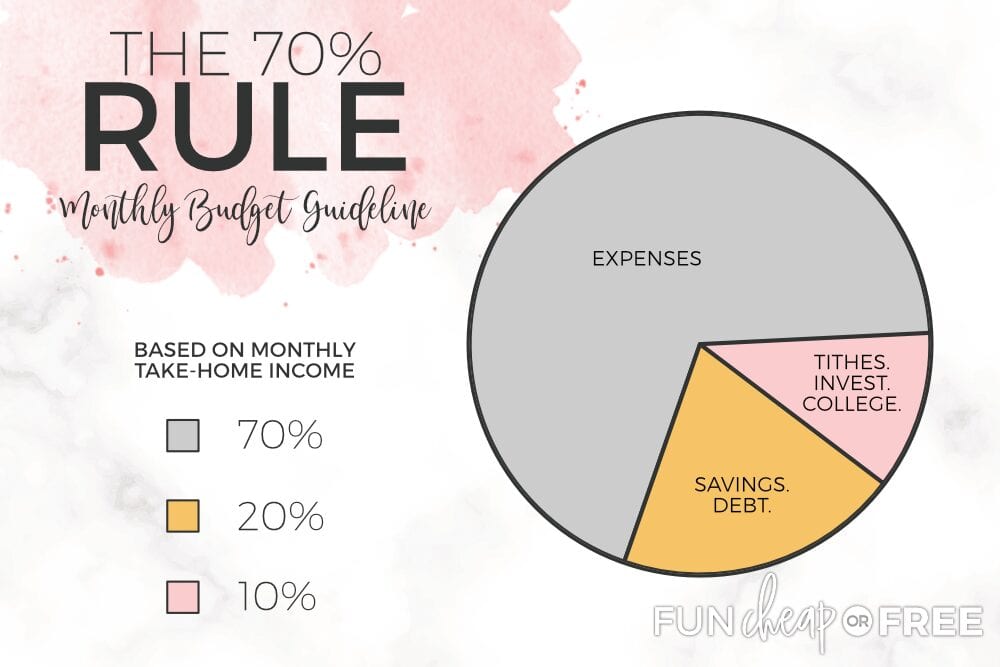

Duhn duhn duuuuuuhn! It's simple, really. Here's how the 70% budget rule works. You take your monthly take-home income and divide it by 70%, 20%, and 10%. You divvy up the percentages as so:

- 70% is for monthly expenses (anything you spend money on).

- 20% goes into savings, unless you have pressing debt (see below for my definition), in which case it goes toward debt first.

- 10% goes to donation/tithing, or investments, retirement, saving for college, etc.

Piece of cake. Piece of crumb cake. (Name that movie!)

I'll go into further detail below, but here is a YouTube video that also goes into more of our personal background and how I came to develop this method!

WHY BUDGET PERCENTAGES WORK

The beauty of percentages versus hard-nosed numbers is that budget percentages fluctuate easily; your budgets will always grow or decrease with you! You'll never be lost or confused. If you make $1,000, $10,000, or $1,000,000… you can always easily find 70% (with help of a calculator, if you refuse to do mental math like I do).

Another beauty with this method is that everything is covered! You have money set aside for savings or debt… for spending… for investing, retirement, or charity… you're covered! So there's no need to stress, worrying about how you'll ever get your dang credit card paid off. There's no need to feel guilty when you go on a vacation. Gotcha covered, chap.

HOW TO MAKE THE 70% BUDGET RULE WORK FOR YOU

With every tip I share, you MUST remember to make this work for you! I've had lots of comments and questions about wanting to tithe 10% AND put money toward retirement. If you can afford it, YAY! GO FOR IT!

This is just a general guideline.

For us, until a few years ago, we wouldn't possibly have been able to live off of less than 70% because we made so little. I understand that so many of you are in that same situation and it's a huge trial. I've been there.

As we got out of debt and my husband got better paychecks, we were able to move into more of an abundance mode… So we take from the 70% and use some of that to go toward investing, retirement, and college for our kids, all while preserving the 20% savings and 10% tithing.

Just do what works for you and your family!

LET'S BREAK DOWN THE 70% BUDGET RULE

We're finally getting to the meat and potatoes! Trust me, you don't wanna miss out on this part…

FIND YOUR MONTHLY TAKE-HOME INCOME

When I say “income,” that doesn't mean the income listed on your tax statements. “Monthly take-home income” literally means IN-come… The amount of dollars that actually hit your bank account each month.

Yes, that means after taxes, insurance, withholdings, etc. From here on out if its not deposited into your checking account, it's not considered “monthly take-home income” in Jordan-dom. Kapish?

TIPS FOR DETERMINING YOUR INCOME

- Find Your Monthly Average – If you're paid monthly or bi-monthly, total how much hits your account (average at least 3 months to find this), and put a solid monthly number to it (not weekly!).

- Random Paychecks – If you have a tip-based, commissioned, or service-based income, you need to find an average so you aren't having to recalculate budgets every month of your life. I have a great post about how to make a variable income budget work that you should definitely check out!

70% OF INCOME GOES TO EXPENSES

Expenses include EVERYTHING you spend money on, including (but not limited to): bills, utilities, emergency or unexpected expenses, shopping (this includes Amazon), groceries, take out, you name it. If you spend money on it, it's considered an expense.

SO HOW MUCH DO YOU HAVE FOR EXPENSES?

- Let's pretend your monthly take-home income is $3,000/month, for easy math's sake. Remember, this is the total amount that actually gets deposited into YOUR bank account each month!

- Find 70% of that take-home income. 70% of $3,000 is $2,100 ($3,000 x .7 = $2,100).

- Everything you spend money on in a month needs to total $2,100 or less (in this example, anyway). That includes mortgage + bills + fun spending + insurance + utilities + eating out + your grocery budget…everything.

70% or less is the real key. If you don't NEED to live off of 70%, then by all means, don't! The less you spend, the more you can save and invest = the better life your family will have. 70% is the maximum!

FIND OUT WHAT YOU'RE CURRENTLY SPENDING

Pull up every dime you've spent for the last 3 months (you read that right) and put it on a spreadsheet. EVERY DIME…even if it's $.50. Every dime or this won't work!

CATEGORIZE YOUR SPENDING

A spreadsheet is the best way to do this so you know at a glance what you're spending money on (groceries, eating out, clothing, decor, bills, school fees, etc). It's best if you can see it!

Don't have a credit card or bank statements because you pay cash for everything? That means you don't have accurate record of all spending, so you'll need to start tracking EVERY DIME you spend for the next 3 months. Electronic is really the easiest, though. Don't like credit cards? Use a debit card, it's basically like cash!

You want to make sure you're tracking everything and know what categories you're spending the most on! I really, really, really recommend using a debit card. Once you have a handle on it, you can go back to cash!

FIND YOUR TOTAL EXPENSES

Find the total of all spending (for all 3 months) and divide by 3, so you find a realistic average. Now that you have your average, you can make some real decisions about how to move forward. If you are under 70%, you are GOLD! And if you're not…

WHAT TO DO IF YOU'RE OVER THE 70% BUDGET RULE

Are you over your 70% guideline? It's okay. Take a deep breath and prepare yourself to start cutting back on expenses. Now, make a duplicate copy of your spreadsheet so you don't mess up the original. Start deleting unnecessary, “want” (not “need”) expenses that you could cut out monthly. This could include things like eating out, shopping, subscriptions, etc. Keep deleting until you're within 70%.

What if no matter what you do, you can't get it to fit within 70%? Get real with yourself and make it happen. Sell your car. Move to a cheaper house. Cut your cable. Get a better paying job or make more money at work. Start a side hustle.

Sorry to break it to you guys, but if you're spending too much, you're spending too much! I'm tough love here because Bubba and I did sell our car. We did cut cable. We stopped eating out entirely. I stopped getting my hair cut professionally. We did it!

We focused first on cutting back to get our debt and spending in order and build up savings. Over time our focus has shifted to making more money (thanks to Bubba working his tail off); so after paying off debt and working hard, we now have started sneaking those luxuries back into our life. It's like losing weight. You might need to live off of lettuce and water to drop 100 pounds, but eventually, you can start eating cookies again… in moderation, of course.

My simple envelope budget method is a super easy way to keep your budget in check each month!

HOW TO DEAL WITH DEBT

Dave Ramsey won't like this, but I don't necessarily believe that everyone should make paying off their house an absolute priority. Why? Because for Bubba and I, it wasn't even close to an option for the first 8 years of our marriage.

I do think you can be very smart about it. Pay extra toward principle, refinance to get a better interest rate, buy a home that allows you to keep all spending to 70% or less of your income. But do we need to sink every dime we have into paying off a house? Not in my book.

When I say “pressing debt” I mean the urgent, expensive debt that is hurting your credit and costing you LOADS of interest each month: namely credit cards and loans.

You need to be your own judge and decide if a car loan is considered pressing debt in your house. Cars are weird for us because they are a business expense, so I'm not going to answer that one for you. Just make sure that any car payments fit easily in your 70% range if you get or have a car loan.

20% OF INCOME GOES TO SAVINGS OR DEBT

Keeping with our $3,000 example, 20% would be $600/month. Yes, 20% might seem high…but yes, savings is that important! I suggest 20% (at least). If you can spare more, then do more! ESPECIALLY if you are paying off debt… Put as much as you can spare toward your debt so you can be free and move on to bigger and better things.

If your current financial situation can't support setting a solid 20% aside each month, that's okay! Do your best to get on your feet financially, put away as much as you can, then increase the percentage as you can spare it as time goes on.

HOW TO MANAGE SAVINGS

I recommend having 10% go into Family Savings and 10% going to Emergency Savings. I explain the difference between the two in my 7 Bank Accounts Your Family Should Have post.

Have it automatically draft into those bank accounts each month so you never have to think about it! Not sure how to do that? Call your bank, and they can set it up in a snap.

If any fees are involved with auto drafting, get a better bank! We bank at Chase, but there are lots of great ones out there.

DON'T SKIMP ON THIS NO MATTER HOW TEMPTING IT IS! The beauty of having half go to Family Savings is that savings account is where the “fun” stuff you never seem to have money for (Disneyland…a boat…new couches…a car…) comes from. The beauty of having half go to Emergency Savings is that it will protect your family when the inevitable hits!

We will all need our savings at one point or another. 10% is nothing to protect your precious family!

DONATE OR INVEST YOUR LAST 10% OF INCOME

Since the day I turned 8 years old, 10% of anything I earned has gone to my church. Not because my church is destitute or money-hungry, but because I firmly believe (and have seen it again and again and again in my own life) that karma is REAL. God is GENEROUS, and 10% is little compared to what He gives. Not to mention you get back 10 times what you give in life, and I'm living proof of that. BUT… I understand not everyone feels the same way.

Here's what to do with that 10% (which, as per our example, would be $300/month):

- Donate – Find a cause you feel passionate about! If everyone gave a mere 10% of their bounty to others, our world would change forever. Find a way to give back, and commit to a solid 10%.

- Invest – If donating isn't your gig, here's the opportunity to invest! This would be in addition to a 401K or anything else that's taken from your paycheck.

- Save for Your Kids' Big Expenses – Here's how to afford your kids' college and/or weddings! Chip away at it by putting money away each month.

Remember, as mentioned above, you don't have to limit yourself to 10%! Just be sure to set aside AT LEAST 10%, no matter your income. For us, we wouldn't have been able to afford more than 10% for years, but now we can.

HOW THE 70% BUDGET RULE IS LIFE-CHANGING

I promise this works. This principle is SIMPLE and LIFE-CHANGING for 3 simple reasons:

- Percentages, rather than numbers, make budgeting easy as life naturally fluctuates.

- By following the 70% budget rule you have all your bases covered, and can magically afford everything you've been wanting or needing to afford.

- Um…I don't know. I just like things that come in 3's. 😉

So now you know all about the budget percentages and how to make them work on any budget, what are you waiting on? Keep up with us on social media to get even more great budgeting tips! I share a lot on my personal Instagram account, Fun Cheap or Free Instagram, Facebook, and Pinterest!

If you're new here, welcome! You can get all my budgeting and finance tips, and my secret sauce in my fun-to-watch video program Budget Boot Camp!

You have nothing to lose because if you don't save or earn at LEAST what you paid for it, I'll give your money back. So use the code FCFBLOG at checkout to get an extra 10% off, and give it a try!

Make sure you check out these other posts!

- Learn how to build your credit so you can make purchases when you're ready or how to improve your credit score if you need some help in that department!

- Pay off your credit card debt quickly with our simple tips!

- Come see the top reasons couples fight over money over and get some great info on how to STOP!

XOXO,

Great post! Question: would things like investing for retirement go in the 70%, or is retirement counted in the non-take-home pay (and thus separate from the numbers you talked about)?

Also, you mentioned Dave Ramsey “won’t like” what you are saying because you don’t want to attack the house debt. I know you haven’t looked into him too much so that you keep your ideas separate, but he actually recommends keeping the house part of your debt separate and paying it off in baby step 6 (rather than baby step 2 where all other debts get paid off). Just thought I’d help ease your mind 😉

Same question about retirement contributions.

YAY! Thanks for letting me know about Dave R., glad to know we have many of the same ideals! As for investing and retirement, go read the “10%” section, it explains that. If you tithe or donate 10% then and you also want to set money aside for retirement and investing (which I recommend), then yes, it would come out of your 70%. If you have retirement money coming from your paycheck already, then be sure to consider that when reevaluating your percentages. Thanks for reading! XO

OK, so not to get into a doctrinal debate, but my tithing comes out to be more like 13% than 10% because we pay tithing on what we make before taxes, insurance, retirement, etc. Also would fast offering be part of this or the 70% expenses? Thanks.

Lol, I thought the same thing about my tithe when I wrote out our percentages. I personally let it come out of the 70%. I think the general principal is the most important thing.

Does the 70% include sinking funds at all ? I’m wanting to start your plan on next payday and finally get our family sorted out.

It would be included in the 20% for savings/debt. You should definitely check out our bank accounts post to see how we do it!

Hey hey! I started following you a year or so ago but quickly got thrown off track by that thing we call life (LOL). HOWEVER, I’m hitting the reset button.

I apologize if you mentioned this somewhere and I missed it, but my question is referring to debt. Right now, I’m snowballing debt and paying the minimum amount due each month. Should I factor that into the 70% section and then use the 20% as extra payment?Or does debts factor into the 20% section only? To me, it seems the 20% would be extra to get out of debt faster and that is what I got when I read the article but just making sure I’m on the right track. Thanks for everything.

Mine is the same way, so it made my numbers all weird. I would just add percentages to the tithing part and take away from the expenses, but I guess that just defeats the whole thing.

To each his own! We were taught to pay 10% of all increase and otherwise it’s up to each individual family, so there’s no problem in doing it however you see fit! As for Fast Offering, yes, that comes out of our 70%. Thanks for reading! XO

I love this! After adding up all of our bills they equal less then 70% of our income, but I didn’t account for our weekly $20 allowance each or eating out/gas. OUCH! We will be sitting down and reevaluating these things for the month of August because I would love to build up more of a savings account rather then eating out twice per week.

As always, thanks for your great tips and advice.

Sara

I’m so happy for you that you are less than 70%, I can’t tell you how FANTASTIC that is!! Most people don’t realize that they are in the upper 90%, so 70’s or less is killer! I’m proud of you, let me know how the re-evaluating goes! XO

I really like this method! Quick question on pressing debt (with a lengthy scenario for you):

I have student loan debt that I would consider a pressing debt because the interest rate is really high, and the total loan amount is bigger than my mortgage + car (we made some poor financial choices as 18 year olds!). In this case, how do you handle? Obviously it’s a monthly expense that I am required by the lender to pay every month, so does this come out of the 70%, or is it considered Pressing Debt and comes out of the 20%? The monthly payment is actually larger than what 20% of my monthly income would be… can something like this cross over into two categories so we know how to budget for it?

I was wondering about student loan debt too. My husband and I each have loans from grad school which are on income-based repayment. We’ve been paying it as a monthly bill…should it actually be considered pressing debt?

I would consider it pressing debt. However, my brother in law is a doctor. His schooling took over a decade and wracked up over $200K, so that’s not so easily paid off in just a few months. However my husband and I considered student loans pressing debt, so that’s my opinion. But just figure out what it means for you!

Hmm…that’s a tough one. And I’ll be the first to admit that I’m NO financial planner! Without knowing your financial situation (aside from what you told me) I would say YES it’s pressing debt. Do everything you can to attack it and get it GONE! Think of how much freed up money you will have once it’s paid off, not to mention how good it will feel to be free of it. We sold our car and refinanced our house in order to get out of our debt, so while it may sound drastic, it was only for 1 year then we got back on our feet! Put 20, 30, 40% toward it if you can! Just whatever you can spare. But make it a top priority. It’s costing you so much money and probably stress, do what you can to get rid of it. The harder you hit it, the faster its gone and the sooner you can go back to usual spending and saving! I’m not sure what your savings is like but if you have at least $1000 in savings, I would put all 20% from your “savings” category into the debt. That’s just me though, you need to decide what’s best for your family and don’t be afraid to talk to a professional about it for further advice! XO

Hi Jordan,

I was so happy to read the post and it comes just in time! Thank you as it all makes total sense.

What I was sad to read was why you tithe. Tithing shouldn’t be about Karma and “give, just so we can get more”; it’s a gift from God. I think it amazingly gracious of Him to say about HIS money “look, you keep 90% and just give me 10%”. That’s a GIFT!! Obviously He doesn’t need the money; it’s His anyway, but He’s testing our faith and seeing if we’re trusting Him fully, yes even in our finances. Many trust Him wholeheartedly, except not in their finances.

I suspect you kept that part “generic” as to not cause a spiritual storm and I pray you tithe because you are SO STINKIN THANKFUL For how He’s blessed you and your family.

I hope this doesn’t offend.

Grace and peace.

You should give from your heart anyway. There shouldn’t be a required percentage.

Glad we’re on the same page! As you can imaging, having to summarize why I tithe in just 2 or 3 sentences is next to impossible. Plus I didn’t want to sound preachy. But just know that you and I are 100% on the same page, and WHY we really tithe goes much deeper than Karma. Thanks for reading!! XO

its simply called paying it forward and it does come back to you, test me on this, or test him on this. I am someone that squeaks when it comes to money, but the chance came up to test the word and I found it to be true give, and you receive to give again and be more helpful.

You are awesome

Great post, thanks! I especially love the Casper reference. 🙂

Ding ding ding! You got it! Thanks for reading 🙂

What do you do to tithe 10% AND invest and save for college? For example, do you invest with one of your 10% savings accounts? Is a portion of your family savings account dedicated to saving for college? Thx!

For us, this is new because finances have been so tight for so long, all we could really spare was the 70/20/10 formula. But now that we are in abundance mode, we take from the 70% and put it toward investing, retirement, and college. Just take the general percentage idea and make it work for you! Hope that helps!

I like the formula concept, but I am having a hard time with a few areas in it. Everyone should be saving 15% towards retirement (IRA’s, 401k’s, etc…) so you’re saying that you can only give towards retirement if you choose not to tithe your 10% b/c that is all that is allocated there…. I think it should be more like 60% expenses, 10% tithe/donating, 15% Retirement, 15% Savings (including college and future expenses). Debt should be paid first! Sorry, big dave ramsey follower here.

Perfect! No, I think that’s great! I was just showing the bare-bones formula system, I think it’s important for everyone to adapt to make it fit. When we were in our financial crisis, there was no way we could live off of just 60% because we made so little income. As we shift into Abundance Mode, we can spare more. So I think that formula of yours looks great! Thanks for sharing 🙂

“Piece of cake, Piece of crumb cake” -Casper hahahaha. Link to the clip. I immediately remembered this scene while reading your post. https://youtu.be/I2x3zFiqiBQ

YES! Nice work! (…and isn’t it always the most random quotes we remember in movies??)

I know my husband and I MUST start this plan because we desperately need to get control over our debt and spending. I just started reading this blog and I am IN LOVE. Cannot wait to start putting all these tips to use. So, with the 20% towards Savings – I know we will have to put at least half of that towards debts. Then do I further split the remaining 10% between Family Savings and Emergency savings?

I’m so glad you like it, thanks for the feedback! If you have “pressing” debt, I would put the whole 20% toward it (especially if it’s credit card debt!) until it’s gone. THEN focus on building up savings. Best of luck!!!

I’m a fan of simple budget principles. You are first that I’ve seen to include tithing as a priority. My one question though is have you considered, for those that do tithe, suggesting that tithe should be from gross income. For me, even though tithe is not a “tax” to God, but rather an expression of our trust and faith in Him, it just seems more appropriate to give Him the first fruit of our labor rather than after the government gets it’s share.

Absolutely! Love this! And I agree 🙂

Thanks so much for this post, so much helpful information in it! Our situation is tricky as we are self-employed…so our income varies month to month and year to year. It is also seasonal work so several months of the year there is very little coming in at all. While other months are easier on us. any thoughts/tips?

We’ve been self-employed 100% of the time! So I get it! This is exactly why we live by the 70% rule. Just find a 6 month income average and live off of that. Tuck surplus away in an account to tide you over on the “low” months.

This 70/20/10 plan is also highlighted in the book “The Richest Man in Babylon” by George Clason written in 1926. However, it used 10% for savings (“a portion of all you earn is yours to keep”), 20% for paying off debt/investment (“make your money/gold work for you”), then live off the 70% as much as possible. It truly is a brillant starter plan for budgeting!

I love this strategy and I totally want to try it!! Questions:

1. How do i get to that 70% goal?

right now we spend 86% of our total income….14% of that is what we have left over to go towards debt and other. The expenses we have for the most part are needed. I can see 4 monthly expenses that we have that we can do away with; and if we did that then we still wouldn’t be in the 70% goal range. Big part is child care. we only have 1 pressing debt and that is our credit card and the debt is small; and easy to pay off. The other 3 debts are Home and two vehicles. Ours goals are to save and save in multiple accounts such as you suggested: Family, Emergency, General, Kids etc accounts too.

Wow, this is great advise. Just went through the last three month spending and WOW, #%&%%#!, this is a tough lesson. We have such a decent income and still never get along, well now I know why. Last years we cut through all the ‘big’ things and I thouht this might help. No, it’s the small daily clutter that accumulates to unbelievable sums. Thank you SO MUCH, for the eye opener!!!

Here is my question how do I apply to my paycheck so that I can set the money aside? Do I divide the percentages in half and go from there? So that for the month I still have that total?

So 70% is per paycheck or per month?

70% of each paycheck!

Thank you so much for clearing this part up for me.. AWESOME explanation of the system & plan…I am so excited to start this on tomorrow..

70% rule is definitely going to help my budgeting!

My husband and I both just finished college and both have full time jobs. We were having a hard time setting a budget and this was PERFECT!!!! It helped so much to put everything in check. THANK YOU!!

Thank you for this!! My husband is about to complete his MBA program and I am a little stressed about organizing finances and paying off debt. This is SUPER helpful to get us started out on a good path with a real income.

Trying to implement this in my house. It’s hard to begin with but I hope it works.

Wow! This is eye opening!! I’ve toyed with budgeting for years (not seriously until recently) but never felt like I truly understood how to budget effectively. You made this so simple to follow! I will sit down and plan out my budget with this info next week!

I have heard of the 70% rule many times before but I love how simple you make it and how you break it down. After I watched your video, I immediately implemented it into our budget along with simpler categories. Thank you!

I love this rule! It’s helped my family so much! It’s sooooooo much easier to set a budget this way! Before using this technique nothing was going into savings because of the way I was budgeting. THANK YOU!

I love this idea! It has worked so well for me and I was able to save my first $1000 in just under two months!! I will be living by this from now on!

A couple of years ago my husband had to go overseas for his job and began to make a lot more money during that time but I found we were still struggling. I wasn’t tracking our spending, I was paying bills simply by checking my account balance, and grocery shopping without a budget, and always feeling like we didn’t have money to do much else. That’s when I came across your 70 percent rule and we have never gone back. Turns out we had plenty of money, even some to save, but our irresponsible methods were doing nothing for us. Now we spend at or below our means, have money to save, and money to spend on fun family activites every now and then too.

Going to implement this with my sweet husband! Great idea!

This has changed how we budget dramatically. We always have had a pretty good budget but this just took it up another level and now I finally feel like we run our money and it doesn’t run us!

Just this 70% Rule has helped our family budget sooo much! Thanks for all the great information!

We are working on getting to 70% living expenses.

The 70% rule has helped me and my husband control our spending and saving greatly. We would be in debt without it!

I love how you add tithe into your budgeting advice! This is very unique and very helpful ? thank you also for explaining the whole 70% rule so clearly ?

Love this 70% rule and we are so close!! still working on doing better to get there!!

I love the idea of only living on 70%, and using percentages so you can (hopefully) always put money into savings. I’m trying to fully implement it next month.

I love this post! Such a helpful way to get on a budget! Thanks for taking the time to help all of us fulfill our dreams and get on top of our money!!

This principle has changed my life! My budget is so much simpler to figure out and it makes saving feel easy rather than struggling to find a balance between the two! Thank you!

I’ve read and re read the post. I may have missed it. ? But does the 10% is to a certain extent part of your 70%? And going a little further (with the 7 bank accounts post) what account would your tithe/donation come out of? Your expense account? And is this set on auto pay? Thank you. Extremely late post but hope it is answered.

Question..if I have $ automatically going to a credit union acct plus retirement money drafted from my check, and husband has 401k drafted from his check, do those count as part of the 20% savings? This has been a real point of confusion for me. Thanks so much..

Hey Donna, remember, the 70% rule only applies to your TAKE HOME income – AFTER taxes, withholdings, retirement, etc. So only do the 70/20/10 on the money you take home from your paycheck and physically deposit into your personal bank account.

Hi my question is in regards to debt, i have a loan i got at a great interest rate, the cost of me to get out of the loan early will be more money than the interest i will pay over the life of the loan is this worth paying it off, it seems silly to pay 100+ extra dollars to get out early.

hi ,

We have almost the same history, last year we had almost lost our house because my husband was laid off and I was 7 1/2 months pregnant. we tried, to make someone win our house through a contest, but nobody trusts anyone anymore, so the contest failed, which was to bad, because someone could have won our house for $ 30 !

well, fortunatly my husband finally found temporary job that helped us a little but we were still losing our house, and because of the oil price in Alberta, unemployment was increasing, and many electricians were looking for work, and the house market was very very slow

Finally my husband opened his business. and thanks to him our house is saved !

We will still try to sell the house in spring to get closer to Calgary, but at least if we do not find a buyer at the right price, we will not have to sell it off.

I would have liked very much if the 70% method also worked for us (because now we want to have more money in savings, for retirement …) but unfortunately, it does not work for our family, with our budget in Canada.

I don’t know how much you pay for you house in Us, but here, small town in the south of Calgary,

for a 1784 sqft house (with 4 kids its already to small we only have 4 small bedrooms ) we pay 1945$/months and for grocery between 1200-1400$/month and I cook everything ( from jam to pizza through beef bourguignon, we are French immigrants ;b )

I will continue to browse your site maybe I could adapt some tips

thank you

oh just to we are at 80% of expenses

…And congratulations for your futur babies

Definitely adapt what you find on the site to your unique situation! These are more guidelines than set-in-stone tips. 80% really isn’t a bad place to start, just do your best and that number should slowly go down for you closer to 70%! We have lots of Freebs in one of our Facebook groups that are from Canada. You should go join that group and ask them for any advice that they can help give! If you’re interested in that, then go sign up HERE.

Interesting ideas. You should read Dave Ramsey so you know what he does teach. Like someone commented earlier, he doesn’t say put all your money towards your house. That should be corrected on your blog post. First you save $1000. Second pay off all your debts except your house; next build a 3-6 month emergency fund (or more if you need to), then put 15% of your income towards retirement till you retire. Once retirement savings is underway start saving for kids college if you choose to do so, and THEN put any extra towards your house and pay it off.

I am wondering, the 10% for an emergency fund, what did you do after your emergency fund was complete? What do you use that 10% for?

Thanks for clarifying that! 🙂 As for the emergency fund, ideally, you never stop putting money into that account! You want at least 6-12 months of living expenses in that account. You can get way more details from this post!

Maybe a dumb question but i’m horrible at money in general. I have automatic payments coming out towards credit card debt….is that included in the 70% or should I consider that part of the 30% (my goal is to pay off debt so if I understood correctly from the video, all 30% should go towards that right?).

There are no dumb questions when it comes to money! The 70% includes any utilities, groceries, house/rent payments, hair cuts, clothes, insurance, etc. So if you’re putting any of that on your credit card, then you would pay that portion of your credit card from that 70%. But if you have debt that you’re paying interest on, then that would come out of that 30%. As long as you have $1,000 in savings, then put the full 30% towards your debt, as long as you’re able to live within that 70%. But if you’re using a credit card daily/weekly/monthly that you’re also paying interest on, then just know that part of that payment will come from the 70% and part will come from the 30%. Hope that makes sense! 🙂

It does! Thank you so much for taking time to explain it. I have to tell you I’m really enjoying your videos and working on applying some of your tips to my life. You crack me up too!!

So glad to hear that! It’s always good to hear that the tips work for others, that’s what it’s all about! 🙂

Hi, first of all thanks for making it so simple. My wife and I started to follow you like 4 years ago and we have benefited greatly from your tips.I have a question regarding the 70% expenses. I set a small amount of money every month for a category I call events & adventures usually we use that money for things like a quick trip during a weekend or if some relatives are in town to do some activity with them like visit a museum or a local fair. We also use that money to pay for a dinner out if there is a birthday within our family or if we do something special for a holiday like Independence day to pay for the extra expenses in case we throw an small party. Would the money for that category should we come from the 70% allocation or for the 20% allocation?

Since you spend it regularly, it would come from the 70% category! So glad your family has benefitted from our methods! 🙂

Hi, first of all this out line of how things should be roughly allocated is amazing. My only thing is my husband and I get paid on different days and it makes it really hard to do the 70/20/10 method. Do you have any recommendations in order to have this method work when you get paid different days example I get paid twice and he is once? So all around makes it difficult but I really want to give this a try!

It still should work out the same, regardless of when you get paid. But if it’s a matter of bills being due before you get all of your paychecks, we understand! Instead of taking 70% from each paycheck, figure out what your paychecks will total for the month. If you need your first two paychecks of the month to fully go towards your 70%, then do that first. Then, take whatever is left of your third paycheck and distribute it to where it needs to go from those three percentages. Hope that helps! You’ve got this! 🙂

This was super helpful, I now have a solid idea of how to portion my income.

Thanks so much

So glad it helped out!

You really need to prioritize 401k savings of 15% of your income. Gifting/thithing/family vacations/weddings are all great but providing for your future self when you may not beable to work is the most important after that emergency bucket. Life, health, economic issues all can occur and people need to prioritize their financial security in their later years. You are missing a huge piece of financial security.

How do you account for investments that come out of your paychecks pre-tax, (ie. retirment contributions) in the 70/30 rule? For example, if I invest 10% of my gross pay into retirement, which comes out pre-tax, this would already reduce my take home pay. Once I get my take home pay, should I be donating/investing/tithing an additional 10%, making it 10% pre-tax and another 10% from take home pay. Or should this 10% be reduced to a smaller percentage and/or be taken out of the equation entirely, since investments have been accounted for already. Doing 10% pre-tax and 10% out of take home pay would result in nearly double the 10% listed for investments in the budgeting rule, so just trying to figure out how this should be calculated.

This is such a great principle, especially when teaching young adolescents to have ownership over their finances before their finances have a chance run their lives. It’s a great method to establish self discipline! Our family only has house debt now since we were able to get out of our other debts 2 years ago by selling some assets. However, I really like the simplicity of your method and using percentages, especially because my husband and I are both self employed and monthly income is never predictable. Thanks for the great advice and recommendations in this blog post!