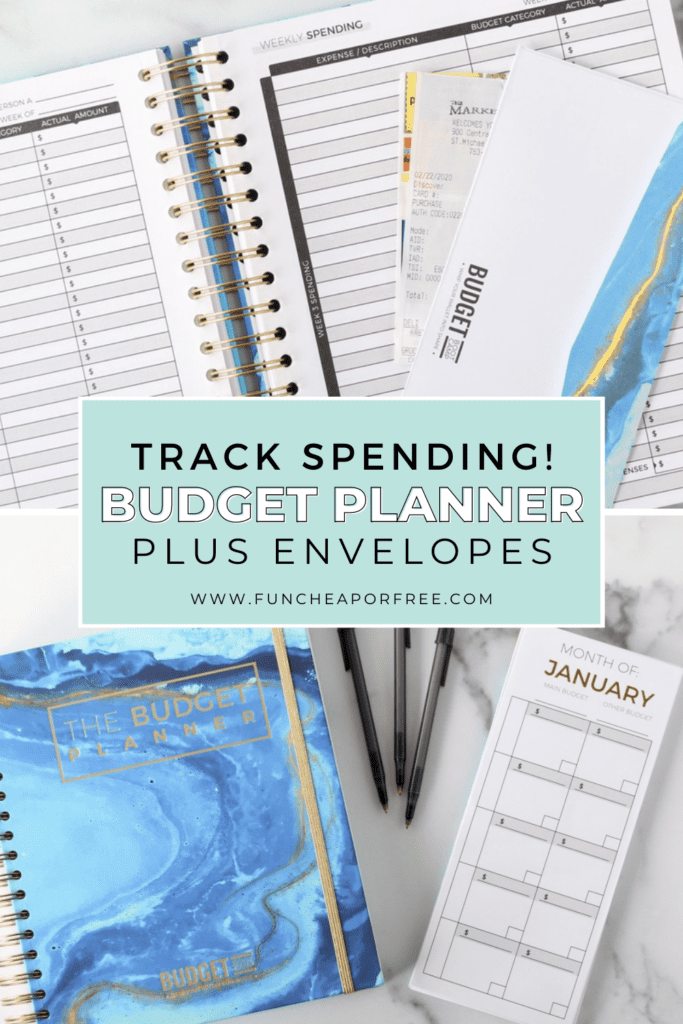

Set goals and budgets, organize your finances, build up savings, pay off debt, track spending, and prepare for the future with the hugely-popular monthly Budget Planner from finance guru Jordan Page!

Are you struggling to get ahead with your finances? Tired of drowning in debt month after month? Wish you could start living your financial dreams? As I've shared MANY times over the years, getting out of debt begins with budget planning and a little support in our lives. Say hello to our Budget Planner as a guide to your finances!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Our Budget Planner has become so wildly popular we have trouble keeping it in stock! Why? Because the thousands who have used my budget planner have seen their financial world turned upside down—for the better! Here's why our monthly financial planner is about to become your new budgeting bestie!

WHAT MAKES OUR BUDGET PLANNER DIFFERENT

This isn't your typical budget planner. This is the key to your financial freedom! Imagine how you'll feel a week, a month, and a year from now when your debt starts to disappear and you can start living your dreams! Our monthly Budget Planner will help you:

- Turn motivation into action and take control of your money.

- Create a clear path to tackle your finances so that you can stop fighting about money and finally achieve your financial dreams.

- Get down to the nitty-gritty. The Budget Planner even teaches you how to budget for gifts, parties, and holidays.

- Covers everything from daily budgeting to long-term financial goals.

- Perfect for families, couples, and individuals at any age and stage of life!

Pro Tip: Give this planner as a gift to new graduates and newlyweds to start them down the best possible financial path! This resource is a great gift of knowledge to those you love and care about.

BUDGET PLANNER FEATURES

This monthly planner is here to help you Whip your Wallet Into Shape™ the SIMPLE way! Use this planner every day, and in just a few short months you're going to be on the road to living your debt-free dreams! So, without further ado, let's get right to bettering your financial future!

Our Budget Planner is designed to help you make the absolute most out of your dollars in no time flat. #FinanceNinja Our monthly budget planner features:

- 12 beautifully-designed custom envelopes to manage your budget categories all year long (valued at $10)!

- Individualized, line-by-line planning, tailored to your unique situation.

- VIP access to videos where Jordan explains her time-tested principles.

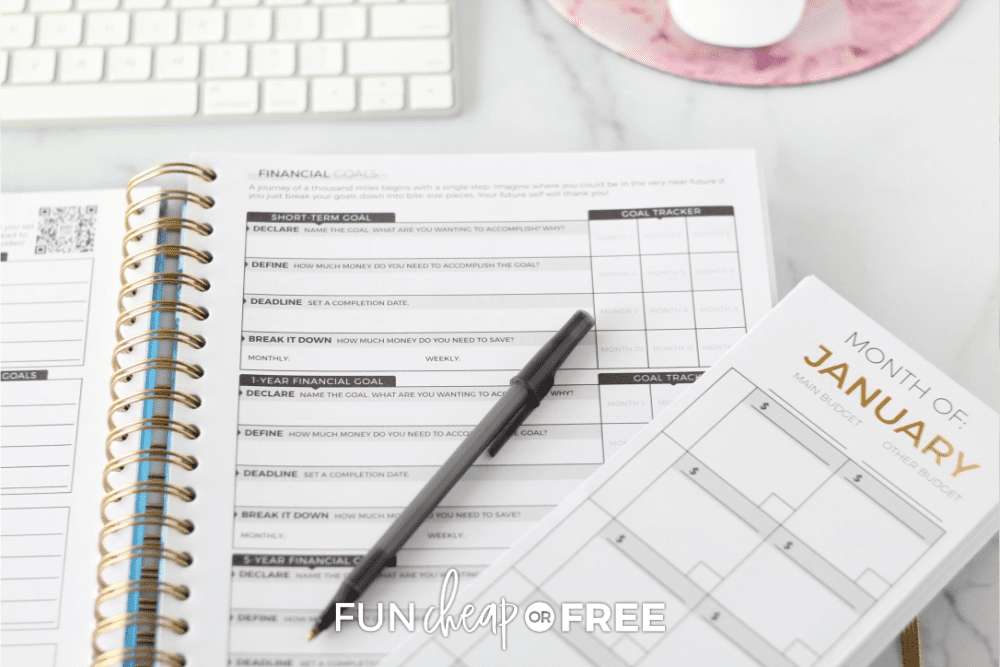

- Goal-setting pages help you identify your dreams and make a plan to achieve them.

- Debt tracker pages help you shrink your debts and break free from debt burdens.

- Dozens of empty note pages for personalization.

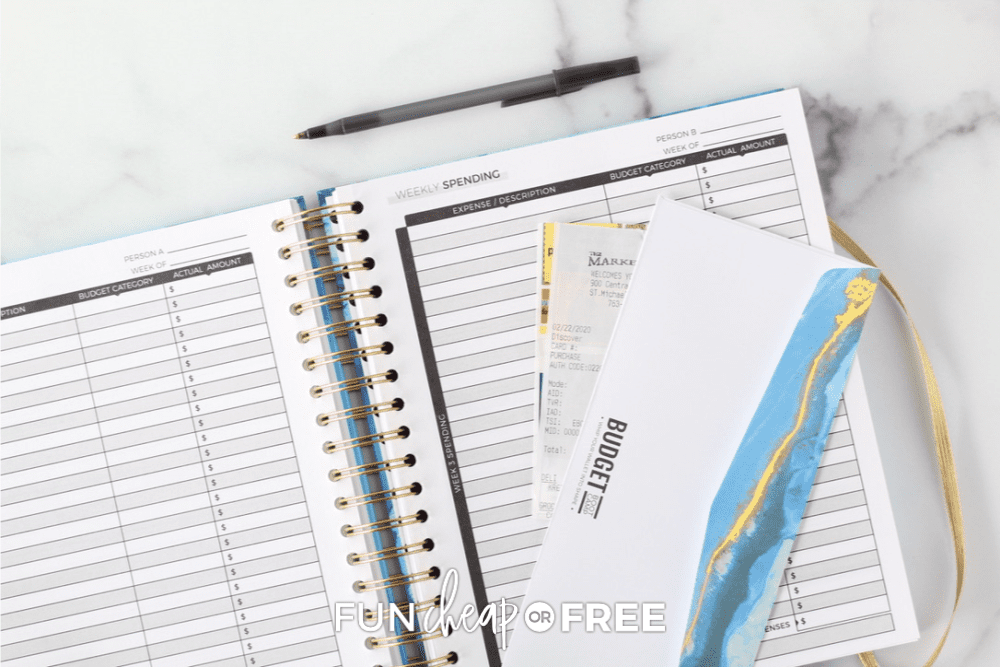

- Gold elastic band for bookmarking your page or storing financial records.

- Gold wire-rim binding stands up to daily use and abuse.

Pro Tip: As you're getting started, you'll map out your goals and financial dreams to make them a reality! What do you want to see your dollars accomplish this year? Are you hoping to pay down debt? Hit a major savings goal? Either way, our corresponding trackers will help you knock your goals outta the park!

TURN MOTIVATION INTO ACTION

My Budget Planner turns your motivation into action and gives you the tools to take control of your money. It will help you create a clear path to tackle your finances so that you can stop fighting about money and finally achieve your financial dreams. This monthly budget planner even teaches you how to budget for gifts, parties, and holidays.

Check out the video below to get a jump on some of our basic principles.

OUR PLANNER SETS YOU UP FOR SUCCESS

With our Budget Planner, you'll not only set specific goals, but you'll also focus on your monthly budget! Working together with your partner, you'll divide and conquer to set your weekly budget. Once your budget is set, you can easily track your spending each week and make sure that you're making progress towards your goals!

Pro Tip: Set both small short-term goals and bigger long-term goals! Make sure to reward yourself along the way to help you stay motivated. However, make sure that you are smart with your rewards so you don't erase your progress.

OUR PLANNER HELPS YOU TRACK SPENDING… WHEREVER YOU ARE

You're constantly on the go. While this planner is not intended to be carried everywhere…our budget envelopes are! These 12 beautifully designed envelopes help you keep track of your week-to-week spending. Watch the video below to learn more about our spin on the envelope system:

As an added bonus, you'll enjoy weekly spending tracking pages so that you can track your expenses regularly. Imagine how powerful you are going to feel as you're getting control of your money (and your life) back!

WHAT PEOPLE ARE SAYING ABOUT OUR BUDGET PLANNER?

I loved the results I’ve already gotten from the budget planner. It’s allowed me to pay off a $1,700 credit card in one month by allowing me to focus on my real goals. It helped me realize I can obtain real results. I’ve set my 5-year goals and I’m excited to see what I can make happen. I just bought the productivity planner to see if it could help me get more productive and focused on my work as I feel overwhelmed. Thank you!

– Nicole K.

The budget planner is a game changer! You don’t have to feel guilt for the way you spend, if you have a budget. I’ve saved more than ever before and paid down a significant amount of debt, simply because I’m more intentional about my money. I’m a visual person so seeing it and being able to know exactly where my money is going is helpful to me. I also feel more accountability because I’m writing it down. There’s a psychological piece behind putting a pen to paper on goals and the way it processes different in our brains. Prior to this, it was all electronic and automatic so I didn’t feel the commitment to my budget.

Brandi Jo

BUDGET PLANNER FAQ

Can I begin using The Budget Planner at any time, or do I need to wait for the first of the month?

You can start any time! Start filling out the planner for your current month. You'll want to stay on track once you get started, but you can start at any point in the year.

Do I have to follow Budget Boot Camp or Productivity Boot Camp in order to use the planners?

Definitely not! The Budget Planner and Productivity Planner make the ultimate companions to our Boot Camp programs, but it is not necessary that you have both a planner and program to be successful.

Will there be other cover design options made available in the future?

Yes we’re planning on it! Make sure to stay tuned to our email newsletter for the latest product announcements.

When will The Budget Planner and the Productivity Planner be re-stocked?

Are we out of stock? Be sure you're signed up for our newsletter to stay in the loop with the latest! You can also sign up to receive text messages by texting FCFTEXT to 833-520-0668.

I have an idea for how to improve the planner. Where can I share it?

Ooo yay! We LOVE feedback. Please visit our Contact Us page and send us your ideas!!

Want to propel your budgeting skills a few steps further? The Budget Planner is the ultimate companion for Budget Boot Camp!

WHERE TO GET OUR BUDGET PLANNER

If you'll click on over to The Page Company website, you'll be able to find The Budget Planner, plus a few more items while you're there! 😉

NEED A LITTLE MORE HELP?

Don't forget about my Secret Sauce online budgeting program, Budget Boot Camp! BBC is a super fun 27-video program that makes money easy to understand. All you need is a screen and you're set!

And don't forget, if you don't save at LEAST what you paid for the program, I'll refund every dime. You've got nothing to lose (except your debt)! Use the code FCFBLOG to get an extra 10% off, because I love you 😉

Make sure that you check out these other helpful articles!

- New to this whole budgeting thang? Go read this post to help you figure out why you need to start budgeting before you do anything else!

- Learn how to build your credit so you can make purchases when you're ready.

- Learn how credit cards work so that you know what you're getting yourself into.

- Get tips on how to improve your credit score if you need some help in that department.

- We've got the top reasons that couples fight over money, then how to STOP that fighting!

XOXO,

Hello, I came across your info with doing a search on youtube on ‘how to create a budget”. I dont even know where to begin so I need some help. I have around $7000.00 in credit card debt a car loan of around 12,000. I live with my parents so I dont have have a mortgage. My parents and I had covid and we are all fine. Grateful that we didnt have any side effects but during that time it really got me thinking about my future. I am 51 years old and I have always loved to shop. I need to get a budget and pay off these credit card bills and have a savings BUT I get overwhelmed of where to begin. If you could help me with what I need to do and if I have any questions can someone help if I have questions, I would grately appreciate.

Thank you for sharing! We have so many great, free resources on our YouTube Channel here -https://www.youtube.com/c/JordanPageFunCheapOrFree and here on our blog under “Budgeting” if you want to really deep dive into finances and make a plan then our Budget Boot Camp course is for you, You can check that out here: https://funcheaporfree.com/why-you-need-budget-boot-camp/. We completely understand being overwhelmed but you can do this. We all have to start somewhere.