Are you looking for some aha moments when it comes to how to budget money? Wish you had some tried and true tips for taming your bank account for your family? The good news is, this is common so you're not alone. The bad news is, this is common so you're not alone! Keep reading for tips that WORK!

Budgeting isn't a piece of cake (if it was, I know I'd want seconds)! Luckily if you're following our budgeting principles, it will help keep you on track all year long. For most of us, at least one challenge encompasses one of the most difficult aspects of our life – finances (ew, that F-word!).

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Here are simple budgeting tips that will, if you take them to heart, ENSURE financial success for you (…and will make it simpler than ever)! We need money to survive and we need to manage that money well to thrive. And don’t get me wrong; just because you’re setting a budget doesn’t mean you can’t do anything fun or spend money. I’m helping you to set a practical budget that you’ll actually keep.

Make sure that you subscribe to my YouTube channel, I have new videos every Thursday! Click to watch my budgeting tips video online HERE, or click and watch me discuss how to keep budgets in line below:

SIMPLIFY: FOCUS ON TWO BUDGETS ONLY

I cannot stress this enough. As with anything in life, if you try to make it too intricate, it just won’t be sustainable. So, a huge mistake I see people make is to have a ridiculous amount of budgets. Dog grooming budget. Hair budget. Decor budget. Pampering budget. Eating out budget. Yadda yadda budget…so confusing! I propose consolidating it down to two budgets only:

- Main Budget – This is your grocery budget and includes anything you could buy at a typical grocery store (food, pharmacy items, basic baby needs, pet food, basic beauty/toiletry items…). This should be $100 per person in your family, per month…then divide it weekly, remember? 🙂

- “Other” – Any other non-grocery items that you regularly spend money on (eating out, hair cuts, clothing, date nights, new cleats, car washes, dog grooming…). Divide up your non-bill, non-grocery expenses for the last 3 months and find the average to get a good start on what this budget should be.

I explain my simple budget system in great detail in THIS POST.

As mentioned above, my husband doesn't worry about the grocery budget. However, we both have our own “other” budget each week. This not only covers our “other” duties, but also gives us some wiggle room for personal fun money. I can grab lunch with the girls, he can do a round of golf…as long as it fits within our “other” budget for that week (it encourages frugality!).

BUDGET BY WEEK, NOT BY MONTH

Many of us say, “Okay, I will have $1,000 per month to spend and that's it!” The first of the month rolls around, you get a wad of $100 bills, and next thing you know, it's gone before Tuesday. Pace yourself. Take your monthly budget, then divide it by how many weeks there are in that month…and now you have a WEEKLY budget! Trust me, it's way easier to manage and much easier to follow.

After all, why don’t you count your calories an entire month at a time? Because that’s a lot to manage. Seven days at a time is so much more manageable. It’s the same with your money.

Let’s say you have that same $1,000 to manage for the month – and that includes groceries, entertainment, eating out, and everything else. Break it down instead into $250 per week. Then split that $250 in two for your two budgets (Main and Other). That way, not only do you set aside money specifically for groceries and consumables, but you also have the rest to spend throughout the week on whatever else you need to spend it on.

You know what? I bet you’ll spend less money budgeting this way. Plus, now you can take that extra money at the end of the week and go put it toward your debts. Or, if you don’t have pressing debt, put it into savings.

Schedule a weekly weigh-in. Sit down every week, go over your numbers, and talk about it. Every Sunday night, Bubba and I sit down and discuss how to spend (or save) any excess money we have. Set expectations that you’re going to talk about money on a regular basis and not only when you’re stressed, anxious, or struggling. The more often you talk about money, the more often you’re talking about the number, the less scary it is, and the more on track you’re going to be. You come together, set goals, and realize you’re working together.

We also recommend holding one money date a month until you can get all of your finances figured out and in order!

Pro Tip: One of my favorite money-saving apps is Fetch Rewards use code FUNCHEAPFREE for bonus. It’s completely free! Just shop as you normally do at grocery stores, physical stores, and even Amazon, scan your receipt (or e-receipt into the app) into your phone, and you get gift cards for doing it! Better yet, I take those Amazon gift cards and buy things like diapers and baby items. Then when I buy diapers off of Amazon, I scan that receipt and get extra rewards! Get 2,000 bonus points when you scan your first receipt.

OPEN AT LEAST SEVEN BANK ACCOUNTS

Ya heard me right. SEVEN! This might sound crazy but think about this. Not only is it free to open other bank accounts, but in a lot of situations, you can get paid to open bank accounts. Plus, the technology is awesome. Think of it as a filing cabinet. Opening bank accounts is like adding file folders to the drawer. Some examples of these account “folders” include:

- Christmas Savings Account – If you need $1,200 for Christmas, set aside $100 per month, so it's there, untouched when it's time to use it.

- Medical Expenses Savings Account – This is an HSA or a health savings account. Some are even tax-free!

- Vacation Account – Want to go to Disneyland? Set money aside monthly. Your kids are going to be so excited!

- Kids Accounts – Each and every child should have an account so they can start saving up for big expenses (like college).

- Normal Family Expenses – Want a new dining set? Need to replace a tire on your car? This account gives you a little cushion so you’re not dipping into your Disneyland money.

- His and Hers Checking Accounts – I have a checking account for me, and Bubba has a checking account for him. This way, we can cover what we each need to spend for the week!

- Family Emergency Account – Picture this as the fireproof apocalyptic vault hiding behind concrete walls in your basement, or the piggy bank you have to shatter to open.

- Family Checking Account – All bills are paid from this account, preferably on auto-pay when possible to avoid late fees.

- Slush Fund Account – This is your 100% FUN MONEY account! Once your debt is paid off, and your savings is under control, this account is your reward for spending wisely.

MORE BANK ACCOUNTS = BETTER

The more bank accounts you have, the more organized and manageable your money is. So when you have money left at the end of the month — and once you know that everything else is accounted for — you can use that money to build up your savings faster (or to pay off your debts faster)!

You don’t even have to have a surplus of money to make this work. In fact, Bubba and I paid off $15,000 of credit card debt in 13 months while making only $31,000 per year at the time. What made that happen for us? Those seven bank accounts. We could save every dime and not spend more due to seeing that one, big checking account. I go into a lot more detail in my article about seven bank accounts.

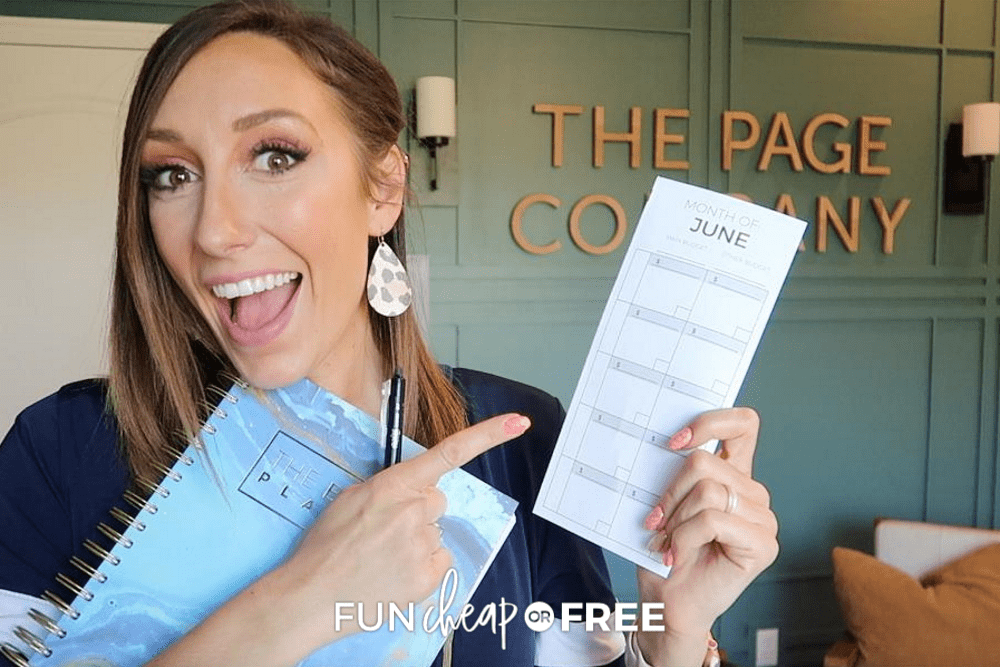

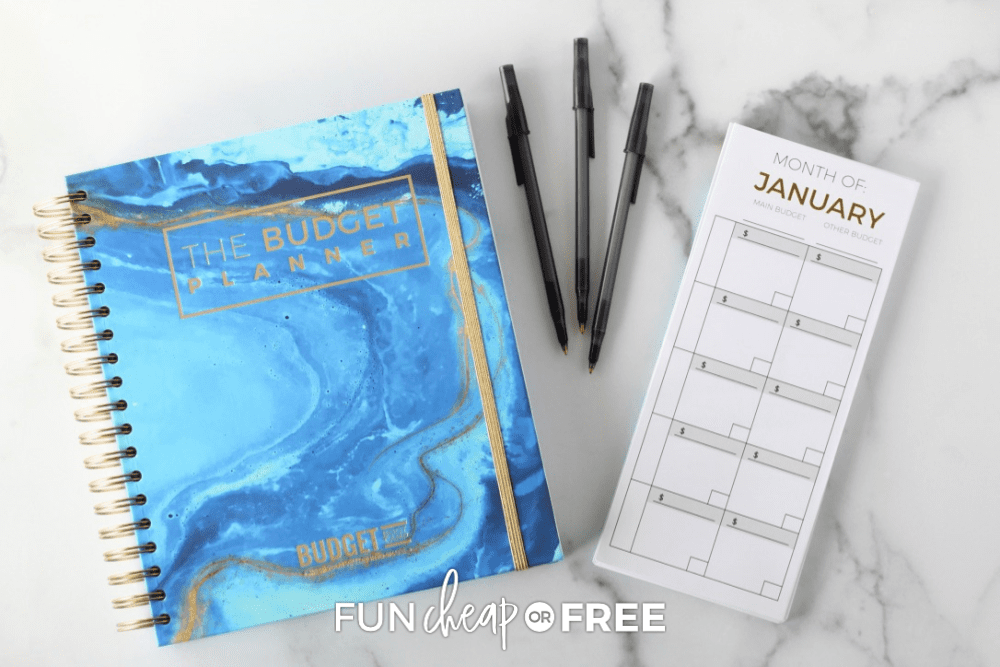

GET YOURSELF A BUDGET PLANNER

Get something that physically helps you track your goals and spending. You need a place so that every week you’re going back and reviewing your numbers. This way, you know you’re staying on track. Examples of a budget planner can be:

- a digital spreadsheet

- a 3-ring binder with helpful budget printables

- a journal that you customize yourself

- our Budget Planner with a year's worth of envelopes

Our budget planner is perfect because it includes everything we're talking about in this post, from budgeting and weekly weigh-ins, to the seven accounts you should have, how to budget money weekly, and so so much more! And in addition to a year's worth of envelopes, it's gorgeous and shiny — just like you, my Freebs!

GIVE YOURSELF SOME SPENDING MONEY

This is probably the most important tip of all because it's all about moderation and setting realistic expectations. Give yourself a treat, but allow yourself the power to do it in moderation. Whether that money is $20, $25, or even $10, what you’ll see is that seven days later you’ll get even more! You can even save it up to buy something you want that costs more.

Work spending into your budget. That’s why the “Other” budget is so important. Yes, you need to budget for groceries or date night, but you need a budget for everything else. And in that, the more responsible you are, the more money you have to spend money on. If you love going to the movies, work it into your budget.

If you work spending into your budget, you’ll never go over your budget. This fulfills that need to spend. I mean why do you love going to the mall, to the movies, or to a home goods store? Because it makes you happy. Don’t cut that out. Find a way to do it responsibly.

The caveat: If you have credit card debt, WAIT. You need to put every dime toward getting those credit cards paid off. They are costing you money every single day and taking money out of your pocket. It is keeping you from that family vacation, that new car, or upgrading your house. Once you get those paid off, you can start to enjoy those things you love again!

DON'T PUSH YOURSELF TOO HARD

Wait, whaaaa? Shocked you with this one, didn't I? Now, I'm not saying to make budgeting a vacation a walk in the park. You still need to push yourself. But the biggest mistake I see people making is to shoot past the moon and aim for Mars! Guys, Mars is really far away and hard to get to…that's why no one's done it yet. When setting budgets, push yourself past your comfort zone, but be realistic! The goal is to SUCCEED! If you fail within the first week, you'll throw in the towel, say “I'm bad at this budgeting stuff!” and never try again. Baby steps! Cut back a little this month. Then a little more the next. Then more the next. It takes time, like exercising a new muscle.

DON'T WORK TOGETHER

Huh? Ok well, work together, but don't work on the same thing. Let me explain. Picture a successful company. There aren't two CFO's…or two VP's of marketing…or two Director of Ops. Sure, they all work together toward the same common goal, but ultimately, they have their own responsibilities that they handle solo so no one's stepping on each others' toes. Why should it be any different in your family?

Sit down and make a list of everything you spend money on…and divide it up! Don't stop until every item has an “owner”. If both of you go grocery shopping randomly, you'll end up paying too much. If you both randomly pay the bills, you will probably miss a payment assuming the other person took care of it. Divide and conquer!

In my family, here are examples of the spending duties we divided up based on our personal skills and daily environment:

Me: Groceries/meals/meal planning, kid activities (memberships, day-passes), clothes, school fees, medical bills and choosing doctors (since I'm the one driving them to their activities), general home needs (but not home repairs), paying and picking the babysitters…to name a few.

Him: Car maintenance/checkups/repairs, paying all utilities/bills/loans (except medical bills), date nights, his own haircuts, paying off the credit cards, home repair needs…to name a few.

WHY WORKING TOGETHER (SEPARATELY) IS KEY

Let's call it like it is, marriage can be tough. Mostly because it's two completely different people who think in two completely different ways, having to come together and work in perfect simultaneous agreement to decide the most important aspects of their lives. Uh, yeah right.

Take the stress and “I'm right you're wrong!”-ness out of it! One of the most important things I've learned in my marriage is that everyone manages things differently, and has their own way of doing things.

By dividing up responsibilities it's kind of like saying, “here's your realm, rule however you'd like! As long as the job gets done, you do it exactly how you see fit”. It leaves tons of room for autonomy and independence and allows people to put their own creativity and personal touch on the way the family runs. (For us control freaks out there, that can be hard…but just remember to focus your control on YOUR responsibilities and run them exactly as you think they should!)

Again, we always need to work tighter (just as employees of a successful company do) but again, everyone has their own strengths, weaknesses, and ways of doing things so you've got to be understanding and work with that.

Be sure to check out our dividing financial responsibilities in marriage post to learn even more about this subject!

LET BUDGET BOOT CAMP HELP!

If all of this sounds fantastic but you would like some extra hand-holding during the process, then Budget Boot Camp is for you! It's our fun, online video program that makes managing your finances and getting out of debt a breeze. Check out what we're talking about…

Sounds awesome, right? We know you'll love it so much that we even have a 100% money-back guarantee! Plus, you can use the code FCFBLOG for 10% off at checkout. You're welcome. 😉

Alright, well now that you know how to budget money, what are you waiting for? Get to it and let us know if you have any questions!

Looking for more greatness from Fun Cheap or Free?

- Kids looking for more ways to make money outside of chores?

- Teach your kids to save money and use our free printable to help track their goals.

- You don't wanna miss out on these life skills that every teen should have!

- Here's how we do allowance in our house without going broke! Plus, there's a great allowance saving chart to help them save up for something special.

- Have an in-home cooking class with your kids today!

You've got this!

Jordan, as always, this post is awesome. I have been in a serious relationship for over 4 years now. Marriage is something we both want but we know that there is still work to be done before it can happen. I really want to get him on board with this budgeting system. I have heard way too many stories of marriages crumbling to bits within the first few years because they were constantly fighting over money. I want to avoid that as much as possible! I understand that arguments about money happens (how do we spend our savings? I want to splurge on this or that, ect), but why fight if you don’t have to! How I have rambled for a while! Thanks again for all your hard work and guidance!

Amanda! I’m so glad you liked it! You’re right, marriage is a lot about give and take. It can be tough! One of the most important things I’ve learned is that everyone manages things differently, and has their own way of doing things. By dividing up responsibilities it’s kind of like saying, “here’s your ‘realm’, rule however you’d like! As long as the job gets done, you do it exactly how you see fit”. It leaves tons of room for autonomy and independence and allows people to put their own creativity and personal touch on the way the family runs. I’m excited for your future and bet you’ll be an incredible wife!!

Hi Jordan:

Just found your website a couple days ago and I’m really excited to get started. My question concerns your free printable for the budget envelopes…the smaller envelope (3 5/8 x 6 1/2″) work better for me for several reasons. (One being that that’s what I have on hand!) I was wondering if there’s anyway to get your printable in that smaller size. I can’t seem to make it fit on the envelopes I have.

I know this is not a big deal and I can always just write it by hand, but your template is so cute.

I love everything about it…the font, the colors, everything. So if you could help me, I’d appreciate it.

Thanks so much for your attention and your great blog…I’ve learned so much already!

Beth

Hey Beth! Go ahead and email Lindsay (at) funcheaporfree (dot) com and tell her the sizes you need, we’ll see what we can do!! XOXO

Okay this is probably one of the most helpful blog posts I have read…EVER!! Thank you for making it so simple!!

Yay! Glad you like it, thanks for sharing!

How do you buy groceries for $100 per person, per month?

This will explain everything! https://funcheaporfree.com/how-i-grocery-shop/

Hi this is great information! Thank you so much for sharing. I have a question regarding pets – you suggest including their food in the groceries/ consumables budget. Is this amount in addition to the $100/person? Do we count them as a person? Our dog food costs on average $66-99 Canadian/month as we alternate types and we have to go to a separate store for it. thanks for the clarification

Great tips!

So how does your husband do it? If I gave him a small envelope that would fit in his wallet, that might work, but mens wallets go in their pockets, and I don’t think he would do it. So how does your husband manage his portion? Thanks. I think I can do this. I really need to. We lost our teenaged son in a moto accident last year and I have let everything go. I did get a loan and we paid off all of our large interest rate things and now that loan is for 100K at 4%. I just got fired, but I will get unemployment for a year. I know I can do this. I looked up HSA and it isn’t really a good option for us as my husband is a school employee and our insurance is 100 month.

It would be interesting to see Bubba’s side of it. I’m sure he has receipts in his wallet and he tally’s it up at home at a desk…or maybe on an app?

You can use banking envelopes that are the size of cash. That will fit in a wallet. You could sharpie on the budget graphic, or work with printer settings and set to whatever percentage will print on that envelope?

I love this envelope system and you really focus on my “mom” part but what about my husband how does he do the envelope system too. If he is paying the utilities there should be no left over money for him to barrow from the other side.. and what is his other .. could you do a video from your husband envelope?

Hi Alyssa! The utilities would actually be a part of the family budget. Your husband may pay them, but they come out of the same budget as bills/gas/mortgage/etc. My husband doesn’t use the envelope system, he uses Mint.com to track his responsibilities because it’s digital and the app is free and easy to use. He just gets a monthly budget that he uses to pay for his “other” items. If you’d like more details on how we do our budget, watch this video and it should answer your questions!

Hi Jordan!

I’ve been married for 6 years and I could use some advice. I really am motivated to get our finances in order. We have 4 kids, 3 of which are my husband and mine and 1 from a previous relationship of mine. I don’t want to keep struggling pay to pay and rely on our credit cards like we have been. I’ve been trying to put back little by little but I always end up transferring it to our checking to cover for the month. I’m getting unbelievably frustrated. My husband smokes and stops at the store when he goes to work (he works 3-4 days a week) to buy his cigarettes and energy drinks. I want to do the one shopping trip a week and $100 per person grocery budget but I can’t seem to get him on board. Any suggestions? I don’t want this to be the end of our marriage but if we keep down this path I’m afraid that may happen in the future. We both grew up in dysfunctional families so getting on the same page for our finances and things before we married was something we didn’t know was important. We definitely do not want our kids to grow up like we did. Thank you for your time!

This is so tough and it’s the number one pain point I deal with when working with families and couples. It’s a complicated matter for sure, but here are the top things I would suggest you start off by trying:

1. Set financial goals together. Find what makes him tick, and what makes him excited to save up for!

2. Give him an “allowance” each week for spending! Say “how much money do you feel that you need each week to cover the things you want to buy?” Let him set the budget and then say “if we give you this budget every week to spend on whatever you want, will you stick to this budget?”

3. Check out THIS POST to get even more tips on how to get your spouse to stop spending money and get on the same page!

I hope that helps! Please let us know if you have any more questions 🙂

I like the envelope system and the tracking/budgeting weekly. Love your tips and videos

I am loving the weekly budget tip vs the monthly I’m not sure why I never thought of that! 🤯

This was the first video I ever watched of yours, my friend Mistie, who is my ex-husbands first ex wife, lol funny story there, anyways, she told me that your tips and tricks have changed a lot of their life and they got her husbands credit up and debt paid off and I am so excited to watch your videos on budgeting and groceries, and YOUR COOK BOOK!!!! I CANT WAIT!!!

Will you be releasing printable envelopes for 2021 or without dates?

That’s a discussion that we’re having soon. What would you prefer?