Who loves to set goals at the beginning of the year and then watch them crash and burn three weeks later? Not you? Good! Today we've got some great tips so you can learn how to set goals and stay motivated to achieve them.

Raise your hand if you're setting killer-amazing New Year's resolutions this year! (Ooh me! Me! Pick me!) Now, raise your hand if you've crashed and burned off the bandwagon and have felt like a total failure in years past! (...crickets…) Don't worry, we've all been there.

Let's call it like it is — the reality is that making plans makes us feel all warm and fuzzy inside. The real challenge is putting it into action, and getting it to stick around for longer than 2.3 seconds!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

We've got some great tips coming your way on how to set goals, how to keep your goals, and we've even got some great ideas for goals you should consider setting! So get comfy, grab some chocolate, and let's talk about some goal setting!

WHY IT'S IMPORTANT TO SET GOALS

The New Year is a great opportunity to pause and reflect on what has been and think about what will be. Most of us set some resolutions in place to help stretch ourselves to become better people, but the challenge with resolutions is they can be quickly forgotten.

Recently, a friend said, “I do a really good job of keeping my diet, except when I'm eating.” The gyms are busy for a few months and the junk food is temporarily set aside, but unfortunately, we then find a way to settle back into how life used to be.

SET GOOD GOALS

Any person who is successful in anything will tell you that one of the first keys of making good things happen in your life is to set rock-solid goals. But here's the catch…

As great as it is to say, “I'm going to get in shape this year” or “I want to spend less money” or “I want to take a vacation,” we can't send a simple statement out to the Universe and expect results. Sorry to shatter your sweet hearts, but life doesn't work that way.

You've got to break it down and truly define your goal. What does “in shape” mean: Lose 10 pounds? 100 pounds? Have a 6-pack and biceps for days? And what does “take a vacation” mean: Italy? Camping? One week? Nine weeks? With friends? Family only? Fly solo?

See what we mean? Give the poor little goals some credit, they deserve more than that!

HOW TO SET GOALS

We've got some great tips that will take your boring ol' plain goals and turn them into the rockstar goals you should be dreaming about! Break your goal setting down, get really specific, and watch your goals turn into reality. *fist pump*

DEFINE YOUR GOAL

The first step is to write a goal. Keep it general — don't add any numbers to it yet (patience, grasshopper, we'll get there…), just decide what it is you want to do. “I want to eat healthier.” “I would love to be more productive.” “I want a new car.” Simple, but important. After all, how do you know if you're on the right track if you don't know where you're going?

DETERMINE YOUR END GOAL

Be specific and accurate. If you want a new car, figure out exactly how much you need. “I want a new car… so I need $1,200 for the increased monthly payment for the year since it's $100 more per month than I'm paying now. Plus $2,500 for the down payment = $3,700.”

Want to be more productive? Figure out what exactly it is you want to achieve from that. Maybe it's to be more productive during the week so you can free up your weekends.

Want to eat healthier? What exactly does that mean? Are you just wanting to get more fruits and veggies into your diet, or are you wanting to try to completely eliminate added sugar from your diet? Be really specific with what you want your end goal to be.

SET A DEADLINE AND WORK BACKWARD

This is a very important step. Many of us set the deadline as “this year” and go about our merry business. December comes along, and suddenly we're walking to Canada on an elliptical machine on Christmas Eve to make our goal happen in time. (Modern Family, anyone?)

The biggest secret of all is to set a deadline and work backward, pacing yourself. Take the staircase one step at a time, rather than sprinting to the top (and most likely fail, or nearly die while doing it). Chip away at it consistently each month. Keep the deadline within 12 months, and be realistic. Adjust the goal if needed to make it realistically achievable within 12 months…but don't be afraid to push yourself, too!

EXAMPLES OF WAYS TO WORK BACKWARD

- If you want a new car, say “I want a new car, and need $3,700. I want to buy it in 6 months, so I need to set aside $617 per month.” Is that doable? If not, extend the goal time-frame. If you say, “I want to buy it within the next nine months,” that brings it down to $411 per month.

- To be more productive during the week, give yourself a goal that will give you enough time to come up with a weekly schedule, and set that into action. Maybe allow yourself two months to implement and make changes so you're able to do all of your laundry and house cleaning during the week, which then opens up your weekends.

- If you want to eliminate all added sugars from your diet, you'll need some time to adjust to your new way of living. Try allowing yourself three months to do the research it takes to determine which products you completely need to cut out of your diet and which ones will replace them.

Again, make it realistic…but also make it a challenge.

DETERMINE YOUR “WHY” FOR SETTING GOALS

Finding your “why” is the most important step! Why is the “why” so important? Because sometimes a huge goal can be daunting, and really, really hard to accomplish. Eventually, you're going to hit a rough patch, lose motivation, and want to give up.

The “why” behind your goal is going to be the only thing to will keep you going! So figure out what it is, and make it good enough to pull you through the rough patches. Why do you want a new car? Why do you want to be more productive? Why do you want to lose 30 pounds?

FINDING YOUR “WHY” EXAMPLES

- “I want a new car so I can safely drive my family where they want to go. A dependable vehicle that won't break down and cost us so much in repairs, so we can put that money toward a family vacation next summer.”

- “I will be more productive during the week so we can focus solely on family bonding on the weekends without chores getting in the way. The kids will only be with us for so many weekends until they go off on their own, so we want to enjoy them while we can!”

- “I want to cut added sugar from my diet so I can have a healthier lifestyle. It will help me to make better decisions when it comes to eating food and also lose some weight.”

Be specific and dig deep!

TYPES OF GOALS YOU SHOULD CONSIDER SETTING

Now you know the specifics of how to set goals and keep them, let's go over the different types of goals you may want to set! It may be hard to come up with new goals year after year (once you start kicking their trash and achieving your goals with these tips!). These may not be for everybody, but there's a good chance you might never have thought to set some of these goals.

FINANCIAL GOALS

These are pretty common goals. Lucky for you, we've got a whole post that's allllll about how to set financial goals. Plus, we've got a great list of financial goals that you should consider setting. So make sure you check that out!

PRODUCTIVITY GOALS

We don't know very many people who couldn't use a little more productivity in their life (unless you've been a Freeb for a while and have mastered the art of productivity!). We have some great productivity posts on the site that you can get started with.

But if you need more help, you should check out Productivity Boot Camp! It's an awesome online program that helps you to get productive in all aspects of your life.

Doesn't that sound so awesome?! Use the code FCFBLOG at checkout for 10% off because you deserve it!

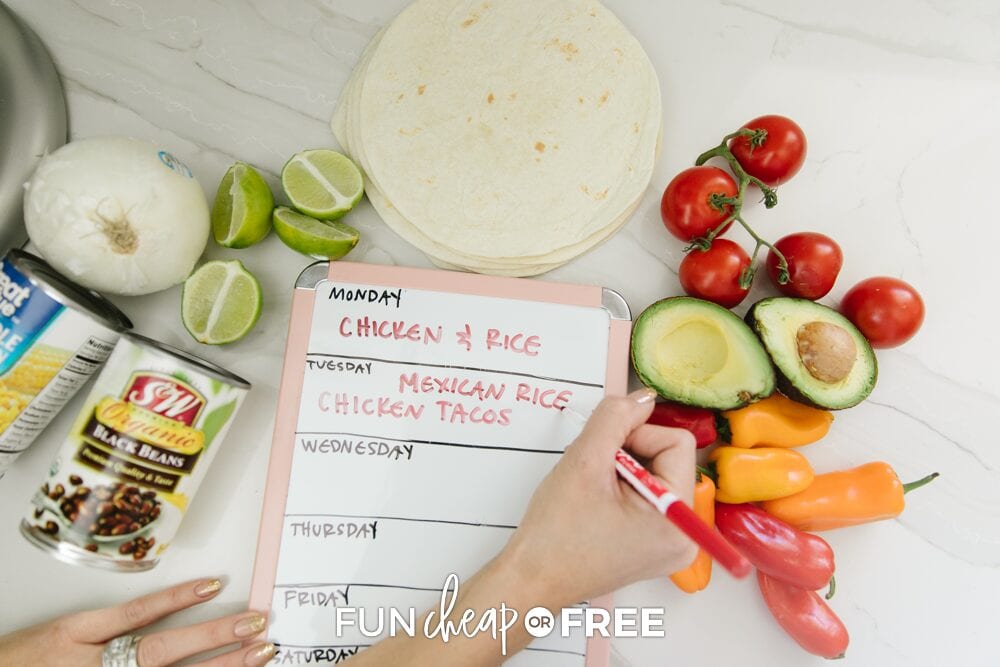

MEAL PLANNING

This may seem like a lofty goal for some, but it's a great way to get your budget under control while also being less wasteful with food. Try it out and see just how much easier it makes your life!

Learn how to meal plan from our shelf cooking site and watch how quickly this goal becomes a reality!

BE MORE ACTIVE

Let's be honest, most of us could probably use this goal in our lives! Whether it's to get up and get moving every hour, take an evening stroll, or train for a marathon, this goal can be for pretty much anyone. We have some great tips to work out at home and reach your fitness goals on a budget.

BE FOOD CONSCIOUS

This one could go a few ways. Maybe you want to be more food conscious and start counting calories so you can lose a little weight. Or maybe it's more about living a healthier lifestyle, eliminating certain foods from your diet, and adding in healthier options. This is always a great option for a goal!

READ MORE BOOKS

Do you love to read but just don't take the time for it? Or do you fall into the camp of people who don't like to read? (Is that really such a thing?!) Make a goal of how much you want to read.

Determine whether it's 30 minutes a night or one book a month, carve out time in your day, and make it happen! It may cut into your TV or phone time, but there's almost always a way you can make time for something like this.

PLAN MORE FAMILY TIME

This is always a good one, whether your kids are young and still at home with you or they've grown and moved out. If more family time is important to you, then make it a priority! Shoot for making a weekly game night every Saturday night. Or getting together with your grown kids twice a month. This also can apply to making time to see your parents or siblings! Just get out your board games and have fun!

SCHEDULE DATE NIGHT

Oh man, this one is so important no matter what stage of life you're in! This should always be one of your top goals. You can focus on having at-home date nights if you're watching your finances or can't find a babysitter. Just don't let anything get in the way of your special one-on-one time with your spouse!

PICK UP A HOBBY

It's always fun to pick up a hobby. It can be completely new to you or one you've always loved but just never made the time for. It's so important to have this time to focus on yourself!

FIND TIME FOR FRIENDS

Friends can hold such a special place in our hearts. Don't let your busy schedule or your kids be the excuse you use to keep from spending time with your friends! Or maybe you've recently moved to a new area and you haven't made any new friends yet… Get out there and find a way to make new friends!

HELP YOUR KIDS SET GOALS

It's so important for kids to learn how to set goals early on in life, whether they're 5 or 15! Use our free printable to help them set and reach their goals. You may just be surprised at how well they do with a little motivation!

Alright, who is ready to get out there and set some goals?! What are your goals this year? Share them with us in the comments and let's all hold each other accountable!

Looking for more?

- Don't forget about those financial goals you should be setting!

- See how you can save money fast with a spending freeze!

- This is the world's easiest and most amazing butternut squash soup. Ever!

Happy goal-setting!

no problem getting here by “read more” from my email – I will keep track of it and let you know. Thanks Cj

Thank you for the good advice!

Perfect timing! I’m teaching this on Wednesday to my Activity Days girls. Mind if I use your steps during my lesson?

Absolutely!!

Thank you so much! This is very detailed and very helpful to me! I guess I’m too weak-willed and don’t know how to achieve my goals, or I just set the wrong goals. But now I have a strong intention to change everything. These are not New Year’s resolutions. But it doesn’t have to be New Year’s Eve to change your habits, does it?

You’ve got this!