Rainy day fund, fun money, extra spending money… AKA slush fund account! It's time to learn about this great savings account and why you need one in your life!

If you've followed us for long, then you know we are all about putting our money where our mouth is and being intentional with it! This means that we not only give it a job, but we also break our money down into separate bank accounts. This way, we're able to keep track, so we know exactly where our money is going.

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

So what is a slush fund account? How do you use one? You're about to learn all you need to know about this FUN MONEY account, so get excited! But first, let's go over…

THE 7 BANK ACCOUNTS YOUR FAMILY NEEDS

We fully believe in having at least 7 bank accounts… Yes, you read that right! We go into full detail in our 7 Bank Accounts Your Family Should Have post, and you definitely don't wanna miss out on that! The main gist: to most effectively track your money and spending, you should have these accounts:

- Emergency savings account

- Regular savings account (that holds money for various reasons, including unexpected expenses)

- Family checking account

- Wife checking account

- Husband checking account

- Health savings account (aka HSA)

- Slush fund account

- *Bonus: Kid saving/checking accounts

Now that you have a little back story, let's go more into detail on that fun slush fund account!

WHAT IS A SLUSH FUND?

A slush fund account is an account where any of your extra monthly leftover money goes. Think of it as the jar in your kitchen or laundry room where you put any spare change. Only it's the 21st century, and we do pretty much everything electronically these days!

However, there are a few rules to consider before we just go throwing all our money willy nilly into this fun slush fund account:

- All debts must be paid off, with the exception of your house and maaaaybe your car… That one is up to you, but why not go ahead and pay it off as quickly as possible?! This includes credit card debt as well!

- You should have enough money in your emergency savings account to live off of for 6-12 months. (This is your dire, “we're going to lose our house next week if we don't do something” account and shouldn't be touched if it's not a life-or-death situation!) We recommend always having 20% of your paycheck go into this account because the more cushion you have built up for absolute emergencies, the better!)

- You should have at least three month's worth of living expenses built up in your regular family savings account. (This is what you tap into first to live off of for a short amount of time before tapping into your emergency savings account.)

- All bills have been paid for the month.

- You've put any money towards the financial goals you're saving for.

“I am saving for a weekend getaway with my husband. Any extra pennies I get are going toward that.”

Meggan

Okay, now that we've gone over the nitty gritty, let's get on to the FUN part!

HOW TO USE YOUR SLUSH FUND ACCOUNT

At the end of the month, throw any and all of your extra money into this account! Maybe you came in $10 under your grocery budget. Maybe you had $50-100 leftover from your tax return that didn't need to go toward any other bank accounts. Or you decided NOT to break into your “other” account for that super cute top you've had your eye on for a while.

While we are all for treating yourself and getting your favorite drink at the local shop, why not put that money toward something you really want in your slush fund account?! (P.S. You can totally still make your favorite Swig drink at home and save a bundle!)

MAKE A PLAN FOR YOUR MONEY

As with everything in life, you'll be a lot more motivated to save all of your extra money for this account if you have a plan for it! While it is fun to have a basic “rainy day” account, it's WAY more fun to save up for something specific. Think of a vacation that you wouldn't be able to go on otherwise, a trampoline the whole family can enjoy, a new TV, or whatever speaks to you and gets you motivated to save!

Don't be afraid to get your family involved with this, either! Once everybody is motivated and on the same page, it's a lot easier to skip those fast food runs, even when you have them worked into your normal monthly budget. Kids may even want to add their allowance or leftover birthday money to your family slush fund if they're excited about the family goal!

Set a goal so this fun money doesn't end up burning a hole in your pocket before you're ready. Once you make a plan and have a goal in mind, it'll be a lot easier to have self-control and not touch it until you've reached that fun goal!

Not only will you end up with something to show for your hard work and dedication, but it'll also teach your family how to save, budget, and learn the fine art of delayed gratification. Talk about some added benefits!

My slush fund is for a recreation property that we can park our trailer on for the summer and always have a spot to camp.

Alisha

TRACK YOUR SLUSH FUND MONEY

The best way to keep everybody motivated is to track your slush fund money! If it's fun and visual for the whole family, then it's a lot easier for everybody to want to contribute!

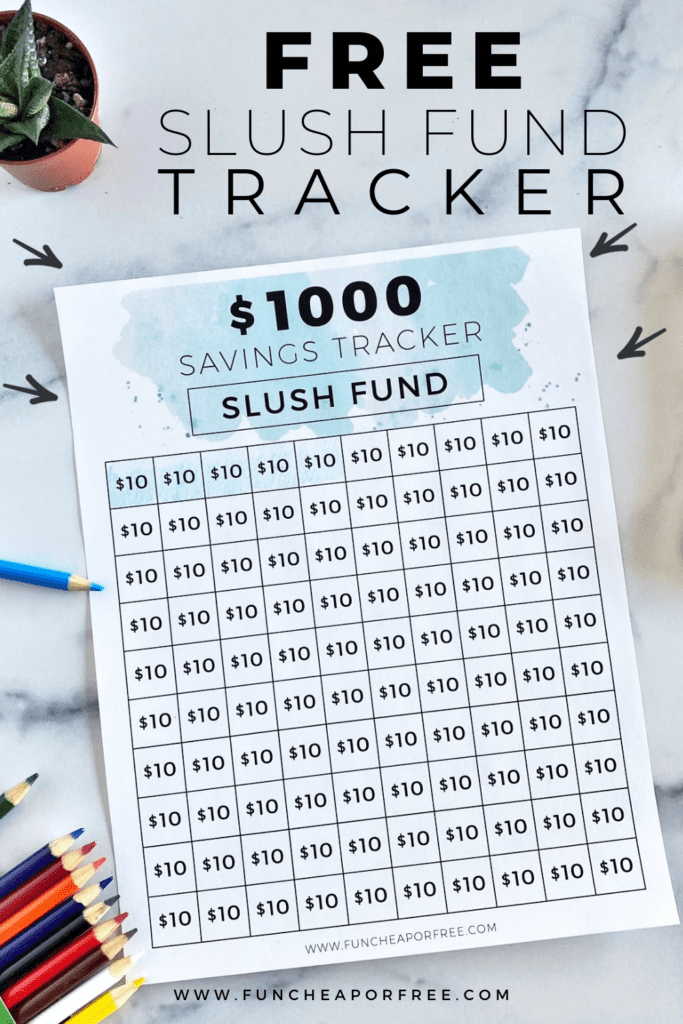

- Make a coloring chart tracker for your fridge. Print our free slush fund money savings tracker printable and color in the square for each $10 saved! It's a fun way to keep tabs of how much you have and is so. darn. motivating.

- Place dried beans (or jelly beans, yum!) in a jar to represent every dollar in the account.

- Place Post-It notes on a piece of poster board for every $10 (or pre-determined amount) you save! It's so exciting to see the board fill up.

I'm been tracking and saving up for a George Mulhauser Plycraft chair for over a year. I know that when I finally have the money to buy it, I'm going to enjoy it all the more.

Jamie

Alright, well there you have it! Now you know everything there is to know about a slush fund account. The real question is what are you saving for?! Let us know in the comments below!

Need even more help with your budget and getting your finances in order? Then you need to check out Budget Boot Camp! It's the perfect, fun way to get your budget in check.

Doesn't that sound awesome? Use the code FCFBLOG for 10% off at checkout!

Looking for even more great budgeting ideas?

- Learn how to budget your money with our best budgeting tips for families!

- Working with a variable income? You can still make it work for your family!

- Get that money date night on the calendar with your sweetie! It's time to get on the ball and discuss all things finances.

Happy slushing!

0 Comments