Ready to teach your kids the value of a dollar? You're about to get the lowdown on how we do allowance for kids in our house. Hint: You won't go broke if you stick to these guidelines! Let's do this! Don't forget to snag our free savings tracker printable!

Ah allowance, the great debate among families with kids. Should you pay your kids an allowance? Should they just be part of the family and chip in without any payment? How much should you be paying in allowance? How can we even possibly afford to pay our kids an allowance??

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

The questions can seem daunting, but it's really not that complicated! I'm about to break it down for you in just about the easiest way possible. No more fretting over the allowance in your house. Use these tips and you'll be on your way to raising independent, capable kids who can manage their own money! Yes, I know, it's as exciting as getting to go to the bathroom all by yourself without anybody interrupting you for a full 5 minutes. 😉

Before we get into the nitty gritty on allowance for kids, let's first go over…

WHAT WE SHOULD TEACH OUR KIDS ABOUT MONEY

Money is HARD. If you don't get into a good routine with your money early in life, then there will be consequences. Here are the two biggest things that I'm teaching my kids about money:

- How to be financially responsible, saving AND spending wisely.

- How to work hard and set the realistic expectations that nothing is handed to you in life. You have to work hard for what you earn, and you earn what you deserve.

Notice that it does NOT include:

- What we should buy for them.

- How to get kids to listen to us when we tell them what to do.

- How not to make mistakes.

- How to avoid real-life challenges until they are adults.

Why do we do things for our kids that they can do for themselves?

Let's face it…it doesn't do ANYONE any favors! By handing our kids things on a silver platter (whether intentionally or not), it's setting them up for unrealistic expectations because, whether we like it or not, that's not how life works!

“But I figured it out as an adult, so can they…it's time for them to enjoy being kids.”

Sure, maybe we turned out okay having had to figure it all out as adults. But at the end of the day we all want the best for our kids, right? So why not teach them to be the most amazing, self-sufficient, responsible, capable kids and adults they could possibly be? If you ask me, there are not many gifts in this world greater than that.

SHOULD WE PAY OUR KIDS AN ALLOWANCE?

My answer, in short? YES. I know the subject of allowance is a hot debate, and can be somewhat controversial. Here's my take on why it's important to pay our kids an allowance:

- Allowance is a great way to teach your kids to manage and earn money while they're young.

- It transfers financial stress and pressure AWAY from you as the parent.

- Giving them personal money to manage allows them to realize that every dollar is a choice they make to either spend or save for a purpose.

- It teaches kids the value of hard work.

- It gives kids the chance to understand and appreciate the value of possessions.

Some people may say, “But I can't afford to pay an allowance for kids! It would make me go broke!”

To those parents I say…that is precisely WHY you need an allowance structure! You must remember, the purpose of allowance is to give our kids money (that they have earned, of course) to transfer the pressure from us to THEM. It puts them in charge of paying for things that would otherwise drain the bank for us. It helps us as parents reign in how much we spend on our kids, and gives us a set budget each month to plan on.

HOW TO STRUCTURE AN ALLOWANCE PROGRAM

There are LOTS of different ways to structure an allowance program. The best answer I have is to keep trying until you find the best fit for YOUR family…then stick with it and be consistent. It's okay to try out a few different systems until you find one that fits.

…but I know you all hate answers like that. So Bubba and I recorded a video a while back to explain how we do allowance for kids in our house! *Note: Our system has changed a bit since we recorded this. We also touch on how much to spend on kids as far as clothing, cars and college goes, but that's a whole separate post that you definitely don't want to miss out on!

Alright, now that you've watched that super fun video that may be slightly outdated… Again, it's important to remember there are many ways to give an allowance in your home. Trial and error is the best way to figure out what works for your family. We've adjusted our system quite a bit over the years to make it work for our family and that's okay!

ALLOWANCE FOR KIDS

Most parenting experts say chores and allowance should NOT be tied together.

Kids have chores to do because they’re part of the family. If chores are tied to an allowance, your child could expect to get paid any time he takes out the trash or carries a dish to the sink.

James Sears, WebMD

When we first started out, instead of a specific allowance per chore, we had clipboards with daily responsibilities they must accomplish, such as cleaning zones, chores, morning routine, practice, reading/homework, being on-time to meals, scripture reading, and so on.

They had to complete their clipboards each day to get paid at the end of the week. If they miss one day, their payout gets cut in half. If they miss more than two, then no payment! We do allow them to do makeup work to make up for a day, such as memorizing a poem or scripture, doing extra chores, or whatever else that needs to be done.

You can also adapt this for younger kids with sticker charts, stamps, paying with pennies or coins, or anything else that works for them.

HOW WE'VE ADJUSTED ALLOWANCE IN OUR HOME

We started giving our kids allowance each week but found that it was challenging for us to keep up on keeping track of the clipboards. They no longer get allowance automatically. Their clipboard responsibilities are now what we consider “norms” in our house. It’s what they do to contribute to the household. Plus our kids get money for their birthdays, so they always seem to have some money in the bank.

Once our kids turn eight and are old enough to start managing their money on their own, they're old enough to earn an allowance. We have them do a variety of chores including “babysitting” for money, which basically means they are in charge of one of the younger kids and help them get their clipboard done, entertain them, and help them get snacks throughout the day. It’s a great way for them to practice for real babysitting when they are old enough, and it also helps mom and dad!

What if they want extra money above and beyond their allowance? They can come to us with the desire to earn money. Then, together we decide on jobs they can do around the house. They give me a bid for the job, we agree on a price, and that’s how they earn money! We choose this system because it feels more like the real world, where money doesn’t just come into their bank account each week. They have to make the choice to earn it.

WAYS FOR KIDS TO KEEP UP WITH THEIR MONEY

In order for kids to be successful in keeping up with their allowance (or any money they earn from working or birthday/Christmas), they need to be able to track it. In our house, 10% of any money they earn is put towards tithing. Then they take the remaining 90% and put half in a long-term savings account (we use Ally bank) and half goes into short-term savings to be used as spending money (whether it's for brand-name clothes, a new bike, or going to the movies with their friends).

If you pay your kids in cash money, then a save, spend, share moneybox will help them to literally see what their money is going towards. Empty it at the end of the month and pay the tithing to the church, put the “save” money in their long-term bank account, and put their spending money in a safe place for them.

If you prefer to keep it all electronic, no big! You basically do the same thing as above, but they don't receive any literal cash in hand.

HELP KIDS TRACK THEIR SHORT-TERM SAVINGS

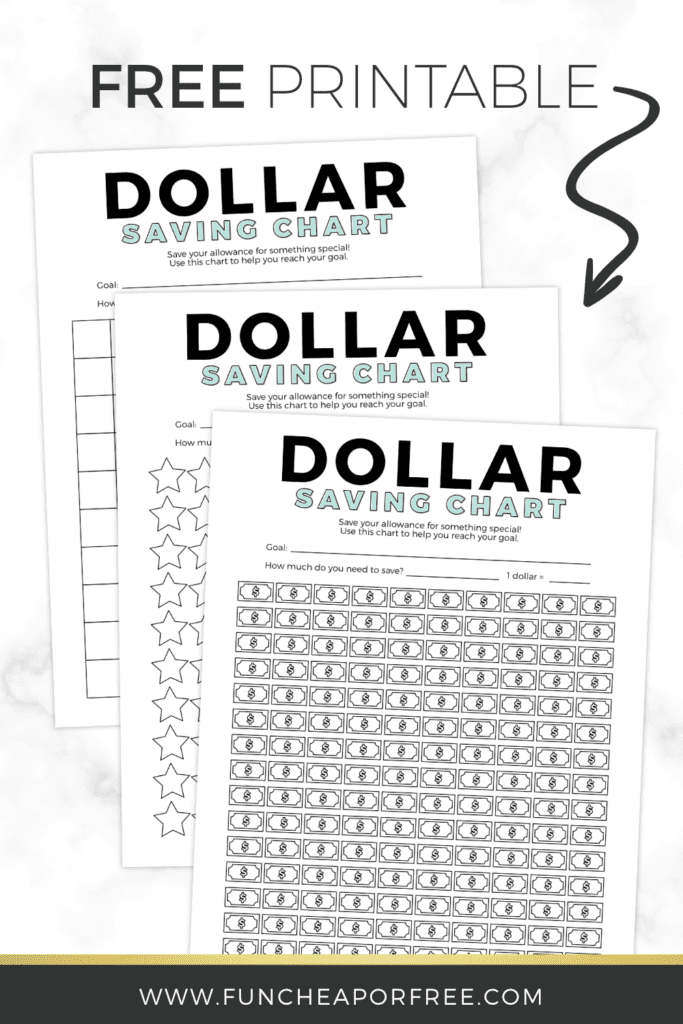

The hardest part for kids, especially younger ones or even those who have never dealt with money, is knowing how much money they have to spend. That's where a short-term savings tracker comes in handy! One of Hutch's first big-ticket items that he saved up for when he was five (after a year of saving!) was a dirt bike. We were all so excited the day that he finally hit his goal! Priya, at the ripe ol' age of four, saved up for a Jungle Jumparoo (get 10% off with code FUNCHEAP10). She is still proud of her first purchase to this day.

I took a piece of paper and drew 100 squares on it so that each square represented $1. Each time they earned $1, they got to color in a square. This not only helped them track their money, but it also made them pickier about what they wanted to spend those hard-earned squares on. Since they knew the amount of work that went into earning a square, or $1, it made them more appreciative.

PRINT OUR FREE ALLOWANCE TRACKER

We've created a cute allowance printable that takes all of the hard work off your shoulders! Your kids will set their goal they're saving for, the amount they need, and how much each square, star or dollar bill represents.

We've also created a fun rocketship printable that will help your older kids focus on what they're saving for. It helps them figure out why they want it, how much it'll cost, and how long it'll take for them to reach that savings goal.

HOW MUCH TO PAY IN ALLOWANCE

Ultimately, this will vary greatly from family to family. Certainly, don't stretch yourself farther than you can afford! But here is a general gauge I recommend based on the research I've done over allowance for kids and how I was raised.

Pay them half their age per week (or two times their age per month). It's a lot easier for kids to get paid weekly versus monthly. It keeps the money at the forefront of their brains and reminds them of why they're working so hard to complete those clipboards.

We will also give our kids opportunities to earn more to pay for things they want or need, but this is totally optional for you! Do whatever works best for your family.

For very young kids, consider working toward a family goal or prize and use pennies as a simple tracking tool. You can either grab a few items at the dollar store to have the kids earn with their “chore pennies” or print out a picture of something they want and are working towards.

WHAT SHOULD KIDS PAY FOR WITH THEIR ALLOWANCE?

Now that our kids are earning regular cash, this is the time for us to back off and let them use it as they see fit! Allowance shouldn't be BONUS money, it should be their SOURCE of money!

Use allowance as a great teaching tool. Teach your kids to shop wisely. Go to deal or coupon sites with them and show them how to find coupons before buying things. Help them learn to shop sales, and when to go for quality over quantity. What a great gift to give them!

WHO PAYS FOR WHAT

PARENT

- Parents pay when you go out as a family.

- School clothes – Give them a budget, then they make the purchases (see how to do that in our back to school shopping post).

- Clothing essentials that they wouldn’t buy themselves, such as socks, underwear, and school uniforms.

KIDS

- Starting at eight years old (when they're old enough to start earning an allowance), kids are old enough to make their own financial decisions and pay for extra things themselves.

- Once they’re old enough to go to places by themselves with friends, they start paying for those outings.

- Clothing beyond school clothes or necessities.

- Name-brand or unnecessary essentials. Give them the budget for school clothes. If they want to spend beyond that, that's their choice…but they pay the difference!

EXAMPLES OF WHAT YOUR KIDS CAN AND SHOULD PAY FOR

- Toys

- Electronics

- Insurance (can split – based on grades)

- Cars (match what they contribute)

- Clothes beyond the basics

- Toiletries beyond the basics. (My parents totally did this! My mom bought cheap Suave shampoo & body wash. I could get some from the storage room any time I wanted it. If I wanted the expensive fancy stuff, I had to buy it myself. Makeup? Self-tanner? Hair accessories? Bought them myself.)

- Activities with friends

- Haircuts beyond the basics

- Makeup

- Gasoline

- Formal dresses/dance attire (taught me to borrow, or buy off-season)

- Dates

- Speeding tickets/late fees/penalties

- School extras – class ring, letterman’s jacket, yearbook

- Eating out insteading of packing a lunch

- Sports equipment beyond the basics (they want nicer, they contribute)

- College – let them contribute – they pay tuition, you pay rent

- The list goes on!

Printable list of this found HERE

Remember parents: They are earning money that you would be spending on them otherwise, so this should not be costing you extra…this should be replacing the money you would have spent. Teach them to spend wisely and make this a great experience!

REWARDS, MOTIVATIONS, AND GIFTS

Let's call it like it is, as parents we enjoy giving our kids things! And at a few dollars per week, our kids won't exactly be able to afford that new bike they really need and want. I think a great way to help keep kids motivated is to provide occasional rewards and gifts to them, and provide them with things they need but wouldn't have the money for (outside of birthday and Christmas gifts).

For example: When my son was younger, he got a pair of Spiderman shoes from a blog sponsor that he wanted for a long time. He really needed them for school. But rather than hand them over to him, I had him “earn” the shoes. The price tag was 20 pennies that had to be earned outside of his everyday chores. He did extra chores, worked on his reading, was extra helpful and nice to his siblings, etc. It took him over one month, but by golly, he earned those shoes! He treasured and appreciated them more because he worked so hard for them.

LET. THEM. STRUGGLE.

At the end of the day, in order for this allowance system to work, your kids must be motivated to make money. The only way they’ll be motivated to make money is to NEED money. The only way to need money is to PAY FOR THINGS themselves! Kids learn the fastest by missing out on something once. It will be harder for you than them, guaranteed… but you want them to struggle with this process.

Miss their homework? Consequences at school. No practicing piano? Let them answer to their teacher. Miss the yearbook fee deadline? No yearbook. Fail to pay their parking ticket on time? Added violation fee. Sure, we need to parent and guide our kids. Trust me folks, I am NOT a hands-off parent. However, I believe these are minor lessons in the grand scheme of things, but all of which really should be learned as a kid to help exponentially in adulthood.

We need to learn to let them struggle. Then give them big hugs, be great support and their biggest cheerleaders, and most of all, be a great example to them and it will be the best gift you could ever give your kids!

How do you do your allowance for kids in your house? Let us know in the comments!

Looking for more greatness from Fun Cheap or Free?

- Kids looking for more ways to make money outside of chores?

- You don't wanna miss out on these life skills that every teen should have!

- Have an in-home cooking class with your kids today!

Good luck!

Thanks for your post (and all your posts)! I love how detail oriented your posts are- leaves me with no questions and is so clear and to the point! My oldest just turned 4, and this is something I can see working for our family. Thanks for the time you put into writing this!

I’m so glad you liked it! Thanks for sharing 🙂

Really great post and thanks for all the tips you shared. I’ll be pinning this for the future when bump is chore-aged.

Can u help me with a budget?

Bring on the mega posts babe! Some of us need that extra detail and insight. Love this twist on it.

We’ve also been looking at Dave Ramsey’s suggestion of having some chores that are mandatory no matter what (and no payment for doing so), and then some less urgent ones that you can earn rewards for. This way they learn to feel empowered in helping the family for the sake of just helping and but also learning to manage money from other areas as well.

Definitely need to throw this post in our discussion as we’re figuring it out for our kindergartner as well. We might hold off on Dave’s way until they’re a little older.

Thanks for putting all this detail out there, I for one appreciate!

This was so much easier when my kids were small… they always did their chores. It was part of our homeschooling day. And they got paid. Now that they are teens and busier than ever, they were less apt to do their chores and I was less apt to be on them about it. So, I switched gears. I had them “interview” for their jobs that they wanted to do. I then “hired” them and gave each chore a value (which they knew during their interview). I took this approach because I wanted them to be more responsible for their expenses, such as haircuts, “extra” clothing, movies or other activities with friends, etc. because I was constantly getting hit up for these things. I figured paying them wouldn’t be an extra expense because I was already paying for these things. Not only that, but I also figured they would be more apt to do their chores knowing that it tied into them being able to buy things. Sounded great to me. They did it wholeheartedly for about 2 weeks… then I began to notice that I had to “remind” them more and more. After a while I gave up. I decided I would just ask them to do the chores when I want them to and they won’t get paid and I’m wouldn’t fork out the money for their extras. Done.

Oh my gosh I LOVE the interview idea! That is genius. Interviews are such a huge part of “real life” why not start them young?? Love love love. Thanks for sharing!

So I’ve done the trial and error thing and I still can’t seem to find a good system. They always debate things with valid points. The oldest is my stepdaughter at 16 who is here on weekends and lives around the corner and can come whenever she wants. This has always thrown things like this off because there are always circumstances that make it difficult to make fair for everyone. There are five children ages 16,15,13,10 and 5. I like your ideas but my biggest problem is nagging and then I go back to find that they were done very poorly. I’d like to teach them to pick up after themselves but whenever I come accross something (like dishes or towels on the bathroom floors being used for extra floor mats!) I alway get the “it wasn’t me” or “it’s not mine”. The only way I feel like I can solve this is with cameras installed throughout the house! Summer is. coming and towels and bathing suits and t shirts all over become a whole other frustrating battle. Ugh! How do you suggest I make them accountable for the quality and consistency of their work? I’ve thought of maybe an accountability system where they have to check off each other’s work??? I feel like they always find a way to manipulate the system to make me question my “fairness”. By now you’d think I would have a system but come up short and throw my hands up until my next meltdown from being overwhelmed! Please offer any suggestions!

Pick up after them, but keep it locked up. (or threaten to put it in the ‘big archive’ (=the garbage). If they run out of their favorite items or schoolbooks, they will feel it). They can earn those items back by doing chores, (no money first, but items as payment, until it is all earned back).

Towels and stuff: give them their own color. And if not in the hamper, it doesn’t get washed. Don’t do their chores for them. If the grass gets too long, it takes them more time to mow it. Let them feel the consequences of their behavior. Good luck!

Great ideas!

As someone who works with college students for a living – this post and attitude is so refreshing! I wish more parents allowed the struggle and prepared kids from a young age to earn for themselves. This is a great system!

Wow, thanks for taking the time to write such a sweet comment!! I agree whole-heartedly. Thanks for reading! XO

I’ve been reading a lot trying to find what will potentially work best for my family. I am so happy I found this blog, looking forward to introducing it to my boys. I especially related to the list of expenses you were responsible for, including the “better” shampoo!

I believe I am a better person for the responsibility and financial lessons taught by my parents growing up. I hope to instill the same values in mine.

Love this long post! We have one child who is 7 and we have daily chores that are like getting ready for school, after school studying, light pick up etc for her, setting the table etc. Because we only have one kid we have her pick her big Saturday chore like the bathrooms or vacuuming so that she is overwhelmed feeling like she’s doing it all. We pay her for extras too…she made a nickel an apple pick up from our trees on the rotten ones that feel to the ground after we were gone on vaca for a week. She negotiated my hubby up from a penny a piece. Having her pay for her own stuff is fun to watch and trying to explain sales tax was a fun one. She didn’t understand it why we had to pay extra. Lol. She’s wanting to save up for another American Girl doll. She’s focused and has a lot of money. Our house rule is 50 percent for her college fund, 40 for spending and 10 to church. Neither my hubby or myself had this financial structure at an early age so we pray this will be long lasting for her as she gets older.

Such great advice on allowance! Thank you!

Another great post. I have also read a lot from the Eyres, including their book “The Entitlement Trap”. Thank you for your list of what kids can afford. This is helpful.

Jordan, I’d love you to re-visit this topic now that your kids are older! Is this spelled out more in depth in BBC?

What if we don’t have extra money while paying off debt to pay allowances?

I understand not typing allowances to chores….but are they just getting money for doing extra chores anyways? It seems like they’re getting paid for chores, even if the chores are not their regular ones? I’m confused.

Thanks so much! I’d love to implement a system, my kids are much older. I just haven’t found it yet.

We do time, our kids earn extra time on their electronics or whatever they’d like. So far the incentive to have extra time staying up (30 more minutes on a school night is huge) and they love it! We aren’t really paying them for anything and buy their items they need when they need them (always on a budget and usually very affordable), we don’t get them a ton of stuff throughout the year and are simple with birthdays and Christmas for the most part. They all do their chores without complaint. We rotate rooms in the house each week and they go through the checklist for each room. It’s super easy.

We also do date nights with our kids and their only parameter for what they choose is it can’t cost any money. They’re very creative with fun things we can do that are free! (Walks in parks, mall window shopping, using a coupon for a free treat somewhere, staying up late playing games, crafting together, etc.) Knowing once a month they each get their own date night works great.

But there’s no allowance still. I’d really love to learn more about how we can do this without any extra wiggle room right now, and how to do it without it being tied to extra chores.

Thank you!

Jordan, I am a recent follower and am beginning to try to implement more structure with chores as well as begin an allowance system. I have a 2 and 4 year old. I was wondering if you could clear up a little bit the distinction you have between chores and allowance? I am sure I’m missing something because in the beginning you quote that you shouldn’t link chores to allowance which my husband strongly agrees with. However, it looks like you do link chores (and a few other things) to allowance. How to you distinguish between chores they do because they’re a part of the family and chores that earn them an allowance? Thanks so much!!!

I love this post! Do you have a link to the printable for your children’s daily responsibility chart?

Amber

This looks really interesting!

My question is…at what age do you allow them to *keep* their piggy banks or money in their room? Right now we keep our boys’ banks in our room because we don’t really trust them not to take all their money to school and buy 1,000 new pencils at the school store! So in a sense, it is their money but we are still in charge of it. How can we transition out of this mind set and allow them more responsibility here?

I love your allowance system. We are just starting this part of parenting (my kids just turned 3 and 2) and this post gave me lots of ideas. One question: do you have your kids to money based charitable giving? How does that factor into allowance earning? When I was a kid, we had to give one quarter out of our weekly dollar to a difference piggy bank that went to a good cause rather than our own earnings, but I am not sure the best way to navigate this with our kids. Do you have any systems that work?

Just like us, our kids take their total allowance amount and then deduct 10% and pay it to the church! You can pull it out each week as they get paid, or pay 1 time per year at the end of the year. If you choose to do it once a year, just make sure that you keep track of what their TOTAL amount was for the year to get the 10%, not necessarily 10% of what’s in there currently. We also teach our kids to take the remaining 90%, set half in savings, and teach them to only spend half. I definitely recommend to keep the savings portion in a savings account. Then you can either keep the spending amount in an actual bank account and manage it that way or keep it in cash and have a “family bank” of sorts. Whatever works best for you and your family! 🙂

I would also love an update on this topic! I have 9, 8, 6, 4, and 1. Have always wanted to teach them to be financially responsible but have never found anything that works!

We’re working on an update, so be watching for one! 🙂

How do you implement something like this for young kids like 3? Is that too young? She doesn’t really grasp the appeal of money and just sees it as another shiny toy she throws somewhere and forgets about lol

I would focus more on giving her pennies and putting them in a jars where she can easily see them. Then you could decide on something that you’ll buy with those pennies once she gets enough, like some paint, an ice cream cone, or getting to go somewhere fun. Then make a big deal out of it when she reaches her goal and is able to buy the thing!

Hi! Thank you so much for the great info! I had a question though, I’m a little confused on how exactly you pay their allowance since you adjusted it. Is it still tied to their weekly chore charts? Or do they only earn an allowance for doing extra things beyond the chart? Thanks so much for your help, love all your ideas!

They HAVE to finish their chore charts as a part of our “norms” of being in the family. Once those are complete, they’re allowed to go above and beyond and ask for extra chores if they’re wanting to earn allowance!

Allowances are so important for teaching kids financial education. I’m starting with my 2 and 5 year old!

HI, I read the blog & listened to the video, but you did say that your kids at the tiem of video was oldest of 7. Can you share what you do now for allowance now that they are older?

I’m going to get this post updated soon with our latest allowance details, so be checking back! 🙂

How do you determine when to stop giving an allowance or buying clothing for older kids? Our oldest is 19 and is still completing her high school education as a homeschooler. She has a job and was working up to 40 hours per week (she just cut her hours back some to concentrate more on school, but she is still planning to work up to 32 hours per week).

My parents stopped giving me an allowance once I was old enough to get a job, so that’s the plan with our kids once they’re old enough. We’ll probably still give them a budget for school clothes, but if they want something above and beyond that, they can either ask for it for Christmas or they can buy it with their own money. It sounds like your oldest is getting really close to being ready to join the “real world” so it may be good to go ahead and start preparing her for that! Just do what works best for your family.

You said that now your children have to earn their allowance by helping with the younger children. I only have a set of 8 year old twins. What are some ways they could earn their allowance? They have no younger siblings to “babysit” or help out with. Thanks!