Simplifying works. Today, I'll break down my ridiculously simple, easy, and practical personal envelope budget system that single-handedly got us out of major debt and helped us get ahead financially. The best part? It's worked for thousands of people, too! Use our free printable below and get started today!

It's no joke that your budget can make you or break you… So it's important to get it in check and under control! Luckily for you, I recorded a video a few years ago showing you how I track my weekly budget using my simple envelope budget system. Little did I know that this simple budgeting system method would be one of my most viral principles ever!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

So, grab some chocolate and get cozy, because we're about to rock your world and change your life! Be sure to subscribe to our YouTube channel so you don't miss out on any of my great tips!

Watch the video all about my envelope budget system online or keep scrolling and click to watch below:

See?? Not so scary! Keep on reading so you can get your finances in order with a simple little envelope!

Budgeting can be complicated. Frustrating. Hard, even. When my husband I went through our tough financial time we learned one glaring fact about budgeting…

A SIMPLE ENVELOPE BUDGET SYSTEM IS THE BEST SYSTEM

As a frugal living expert and financial disaster survivor, I've learned the secret to budgeting that actually works – simplifying.

The simpler you make it, then the more realistic it is to implement into your life permanently. I am not a fan of crash diets, just as I am not a fan of crash budgets.

Today I'm going to give you an in-depth look inside the simplest technique ever. It has not only single-handedly helped us get out of major debt (more than $10,000 on just one credit card), but it has helped thousands of people stop getting by and start getting ahead.

This simple envelope budget system works whether you spend with cash, debit cards, or credit cards. Ready for the secret sauce? Let me start by explaining why this works so well for us.

WHY THE ENVELOPE BUDGET SYSTEM IS BEST FOR OUR FAMILY

When we first cracked down on budgeting, I tried everything.

- Monthly Budgets – Getting a lump of money is hard for me to not blow through quickly. Anybody else struggle with that?

- Multiple Budgets – Unfortunately, it was confusing and hard to track. Especially if I needed one budget one month and not the next, like haircuts or vet visits.

- Using Cash – Cash was hard to track, so I would have no idea where it had all gone at the end of the month. Those of you who can use cash are just amazing to me!

Nothing was working for me long-term, so I wised up and created my own system. A girl's gotta do what a girl's gotta do!

HOW THE ENVELOPE BUDGET SYSTEM WORKS FOR US

Since I got my act together, I now:

- Budget Weekly – Yes, you read that right! I break my budget down weekly.

- Have 3 Budgets – These encompass our regular spending (grocery, other, and family — more on that below).

- Use Credit Cards – They make it so easy to track all transactions and pay all bills!

Simplifying our budgets has literally changed our financial lives!

MAINTAIN A PRACTICAL & BALANCED BUDGET FOR-EV-ER!

Here are the tricks to maintaining this envelope budget system for the rest of your life:

- Divide up your spending and simplify your individual budgets. No more “hair cut budgets,” “eating out budgets,” or “dog grooming budgets.” I suggest you lump your spending into two categories and simplify.

- Break your budget down weekly instead of monthly. As I mentioned, it's hard to make a lump sum last 4 weeks, you're likely to run out. One week at a time is much more manageable.

- Keep track in a simple envelope.

Ready to see how? Let's break this baby down!

SET THREE SIMPLE BUDGETS

Alright, let's get into the nitty gritty of my 3 budgets to give you the BIG picture. By the end of this, you're going to be an envelope budget system pro!

WHAT DOES THE “GROCERY” BUDGET INCLUDE?

Anything you could find at a neighborhood grocery store. We're not talking Costco or super Walmart. We're talking Neighborhood Walmart, Smiths, and Safeway-type stores. They don't have power drills and sheets for your bed, but they have most of the basic items you might need to buy on a day-to-day basis.

Examples of grocery budget items include: food, shampoo, dog food, lotion, baby diapers and wipes, shaving cream, baggies, basic kitchen utensils and baking items, cleaning supplies, milk, basic cold remedy medicine, makeup and other toiletries, and so on.

WHAT DOES THE “OTHER” BUDGET INCLUDE?

Money set aside for normal, regular, non-grocery expenses. These are “want-to-have” items most of the time, and not “need-to-have” items. Once again, this does NOT include any form of bill or utility (see the next category for that).

Examples of other budget items include home decor needs, clothing, haircuts, babysitting money, piano lessons, getting the car cleaned, school pictures, lunch with friends, spa treatments, shoe repair, gifts for birthdays and showers, and so on.

So where do bills, utilities, and gasoline come from? In our house, money for that comes from our family budget.

WHAT DOES THE “FAMILY” BUDGET INCLUDE?

Expected, set, monthly expenses involving the family, house, and travel, as well as unexpected expenses involving the family. These are the “need-to-have” expenses that keep the family running and are NOT food-related.

Examples of family budget items include utilities (gas, electric, cable, internet), medical expenses (co-pays, medical bills, insurance, HSA), car expenses (gas, repairs, new tires, registering the car, oil changes), home costs (mortgage payment, homeowners insurance, home repairs, new water heater, new furniture, TV, or other large household expenses, etc.), family entertainment (travel, trips), and so on.

DETERMINE HOW BIG YOUR BUDGETS SHOULD BE

Before you can actually start using your free budget printables, you'll need to get a few things straightened out. Namely your grocery and other budget. But don't fret! I'm here to hold your hand and walk you through it to make it as easy as possible! 🙂

FIGURE OUT YOUR GROCERY BUDGET

This may sound like a daunting task… But lucky for you, we've got an amazing, in-depth grocery budget 101 post that'll help you figure out how much you should spend on your groceries! If you shelf cook, stock up on a budget, and use our grocery shopping tips, you'll be able to save THOUSANDS without clipping a single coupon. Yes, you read that right!

FIGURE OUT YOUR OTHER BUDGET

It's really not as hard as it may seem! Here's how we decided how big that should be:

- Pull out your detailed statements from the last 3 months showing every dime you've spent (spreadsheet, credit card statement, budget planner, or whatever you use to track your spending).

- Decide what will be covered in YOUR “other” budget.

- Total up how much you spent on “other” in the first month, then second, then third.

- Average them out (add the sum of the 3 months then divide by 3).

- There's your STARTING point.

- Now… cut it in half! 🙂 If half seems too harsh, cut it down and start there. Make it hurt a little, it's almost guaranteed you are spending more than you should because, well, that's human nature!

Not too hard, right?! Now, let's go over the absolute best budget printables you'll ever see!

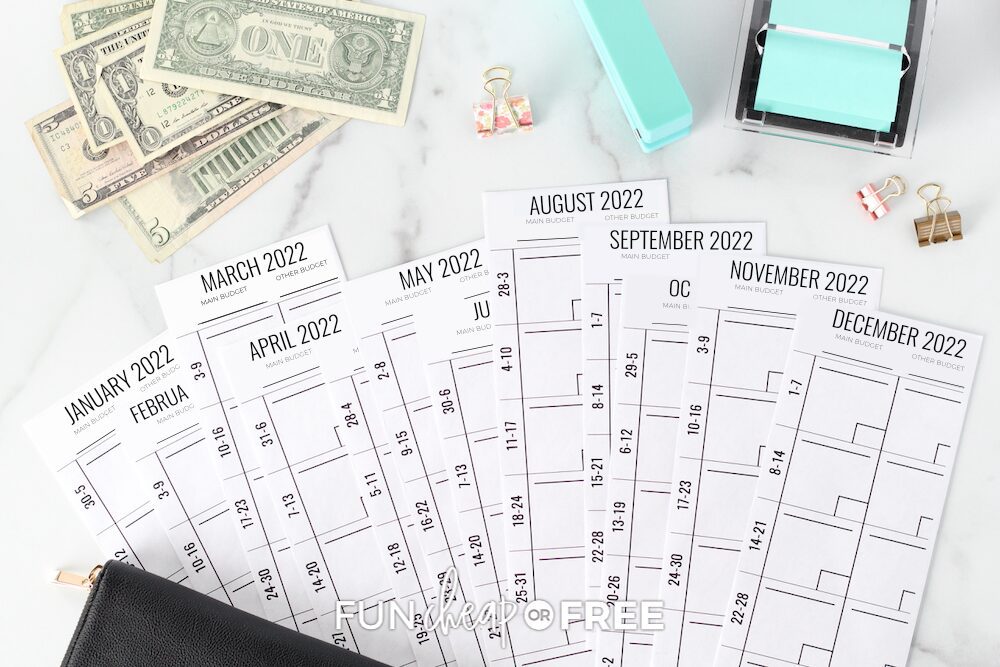

USE THIS ENVELOPE PRINTABLE AS YOUR BUDGET TRACKER

As explained in the video at the top of the post, an envelope is the single most effective budget tracker I've ever tried. You can make your own envelope like I did in the video, or you can download our free budget envelope printables.

If you want some oh-so-pretty-and-fancy envelopes, then we've got you covered! Head on over to The Page Company website, snag some, take a little look around while you're there, and use them already! 😉

A FEW TIPS TO MAKE THE MOST OF YOUR ENVELOPE BUDGET SYSTEM

It's not too difficult once you get the specifics down! Here are some of my additional tips to really make the most of this printable budget tracker.

- Stay Within Your Weekly Budget – This is key! However, life happens. So if you accidentally go over budget… NO BORROWING BELOW THE LINE FROM WEEK TO WEEK! You can feel free to borrow side-to-side between your weekly grocery and other budgets as needed.

- Cut Your Budget at the Beginning – Try cutting your budget down a little to begin with. You probably spend money on little things that you don't need. Cutting back could really help your family reach your goals if you put it in your slush fund and put it toward BIG, long-term financial goals.

- Use Leftover Money Wisely – Try to stay below budget each week. If it's the end of the week and you have money left in your budget, try not to look for a way to spend it. Rather, put it toward getting out of debt, or if you're debt-free other than a house or car, put it in your slush fund or savings accounts.

- Prepare for a Long Month – If you have a month with 5 weeks, you can either make the first or last week of the month longer to include the extra days or simply divide your budget by 5 and keep all your weeks as 7-day weeks. Do what works best for you! In our free printables, we divided everything by 4 weeks to keep it uniform and simple. Some people will also do a spending freeze one of those 5 weeks, but that's completely up to you!

- Keep EVERY Receipt – Put every receipt for the month in your envelope budget tracker. If you lose track or need to return something, you have everything right there!

- Be Wise with Every Dollar You Bring In – If you bring home extra money in a month (bonus, extra commissions, extra paycheck that month, etc.) DON'T alter your budget! There is absolutely no need! Put the extra money toward debt, put it in your savings, or put it in your slush fund. Don't go out and buy more groceries with it unless you absolutely need them!

TAKE A TECHIER APPROACH TO YOUR BUDGET TRACKER

If you prefer a more “techy” approach to tracking, you're like my husband. He would rather shave his eyelids than carry an envelope! Find a budgeting and money management app that works for you and stick to it!

He uses Mint.com to track his responsibilities because it's digital, has a free app, and connects with every loan, bank account, and credit/debit card we have. Plus, he can also set and track financial goals. I recommend doing both the free budget printables and the app. Mint is more comprehensive, but it didn't work for me in terms of keeping track of day-to-day spending.

HOW TO REALLY MAKE THESE BUDGET ENVELOPES WORK FOR YOU

Trust me, it's much simpler than it looks on paper (that's why watching the video is just plain easier). Making these simple changes transformed our financial lives and has allowed us to get out of a very scary situation… and get ahead!

Adapt the system to fit you and your family. And remember, if we can do it, you can do it. 🙂 This envelope budget system can work for anybody!

To really take it the extra mile and give you the most bang for your buck, here are a few additional tips to make this method work even better for you…

OPEN 7 BANK ACCOUNTS

Yes, seven. “Whaaaaat?! Hold the phone! Put on the breaks! Sound the alarm!…SEVEN accounts? Giiirl, you must be ca-RAY-zay!” Ok, maybe I am. But I will promise you something… By opening multiple accounts, it WILL make your life easier as it helps you organize and simplify your money more than you can imagine.

It's been such a game-changer for us! So be sure to read our 7 bank accounts post for all the details, how-to, why's, and info on why setting up 7 bank accounts will change your life.

DIVIDE UP SPENDING RESPONSIBILITIES

There's no reason to step on each others' toes! Divide and conquer! Sit down and write out everything you spend money on, then divide it up.

You should buy the groceries if you do the cooking. You should be in charge of paying school fees if you usually drive the kids around. If you are the one who knows about cars, then you should be the one to handle oil changes and car repairs.

Dividing things up this way will keep you efficient, organized, and give you autonomy to do things your own way! Check out more details about how to divide up your financial responsibilities in marriage responsibly.

LET BUDGET BOOT CAMP® HELP YOU WITH YOUR BUDGET

Need a little more help and hand-holding when it comes to your budget? Don't forget about my Secret Sauce online budgeting program, Budget Boot Camp®! BBC is a super fun, 27-video program that makes money easy to understand. All you need is a screen and you're set!

And don't forget, if you don't save at LEAST what you paid for the program, I'll refund every dime. You've got nothing to lose (except your debt)! Use the code FCFBLOG to get an extra 10% off, because I love you 😉

Have you checked out ShelfCooking.com yet? Our brand new site is dedicated to helping you cook delicious, homemade, down-home-cooked meals for your family without slaving away in the kitchen!

Basically every parent's dream, right? Join our Shelf Cooking Community today!

Make sure you check out these other helpful budgeting articles!

- New to this whole budgeting thang? Go read about why you need to start budgeting before you do anything else!

- Learn how to build your credit so you can make purchases when you're ready.

- Learn how credit cards work so you know what you're getting yourself into.

- Get tips on how to improve your credit score if you need some help in that department.

- We've got the top reasons that couples fight over money, plus some ways to easily STOP that fighting!

Good luck with your new envelope budget system!

What about a household of 1 or 2? Do the single person and the couple still get $300/month for groceries? I assume yes bc you still have to buy all those household items. Planning out my meals (and then sticking to it, not making whatever’s quick bc I’m HUNGRY) is the hardest change for me. But I eat better when I stick to this. Healthier body and healthier budget? Double win!

Yes $300 for a household of 1-3 is where you should be at!

Hi there! I have 2 questions, the 1st is do I have to budget gift cards into my regular budget? For example if I have a Starbucks gift card does that still count as part of my “other” budget or is it some extra “slush”? Also, my 2nd question is how do you budget for monthly “other” expenses such as dance or swim lessons? They are still considered other but it’s one lump sum a month as opposed to broken down through the week.

Great questions! On the gift cards… If you mean that somebody gave you a gift card, then it’s just some extra fun money for you and it’s not included in any budget! But if you buy gift cards to then use because you get perks for using them (which I think is what happens if you use a Starbucks gift card in their app), then that would need to be included in one of your budgets. You would choose which budget that would come out of, either your slush or other. As for your other question, THIS post goes into a lot of detail for extracurricular activities for kids! Hope that helps! 🙂

I have a very similar system with a few slight changes – I budget $250 per week for grocery and other – So I combine the 2 into one weekly envelope. If there is $ left over at the end of any week, it remains in the envelope until the end of a four week cycle. At that point I transfer it into our savings account. It gives me the flexibility to have that extra cash on hand for a meat or bakery or Costco order, for example. While I understand your point about not going over the weekly limit, I would prefer to keep the extra cash available for a planned larger grocery haul, rather than a shopping trip just for the sake of spending the extra money.

Also, my husband has a credit card that we use to make most purchases to collect much needed airline points to visit our son overseas. Each month he buys gift cards to the food shops that I frequent using his credit card. I then reimburse him with cash and use the cards for grocery purchases… Win, win! Points and I am still technically paying cash!

Thank you for the video … Your enthusiasm is remarkable!

Any tips for using this with Amazon? Some of my purchases on Amazon are consumables and some are other. Also I can look at my orders but won’t have a receipt. Also what if my husband and I split our Other purchases? Do we just split our Other total? What if he’s not on board with this? Do I just do my best with my envelope? Thanks!

Your envelope should cover what YOUR spending responsibilities are, your husband’s spending shouldn’t affect your envelope in any way. So divide that up FIRST! As for online expenses, they count! They need to come out of your budget, so write them on the envelope just like everything else!

What do you do with online purchases?

Same! Write them on the envelope just like anything else!

Jordan, you are adorable! I have LOVED this tip for years and wanted to share it on our blog: http://www.dealstomealsblog.com/2017/07/05/jordan-pages-simplest-budgeting-method-ever/. Hope that’s okay? I linked back to you 😉 Keep up the amazing work!

Two part question, have you every thought of a payment plan type of option for your financial bootcamp? I would love to do it but need to budget for it.

Also do you mirror this for household expenses?

I’ll take the payment plan into consideration! It usually works out because people will just set aside $25/week or so, and will have enough for the program in a few weeks. So maybe you could try that? Use the code FCFBLOG for 10% off which also helps!

Hey Jordan! I am starting your envelope budget today. Thank you so much for sharing your system with us!

Two questions:

1) what do you do with excess? Do you keep it for the next month? Or do you deposit leftovers into savings?

2) What does your husbands budget method look like? I know you have said that he covers entertainment, but what else? I’m trying to get my husband on board too. 🙂

thanks again!

How do you handle Christmas and birthday presents?

So if you do a Costco run or Walmart run…maybe even Target and are purchasing things that belong in “grocery” AND “other,” do you just have to go through your receipts to figure out how much to deduct from each category? Does that make sense?

Next question that has NOTHING to do with any of this. Ha! Can you give me some tips for having your kids 18-months (or so) apart? My first two are 22 months and my oldest handled it like a champ. But my 18 month baby boy is sooooo clingy to me. I’m due soon with our third and wondered if you had any tips for handling a new baby when I still feel like I HAVE a baby. Ha!

Hi Julianne. I was having this issue too. What I ended up doing is just separating it into 2 transactions. So I have 2 nice receipts. The cashiers never seem to mind it.

Hope that helps.

Hello There! Question J, how much do you budget weekly for your other budget? Also, how to you budget for new clothing or to get your nails done or even a pedicure? I would love to see a video or a picture of an envelope from your June budget just to see how you adjust if you go over budget! Thanks J!

I, also, am confused how you figure out how much to budget for the “other” category. Is it different every week or the same? So confused !

It should be the same every week. So set an amount, and work with that!

If there are only 2 people in your family (just me and my spouse) should we only budget $200 each month for groceries? In the video you mention $100 per person per month starting at $300. So do you suggest budgeting $300 for groceries per month?

If you could get by with $200/month that’s great! But $300 is probably more realistic. Don’t go over $300 though!

What would budget look like for 2 people (me and my husband) And I also babysit 1 three year old full time and watch my 2 grandchildren (3 and 6) full time and feed them also so I need to include breakfast, lunch, snack and sometimes dinner for them.

Would I be budgeting for 4 people?

My husband thinks $100/pp is unrealistic in Hawaii what do you think? Tia

Right now I seem to be spending at least $800/mos if not more because I have no time for couponing like I used to so I do most of my shopping at Costco and I buy a lot of fruits/veggies for the kids.

Hawaii is very expensive so I agree, you would need more than $100 – maybe more like $150/pp. Just test it a bit and see what you can do!

Aloha Ray, I am also in Hawaii-in Kaneohe. I have a family of 5 and find that $150 per week suits us fine. I do not coupon. I shop at costco and times mostly. I find that I can only stick to my budget IF i meal plan and do not go crazy at Costco (lol).

I buy lots of fruits and veggies and since meal planning, ive been having to buy less at Costco and also experiencing less food wastage.

Aloha Hoku, I was just going through my emails and came upon you reply to my question about budget. I was just telling my husband that we really need to sit down together and start meal planning so we can cut back on our monthly grocery budget. I’m definitely going to try it now seeing that it helps you keep to your $150/wk budget. I too buy a lot of fruits and veggies since that seems to be the only things the kids really eat.

I looked through to see if you had answered this question. I have watched a few videos and read a few posts, but still haven’t found your answer, Jordan 🙂

If Costco doesn’t fit into groceries, where does it fit? I just started this system on Friday, so far so good, but I haven’t made my much needed Costco trip because I don’t understand where it fits. Thanks so much 🙂

Fits into grocery! Unless you’re buying clothing from Costco (or toys) in which case it’s from your “other” budget 🙂

What did you do for your family budget when you earned $31k/year? We can’t afford to pay a mortgage or rent in the new area where my husband got a job (not unless we want to pay over 50% of our income on housing and utilities – and have no money for anything else).

Yes! Please share! How can this work for a single mom making 31,000 and barely getting by? I can’t seem to get ahead and I only get paid twice a month I’m working on raising my awful credit score

. I am tired of stressing over money but I love my job I’ve been at for 19 years. Mine is a mess

This sounds like a really simple method to try, but I’m confused about your husband having separate envelopes. If I’m trying to figure out our entire monthly budget, I would need to know what my husbands envelopes are for and how much his should be as well. You said his is for going out to eat, but you also said your “other” is for that as well. How do I know if it comes out of mine or his? I would love to get some clarification on this. Are there any other envelopes that your husband has? I’m the one in charge of the finances, so my husband would probably just rather I keep track of everything. Thank you!

Hey Holly. I was having the same issue with my husband. From what I understand the envelopes her husband has are what he spends on and she doesn’t spend from her envelopes for eating out or entertainment. But I’m with you and I just keep track of it all myself. When ever my husband spends anything I make him give me the receipt or write it down on a post-it how much he spent (we use card not cash). We have to communicate a lot more with doing that, and I end up telling him how much he can spend on something based on the budget for that week/month.

Example: He wanted to go out to a comedy club (on a Wednesday night) tickets were $40 for both of us and our entertainment budget is $45 for the week. So if we wanted to do that we had to understand that this was all we would could spend for entertainment that week. (We ended up no going and did something else that weekend.)

Hi Jordan! I am excited to try this method out for myself for the first time and see how it goes. I had a question – you said under grocery tab it doesn’t mean like Costco. I understand we are looking at a week at a time needs – but some things that are consumable I like to get at Walmart – like bread and milk and butter and toilet paper…so how do I best do this to stay in the budget? I mean usually when I buy stuff like this at Costco I don’t need to buy it every week but it might be a bigger spent week one week…does this make sense what I am even trying to ask…haha, just wondering can I use this budget thing and Costco or is it only work if I use a local grocery store and buy things not in bulk…

I was wondering where does day care fit in? I was thinking family budget with the monthly bills but I’m not too sure. Thank in advance for your help.

Me and my husband started your system three months ago and have loved it! The first two months were working on becoming accountable to the weekly budget (rather than our monthly- oops missed the budget again system). Last month (even being December!) we finally were within our budget!!! Thank you very much for posting about this and for the free envelope printable’s. We divide our monthly budget into 5 columns (Grocery, Family-him (gas) , Family-her (standard bills), other-him, and other-her) that way both me and my husband have our own envelopes on the bills we are in charge of. Thanks again.

I kind of have a dumb question:

When i am putting down the totals on the envelopes and you are grocery shopping on a saturday and your week ends on a Sunday that grocery money is for the upcoming week. So today is Monday but i purchased groceries this past satuday which was last week. Should i do my weeks satuday to saturday or just think that I am spending it at the end of the week?

You can choose your weeks, as long as your budget isn’t longer or shorter than 7 days!

I am giving this a try. So far, I am a bit confused because I keep crossing over my cash/debit spending with other/grocery and forgetting which comes out of which side.

Our food money is SNAP right now so I think I need FOOD/GROCERY/OTHER until the food comes out of grocery as well because that confuses me further-?!

But it’s only the first week and I plan on sticking to this for the 3 months like you said.

I love this idea! Ready to try it with the new month coming up!

I’m going to try adapting these concepts! Thanks so much!

I’m going to try this out!

It is seriously so simple, but since I started doing it we have saved so much money! I was going to the grocery store way to often and this really opened my eyes. Thank you!

This budgeting method changed the way I look at money. It makes it so simple and straightforward I don’t loathe budgets anymore! ??

I tell anyone who mentions a budget to me that they need to watch and try this!

Your envelope system is absolutley brilliant. The first system that resonates with me. So sensible!

This idea is brilliant!

These videos are the reason I started following along. This budgeting hack is so simplified and has been so simple to work into our family life. Thank you!!

I loved this video! It helped me realize that our budget it too complicated and that is why it just isn’t working for me! Thank you for your amazing tips!

Love this budget method! Envelope fits tight into my wallet and so simple to keep track of. Saved us lots of money so far….so thank you!

I’m new to this method but so far it’s helped a ton. I’m still figuring out how much to put in for each week. I have a family of 7 but I don’t have a hundred dollars per person. Sometimes I do and sometimes I don’t. I think I just need to hang in there for a little longer. I’ll get it figured out aventualy. Thanks!

I LOVE this method! I am so excited about it that I have shared it with all my family. So simple but makes such sense. Thank you!

Love this idea about budgeting by week instead of for the entire month. I will definitely be trying this. Thank you!

Thank you for sharing these tips. The hubby and I have been trying to work on being better about budgeting. Trial and error, but not giving up.

The hubby and I stumbled on to your page in January and it is has helped us be more serious about budgeting. Thank you for sharing.

I do this now and love it!! I have a hard time treating myself to a Starbucks or timmies (canadian) but If it’s close to the end of the week and I see an extra $20 in our food budget, I’ll treat myself to that .80 donut!

This is the best! A serious game changer for me! It’s so logical. Thank you!

This is so simple but so good!! I’ve been using it for months. I think my favorite part is having the receipts all in one spot (instead of the bottom of my purse or car floor ?).

Love this! Simple and easy!

This wa so helpful Jordan, been following you for 1 year now after finishing college and jumping right into paying off student loan debt. Every penny counts! Your story is so inspiring. Congrats on 100K followers on Instagram ???

I went to do this and failed miserably…I definitely need to work at it a lot more! Hard thing is that my boyfriend is home for 2 weeks and gone for 2 weeks and I meal prep for him so he has good cooking when he’s gone on the rigs for 2 weeks. We are a family of 3, him, our almost 2 year old and me (hoping to add another soon!) so that’s $300/mo, $75/week however I feel like I need to make it $100+ when he’s home to buy food to prep and $50 or lea when he’s gone. Idk! HEEEEEELLLLLP!!!!

I can not give you enough love for this method!!!! It’s so easy to use and figure out! My husband was totally on board right away when I told him your system! It’s the best! Thank you for sharing!!! ❤️

Hey guys, found this really interesting and helpful. We are Australians living in Ireland and have adapted to making it work here for us

Hopefully we win a budget boot camp pack and we can really start saving!!

Cheers Cara

This one helped us out a lot thanks!

I LOVE this method! I’ve used it for several months now and tell everyone about it!

This tip has changed my life! My husband and I are trying to take control of our budget and pay off debt, you have inspired me so much?

I am going to start doing this today! Thank you so much for this advice!

JUst started this! Thank you so much! This is so helpful!

This is the first video I saw of yours. Now i’m hooked and motivated to save money and pay off debt!

Love using this – so simple and so effective! I have been using this for several months now and it works wonders! Thanks, Jordan!

Finally an envelope system that works!! This system is actually saving us money and is way better than any other envelope system I’ve tried in the past!

This budgeting system has helped my family in so many ways!! I will never shop any other way.

Your budgets are amazing. Simple and easy to understand and I love that they are something that works and worked for your family. It’s not just something your trying to sell. It’s something that is genuine. Also easy to adjust for everyone else’s situation.

Printed them…used them, but it’s so hard to learn a new routine!! I’m gonna keep trying because I think I works for sure!

Hi! I really want to try this! Thank you so much for sharing what helped you!❤️

I love this method!!!!! Totally going to try this!!! My hubby and I are working on splitting the budget so I know what I’m CFO over lol!!!!

I watched this video last night & LOVE the simplicity of this method. I’m doing it!! Thanks!

I have such a hard time with cash, going to try using the “envelope” method, but with no money..just keep track of what I spend with debit card daily and try to stay within budget. Yikes!

OK! So, this system completely changed how I think about budgets! I am a budget girl and have adhered to one for a long time but ALWAYS wrestled with creating a “perfect” budget that worked for each month/each situation/and for both hubby and I ( I get lost in ALLLLLL the details…smh) …so for years now, we would rework how we do the budget…like every few months. I know, it’s insane and exhausting. This was the very first blog post I read of yours and I have read it over an over (along with the other budgeting posts) and slowly we have been simplifying what we do to resemble this. I can’t thank you enough!

My hubby and I used to be so good at budgeting in the early years of our marriage. Then life happened and now we need to get back on track. Excited to give your system a try!

Love this. I know do it every month.

This envelope system has already been so big for us. We’ve only been doing it for three weeks so far (started the moment I saw the video) and my husband is already surprised by how much less money we’re spending. We have enough money to live on but still end up transferring from savings at the end of the month and now our savings is nearly gone, so this plan came in the nick of time. We’ve tried Ramsey’s envelope method but we’re always a bit overwhelmed with the cash part. This has been awesome! It’s like a game for us to…an obtainable goal. Thank you so much for sharing all your tips Jordan, they’re so needed!

Seems so simple and easy, which is great cause some others methods i have tried make it more complicated.

I love this is method!! We’ve started using it and it’s made a world of difference! ???? Also the 7 bank accounts is genius!! ??

I love this tip. I have followed Dave Ramsey, Suzy Ormond, Tony Robbins all to just say all along “How do I know how much to budget for food? Just someone tell me!” Thank you.

I love this! Food budgeting has been my biggest question for years! Thank you.

This budgeting method has been a serious game changer!! I used to spend all of my food and other budget money so early in the month and then be left with nothing for the rest. This totally fixed the issue. I just tried it this last month and it was the most no stress budgeting month yet! THANK YOU!

Oh my goodness! This is so simple that I can be consistent at it!! Thank you. This came at the perfect time as we are trying to head off our own FD.

This changed my life!!!!ive tried so many techniques but this just spoke to me and I have no clue how much it’s actually saved us but a lot for sure..

I really like that you try and make budgeting relatable for everyday moms. It isn’t going to work if there isn’t a way for us to fit in a chick-fil-a day every once in a while! ?

This tip has been the most life-changing tip you have ever shared, HANDS DOWN!! I have been using it for about 6 months now, and I have such a better handle on where my money is going each month!! And I can purchase “splurge” things with confidence. Now, sometimes I still overspend, but I can go back to my notebook (I use a notebook instead of an envelope) and find out exactly where I got out of line and how I can fix it! Especially the grocery, shopping in bulk saves but it always threw off my budget (like a $300 trip to Sam’s Club!). So thank you SO MUCH for breaking this down for me. Love it!

My husband and I are working hard to get a budget and pay off some debts and I think we just might try this method!??

The “other” budget has changed my life!! Thanks Jordan!!

I love your blog and have watched many of your videos! My sister and I follow this and I know it’s helped us! Thank you for all your advice!!

Going from Once a mouth shopping to this has been a challenge….but has saved us sooooo much money! Thank you!

These are all great tips. Can’t wait to get started. Thanks so much!!

I know you say $100/person/month…I don’t know how to do that?!?! Probably better planning than I do….I really want to win one of your budget bootcamps!! My husband loves Dave Ramsey, but I think I identify more with your ideas!

I have referred to this blog post so many times and taken SEVERAL notes ?

This budgeting method has seriously changed my life! Is that cheesy?? But no for the first time budgeting makes sense and I like doing it!!

We are wanting to get our finances in shape-love all your posts!

Discovered you a few days ago. Just in the nick of time. Totally trying this. My husband and I have done something crazy… we’ve moved from the city to the middle of nowhere! We purchased a farm to share… house hadn’t been lived in for 11-12 years ish. Can you say renovation? This has been our dream for years- to have a place in the country to share. Guest rooms and bathrooms are done! Yay! But we’ve hit a giant roadblock… while I was out of town the contractors found a major problem that had to be fixed… thousands of dollars later out budget is totally trashed! No kidding. Painful to even share this! Pain full! We went into oh no it’s over mode. But this gives us hope! We can figure it out! We can do it! It’s going to be hard but with some guidance I think it will be ok?! On the day my husband went to ask for mentor suggestions and came back from his meeting empty handed…. I found you on Instagram! Deep breath here. Thank you for doing what you do! For giving people hope! So we are trying this first! One step at a time! Would love to win your giveaway! We need this! We can’t afford this right now! So empowering… thought a vacuum would be awesome but this is more important than a new floor cleaning machine! This is a life cleaning gift. Life cleaning. Thanks for the chance to win! @gidnas #wanderinfarm

The best “envelope method” ever! Your tips are amazing, especially to make things more simple for a moms/families!!

Thanks for these great tips! I’ve always been a saver but not in geoceries other than a few coupons. This method has helped me go from a 1200 grocery bill to 600. I have a family of five but two teens so they eat like 4 people. Yikes!

I was a mthly. shopper before & this method works so much better thus keeping my budget under control & focused more on what I really need. I had been wracking my brain trying to cut mthly costs w/no where to go because I had cut everything or so I thought. For some reason groceries didn’t come to mind until I found your budget. Funny because I wasn’t looking. I was like Lord, “please I want to make this better.”

I stumbled onto your laundry video & that led me to watch more when I found the budget envelope. So thankful, this has made a tremendous difference not only money wise but the way I look at my shopping items, price checking, keeping me focused, & so forth. This works!! For anyone skeptical it works it really works! Thank you Jordan I can’t say enough!

I LOVE that you split everything into 4 weeks. IT IS SO MANAGEABLE. I always failed at budgeting because 30 days is just way too long. I also love your grocery tips. We are a family of 2 adults and a dog and I’ve been really good at keeping our grocery budget right around $200- including toiletries! I’ve combined shelf cooking methods and have wasted so much less food. I’ve been doing this since January and have paid off over $1k of debt. SO grateful for you sharing all of these things!!

This has been life changing for my husband and I. Such a big change in only two month’s of this method. Thank you so much for taking time to share!

This was life! I appreciate you putting great info out there just to help people budget.

So thankful for this method. I have always been a saver & focused on having budgets but somehow it never translated to my geoceries other than a few coupons. I have a family of 5 two being boys & teenagers so they eat for 4. My groceries were around 1200 a mth. & because of Jordan’s method I went down to 600. There was nothing I could cut from our mthly. expenses or so I thought & I was like, “Lord please help me.” I saw Jordan’s laundry video & just kept watching more & finally saw the envelope video. I was always a mthly shopper before. This method works it really works! For anyone thinking they can’t do it “You Can.” I’ve been doing this for 3mths now. The weekly budget keeps me focused on what I really need & out of the multiple trips to the store. So appreciative of you Jordan!!!!!

I love this so much. So easy to follow, stick to and keeps everything so organized.

We need to try this! We’ve been trying to get back to budgeting this year (we were super consistent with it for over a year and then my husband took over?), but I’ve been finding the traditional methods too complicated and time consuming. If we can figure out a way to split up our expenses (we both cook and grocery shop) this could make life so much easier!

This is genius! I didn’t think it’d make such a difference but it’s great to visually see how much we’re spending each week!

Thank you for all the great content! It inspires me to get my house and budget in order.

I want to try this!

I’m working on getting my husband on board with this concept. ?? lol

HOW to budget for a family of 3?

Love, love, love this budgeting method!

I’m so energized by your method and am excited to incorporate it into our way of living!!

I’m excited to dive deeper into all of this information you’re sharing!

This is such a good idea! An area where I need to get better at

I love this system. It has saved me so much money. The $100 per person per month is so reasonable and a little challenge for yourself to make sure you’re getting a good deal to help stay in your budget. And its an easy way to have your receipts organized.

Love this method! I’m an accountant who hates budgeting for herself because so many systems out there are too complicated & I just don’t want to lol. I started using this last month & now im hooked! It is super easy and makes me very aware of where my money is going. I have now made my sister start doing this too. So helpful!

I’ve been using this method lately… and it WORKS!

This is how I originally found you!! Your personality and openness kept me coming back for more! You are truly an inspiration to me in so many ways!!

Thank you!! Thank you!! Thank you!!

This method using the envelope has been a game changer for me, especially with groceries. I have been cooking from scratch and trying to save money while feeding a large family for quite a while, but it wasn’t until I broke it down by week and stayed accountable with the running tab on the envelope, that I was truly able to stay within my desired food budget each month. I always tried to just stick to a monthly food budget in the past, and it does not work nearly as well as the envelope system. Thank you!

Love this. Hoping to one day purchase budget boot camp for more!

Love this simple budgeting plan, I keep Trying to keep up with it! My downfall is not recording online purchases, and also ‘extra’ things that come up like a birthday or making a meal for someone else. I will keep trying!! ?

I really love this idea. Seems so straight forward and doable.

Been following you forever. From way back at the old house when you’d stay up late and post you tube videos from your kitchen table. You are full of advice that’s simple and smart and I’d love to win your boot camp. Ha Dt bougjht bC I’ve followed you for so long I assume I know what’s going to be in it and we don’t have Much debt so it’s hard to justify the cost. But…… if I was lucky enough to win it. I’d watch it all and live by it!

So easy! I’m torn on this or having it all separated into separate areas. Gonna just start and see what happens.

We did Dave Ramsey and it was awesome for about three months, and then I stopped keeping up with our budget. This is a much simpler idea, thank you!!

A way simpler envelope system! We used to have a million envelopes. Then I bought a wallet with 4 file folders. I love that wallet and I can apply a week by week mentality to it! I love love LOVE how simple this is. Thank you!

these are great tips but i bet your budget boot camp is full of even more! ?

I think I was watching this particular “ envelope guidances “ four times. I’m very inspired by this and I think I can do it. Going into stores thinking of it . Funny, your face popped out in my brains now ?.

Thank you for this, I have been tracking my grocery shop this way for 2 months and have managed to save $100s. We have reached our savings goals super quick just by tracking and sticking to our set grocery budget. I love the added bonus of having all my receipts neatly tucked away

Hi,

I have tried to read through the comments to see I found this is answered but didn’t see anything.

My question is what do you do about and expense that is over the weekly budget but only happens every once and a while. Example: hair appointment that is $200 (weekly budget is only $100) or Vet bill?

I’ve been doing the envelope system for about 2 month so now and love how easy it is and really makes me think when I’m out if I really need something.

You are amazing! I am a recent follower (I found you through the I am Mom Summit if you track that info 🙂 ) and have been enjoying all the youtube content. Question about the 10% tithing. When I brought this to my husband he said,” we pay on the pretax amount, so that would be like 26-30% goes to tithing, then live off 70%. Doable, but we’d have to change A LOT of things.” To me this was a big “wow” moment, bc if we’re paying that much in tithing, isn’t that MORE than 10%, but to him this is the way he was taught to pay tithing, so he thinks switching to your method would be sinning (not joking…help me out girl, bc I really want to get him on board with a budgeting system we’ll stick to, instead of one we talk about then shelve.) Tips? Tricks? Advice??

So thankful !!! For years YEARS !!! Seriously I have zero sleep over what is coming next in our mail box . When I here the mail mai. On the porch I get that horror movie sweat like he/ she is JACK THE RIPPER . !!!! We have done something similar to the 7 bank accounts . We split up our money when it comes in so it’s not all blended like a smoothie 🙂 and I heart ! HEART. This envelope . I seriously can show you envelops all around the house that have lists and money accounts on them ??? . Your post let’s me know . “ hey , you . Your doing everything right . “ and maybe not today or tomorrow but months down the line every little money move … is family and “less stress “ destination relax ! Seriously I want to sleep like those parents in the NyQuil commercial ??♀️ . Thank you . I can’t wait to see more ????

Also ! On the other side of the envelope . I’ve noted birthdays , parties and anniversary’s and holidays etc for that month . So I’m prepared:) even more ! Thanks again ! I live all of your videos !

I started using your envelope method and I am sold, I was always just taking my money out at payday and spending my budget over the month. I am using the same budget as always but I am finding that I actually have money left when I am moving on to the next week. It does make you stop and think about nipping in to shops to pick up bits, that you don’t really need. And it’s like payday every week and not how many more days to pay day!!!. I will continue with it as it’s so simple but so effective

I’m confused about how Costco factors into your weekly grocery budget. If I buy diapers, wipes, paper towel, and toilet paper at Costco one week, that’s at least $100, which technically used up my $100 per week grocery budget for a family of four, without even purchasing food. Since Costco is a bulk store, shouldn’t it be a separate? It doesn’t seem that buying in bulk and having a weekly budget is compatible.

Where does gas fall into? Family, grocery, or other??

What if both of us grocery shop (separately on multiple occasions )? Should each of us be allotted 50% of the $ amount ?

Where does clothing go? The other column? It seems like that would eat up that column super fast. Also, some weeks we spend more money eating out because of schedules and nothing on grocery so would that go under grocery?

What are the small boxes for? Totals at the end of the week?

What is the square in the corners for?

That is what I use it for! I circle it in GREEN if it is positive and RED if it is the negative. 😉

I absolutely LOVE this envelope budgeting method! It has helped me “shrink” my budget because I am focused on smaller portions of money each week INSTEAD of just seeing the $ in my bank account and thinking I have lots to spend….which, inevitably lead to OVERspending every month. I have been using your printables for 4 months now and have not had to use my CC at ALL to cover expenses at the end of the month!!! WHOOO HOOOO!! Thank you so much for this amazing idea.

I feel like you’ve lifted a weight off of my shoulders. I love the envelope for budgeting personal spending responsibilities.

Thank you for your message! I’m so happy this could help you 🙂

$100 per person per week? Is this even possible in Canada??? Love the rest though and going to give it a try!

I’ve heard of some Canadians who are able to make this work! But if not, try and see if $115-125 per person a week would work!

Just wanted to let you know I love in Toronto and I’ve been able to make this budget work for a family of 4.

What category would you put diapers and formula in? They are both so spendy – and I shop around.

I include those in my grocery budget. I definitely try to stock up when they go on sale, especially at CostCo! Those are the reason that newborn babies get a portion of the budget as well.

Hello! I am wondering if you have 2020 envelope printables?

We’ll be getting that one up soon, so keep watching for it!

I’m curious (and as far as I can tell my question hasn’t been answered) what the purpose in the bottom right corner of each square on the envelope is for.

That would be for how much money you have left from your budget at the end of the month, if any. In a perfect world, it would be at $0 or you would have some money left over. But if you go over budget, then that allows you to see how much over you went at the end of the month.

Help! I have budgeted out groceries at $300 for my husband and I (No kids) and $200 a month for other. That’s $75 for groceries and $50 for “other” per week. I’m looing for clarification on staying under budget for “Other.” For example, this week I spend my full $75 on groceries. I have $50 for “other” and want to buy an outfit at the store or a bridal shower gift that’s easily over $50. If I can’t borrow “below the line” and my grocery budget for the week is already used up, where do I borrow from for those bigger purchases?

This is where you have to be picky about your spending! If you can’t borrow between the two, then you need to wait until the next week to make the purchase. If you buy a lot of gifts, then you could have a separate gift budget that you put money towards every week. Look at our 7 bank accounts post for more details!

Thank you for this simple method of budgeting! I love the idea of grocery store money and other store money. It pretty much fits the way I shop and is so much easier than thinking I should break the purchases down into a dozen subgroups. That makes me overthink it and give up.

Hey there! I’m a little behind on getting my envelopes started, but when I went to put my first expenses on them yesterday, I noticed that the year has changed but the days are still the weeks of 2020 on the envelopes linked above. Did I miss the updated envelopes somewhere? Thanks! 🙂

Oops, thank you for bringing this to our attention! This has been fixed! We just removed the dates on the side so you can decide what day of the week your week starts on 🙂

Love this! My husband and I have been doing this for a couple months now and are getting the hang of it. Question though- what do you do with the old envelopes? Keep them in a box somewhere? Throw after a couple months? This stack is an eyesore!

I usually save the current year’s envelopes and then throw them away once the year is over. That way if we needed to see how we did for the past year, we have it handy. Keep it in a drawer or cabinet where you can’t see it every day, but can easily find it! 🙂

I’m on SSI, and my monthly income is $850c a month (not week, month). My rent is $300 a month. I also have to eat gluten free for medical reasons, which makes it harder to eat cheaply and have any kind of variety. Do you have any good tips for me on how to get by?

We have tons of content on this site! Click the budget button at the top to see all of our budget-related posts. This post is a great place to start!

If we stay within budget one week and have leftover money, is that supposed to go directly to savings or is it okay to add it to the next week’s budget to make a bigger purchase? What should we do with the leftover money? Also, will you be updating the printable envelopes to say 2022 or otherwise would you be able to remove the 2021 so we could add our own year? Thanks so much for all you do! I am excited to try out your system.

That is a personal preference and completely depends on where you at on your debt free/savings journey. Thank you for the suggestion on the envelopes we will look into that.

Will you be updating the free envelope printable for 2023?

Is there anywhere I can find 2023 versions of these envelopes? I’ve been loving them for the last couple of years and am not quite tech-savvy enough to make such a clean and pretty version on my own! Thanks 😀