Credit card debt can literally suck the soul out of you. It's time to stop it in its tracks! Learn how to pay off credit card debt in a way that works best for your budget and personality. Kick your debt to the curb using our free printable tracker!

Credit card debt is no joke! Who would've thought that a harmless little plastic rectangle could get you into so much dang trouble? Seriously, a swipe in person or a few clicks online can really rack up the debt. We've been there, done that with the whole “in debt” thing, so don't feel bad if this is you!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Since we've navigated those shark-infested waters before, we've got a few tricks up our sleeves to help you out. Use our tried and true methods on how to get out of credit card debt fast and you'll be safe on land in no time. Put your mind to it and you'll be able to kick that debt to the curb, woot woot! We even made some free printable credit card debt trackers for you so you focus on your goals. Be sure to print those out and use 'em!

WHY PAY DOWN CREDIT CARD DEBT

Before we get started on how to pay off credit card debt, let's have a little refresher on why you want to get out of it as soon as possible! (We go over this in great detail in our “how do credit cards work” post, so be sure to check that out!)

All credit cards have an annual percentage rate (APR) you're charged if you don't pay your card off each month. Sure, there are some cards you can sign up for that start at 0% interest for an introductory period. But once that time is up, you have to pay that card off monthly if you don't want to pay extra in interest fees. Trust us, you don't want to pay anything extra in fees… That's just throwing your hard-earned money down the drain!

Once you start accruing interest, it's accrued on the daily. Yes, you read that right! If you can't pay your credit cards off and you're still using your cards regularly, then that interest owed just keeps increasing. Doh!

DON'T FORGET YOUR CREDIT SCORE

Yep, you read that right. It also harms your credit score when you're in credit card debt! If you borrow more than you can pay, you will likely go above and beyond your credit utilization ratio. (Remember, you want to keep this under 30% usage each month to help your credit score!)

HOW TO PAY OFF CREDIT CARD DEBT

Alright, now that you're on the up and up with credit cards, let's go over some tried and true methods to pay off that debt. You'll not only get the best options over how to pay off credit card debt that will work for your budget and personality, but also how to stay out of debt once you pay them all off!

We have a post dedicated to giving you the best tips for getting out of all types of debt you definitely don't want to miss out on! It has three different printable debt trackers that make paying off that debt fun and easy to keep track of. So be sure to check that out!

Oh, and we love you so much, we created some super cute and free printables to help you tackle your credit card debt as well! Be sure to print those and then we'll go over how to use those in a few.

STOP USING YOUR CREDIT CARDS

The first thing you want to do is stop using your credit cards if at all possible. You'll never be able to catch up if you're continually charging things to them! We understand that you may not be able to stop using them completely, but you want to cut down their use as much as possible.

Literally freeze your cards in a cup of water so you're not tempted to use them! You can also cut those bad boys up if you don't think freezing them will keep the temptation away. You should also go through all of your online shopping websites and apps and delete your credit card information. The convenience of online shopping makes it too easy to rack up that credit card debt!

DON'T CLOSE THOSE ACCOUNTS

Now, with all that being said, you really don't want to cancel your credit cards and close out those accounts. Remember that credit utilization ratio we talked about a little bit ago? Closing your accounts will lessen the amount of credit you have available to use. This will make that ratio even bigger, hurting your credit score even more!

The only time we suggest closing out an account is if you have to pay an annual fee on a card and you're okay with taking a ding on your credit score to get that off your plate. But you shouldn't even consider doing this until your debt is paid off and your credit utilization ratio is well under 30%.

MAKE A BUDGET AND STICK TO IT

This is the KEY to getting out of credit card debt fast! Dig deep and get into the nitty-gritty of your finances. Get our easy envelope budgeting system going and never look back! If the thought of figuring out a budget sounds daunting, never fear… We have the perfect resource that will walk you through it, step by step, and turn you into the budgeting master we know you can be!

Sticking to a budget will help you cut back on your spending. It'll keep you from going into further debt, and will also help you make a plan for your money. Give your money a purpose and let it work for you!

MAP OUT YOUR CREDIT CARD DEBT AND MAKE A GAME PLAN

Before you can focus on paying down your credit card debt, you need to know exactly what you're working with. Grab a piece of paper, your handy dandy Budget Planner, or open up a spreadsheet on your computer. Pull up all your credit card accounts and jot a few specifics down:

- Credit card name/last 4 digits (this will help you know which card you're working on if you have two Chase cards, for example)

- Amount owed

- Interest rate

- Due date

- Minimum balance

Once you have those specifics, it's time to get real! Accept the debt for what it is…mourn, freak out, whatever you have to do, then pump yourself up because you. can. do. this. It will be hard, no doubt, but you're about to do something amazing!

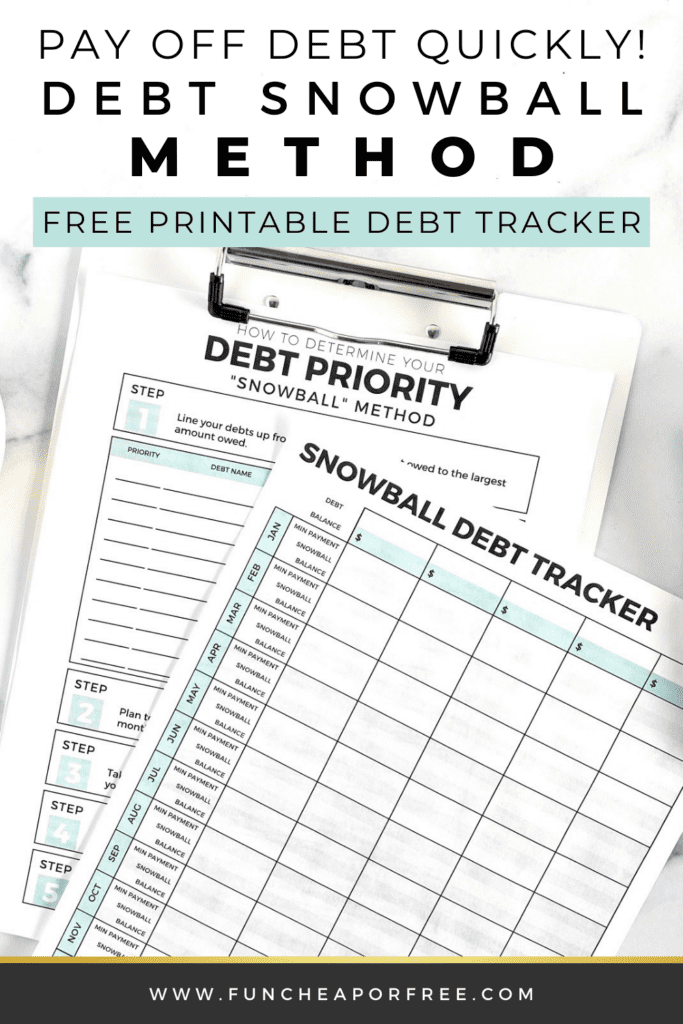

THE DEBT SNOWBALL METHOD

Now you have all of your credit card debt information in front of you, it's time to decide how you want to go about tackling it. We suggest the debt snowball method the most! Here are the basics:

- Line your debts up from the smallest amount owed to the largest amount owed.

- Plan to pay the minimum amount owed on all credit cards monthly.

- Take whatever money you have left over in your budget and throw it all at your smallest credit card debt. Do this every month until you have this card paid off in full!

- Once you pay a card off, take the amount you were paying on it monthly and put it towards your next smallest credit card debt. Do this until you pay the card off in full.

- Keep snowballing your debt like this until all of your credit card debt is paid off!

So simple, right? Print off our free printable debt snowball tracker, fill it out, and get to crushing that credit card debt!

THE PROS AND CONS OF THE DEBT SNOWBALL METHOD

Like everything in life, there are pros and cons to paying off your credit card debt with the snowball method. It's all about achieving those small wins right off the bat. You're a lot more likely to pay off a card quickly, which will motivate you to keep going and pay off the next one, and so on.

The downfall is that you're still paying interest on the cards, and the card with the smallest amount you're paying off first may not necessarily have the highest interest rate. You end up paying a little more in interest with the snowball method, but it's worth it to keep you motivated, in our opinion!

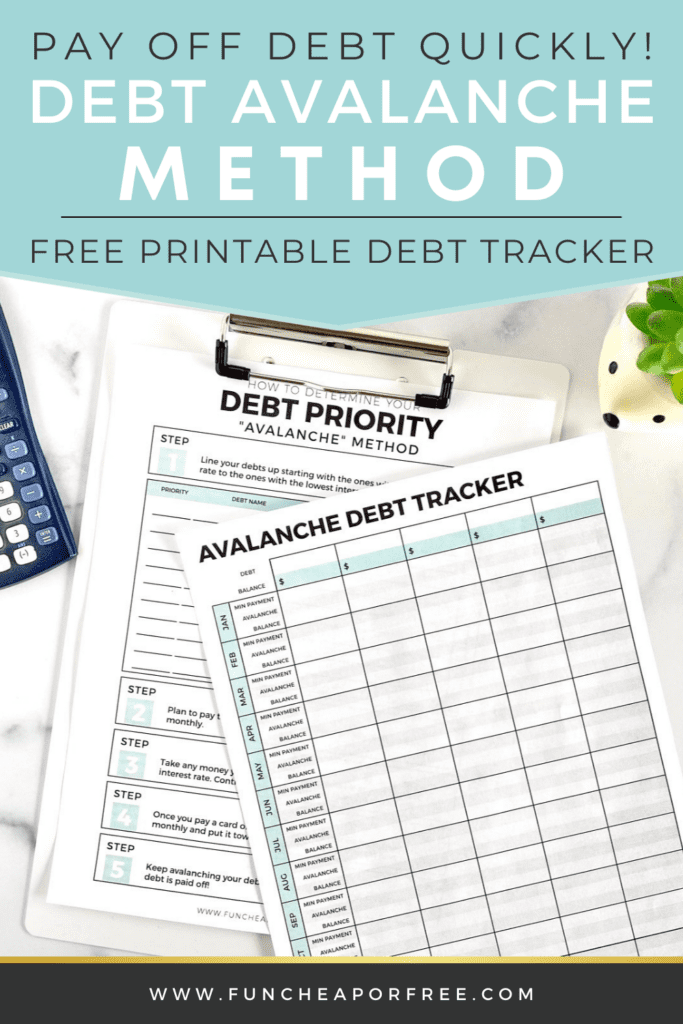

THE DEBT AVALANCHE METHOD

If you don't necessarily need small wins to keep you motivated and saving money is your motivating factor, then the debt avalanche method is the best way for you! Here's how it works:

- Line your debts up from the highest interest rate to the lowest interest rate.

- Plan to pay the minimum amount owed on all credit cards monthly.

- Take whatever money you have leftover in your budget and throw it all at your credit card with the highest interest rate. Do this every month until you have this card paid off in full!

- Once you pay a card off, take the amount you were paying on it monthly and put it towards the credit card with the next highest interest rate. Do this until you pay the card off in full.

- Keep avalanching your debt like this until all of your credit card debt is paid off!

See the difference between the debt snowball and avalanche? Print off our free printable debt avalanche tracker, fill it out, and show that credit card debt who's boss!

THE PROS AND CONS OF THE DEBT AVALANCHE METHOD

As you can probably guess, the biggest benefit to the avalanche method is all the money you'll save in interest fees by paying off those higher rate cards first. The downfall is how long it may take before you reach that first hurdle of completely paying the card off. Since it has the highest interest rate, there's a chance that it will have a larger amount than the other cards because the interest rate can really rack the amount up.

PAY MORE THAN THE STATEMENT BALANCE

If you really want to help crush your credit card debt faster, then pay more than the statement balance on whichever card you're focusing on! It'll go towards the principal owed, rather than toward the interest owed. This will help to lower how much interest you're charged. #Winning

You can also pay on your card multiple times a month as you have extra money available! This is a great way for you to stay on track and not be tempted to spend that money elsewhere. Sorry, Target. You're getting the boot for a bit.

DO A BALANCE TRANSFER

A balance transfer is another option you can look into when you're looking at your debts. As long as your credit score is high enough, you can transfer a specified amount (that depends on the card issuer) from one credit card to a new credit card at 0% APR. They usually stay at 0% for 12-18 months, but that all depends on the credit card company. But what exactly does this mean??

Basically, you'll have 12-18 months to pay off your credit card debt without it accruing any interest… Yes, you read that right! Okay, so what's the catch?

Usually, you're charged a balance transfer fee, which is a percentage of the amount you're transferring. It's rolled into the amount owed and is around 2-5%. Your credit score will also take a dip because you're opening a new line of credit. It won't last forever and will get better the quicker you pay off that credit card debt!

As long as you're okay with those two things, then a balance transfer can really take some pressure off your shoulders. You can only transfer the balance of one card, so make sure to weigh your options between the highest debt credit card and the highest interest credit card when doing so.

LOOK INTO A DEBT CONSOLIDATION LOAN

The last option to pay off credit card debt is to roll it all into one debt consolidation loan. This can work, but you have to be really careful with it! It's opening up a new line of credit that may be quite large if you have a lot of credit card debt, so it can really ding your credit score. But if you can find a loan that has a lower interest rate than your credit cards, it can save you money in interest.

Before you apply for the loan, talk to the bank to see if your credit score and income will be able to get you a loan. If you're not guaranteed to get the loan, then there's no sense in applying since it'll be counted as an inquiry on your credit and lower your score. We're all about protecting that credit score, Freebs!

LET BUDGET BOOT CAMP HELP

If all of this sounds fantastic but you would like some extra hand-holding during the process, then Budget Boot Camp is for you! It's our fun, online video program that makes managing your finances and getting out of debt a breeze. Check out what we're talking about…

Sounds awesome, right? We know you'll love it so much that we even have a 100% money-back guarantee! Plus, you can use the code FCFBLOG for 10% off at checkout. You're welcome. 😉

HOW TO STAY OUT OF CREDIT CARD DEBT ONCE YOU'RE FREE

Once you reach your financial goals of paying off your credit card debt, you're going to want to shout it from the rooftops. Go for it and celebrate! You deserve it and you should be proud. But don't allow yourself to fall back into your old ways after you've worked so hard!

We're gonna tell you like Hagrid told Harry (sorta)… Stick to your budget! Only go back to using your credit card if you can trust yourself to use it properly, especially if you were using multiple. It's okay to use your credit cards as long as you're sticking to your budget and completely paying off the balance every month.

If you don't think you're ready to use credit cards again, then switch to debit cards, prepaid cards, or cash. It may be hard, but it's worth it until you can get into your new normal!

Whew, well there you have it! You now know how to pay off credit card debt and you are ready to kick it in the teeth. Good luck! Let us know if you have any questions in the comments!

Looking for more great ideas?

- Use the 3-month budget rule before making any big purchases!

- A monthly budget is so yesterday… Try a weekly budget instead!

- Keep your money organized and give it a purpose with 7 bank accounts!

Go kick that credit card debt to the curb!

You and your husband are such an inspiration to me. Thanks for writing! I love your blog!

I really enjoyed this post! 🙂

I just recently discovered your site. I am SO glad I did! I loved reading this post. It helps put in perspective the things I NEED to do, but have been trying to avoid. But if I seriously want this debt GONE, I need to start making the temporary sacrifices in order to make it a reality. Thank you so much! I look forward to reading more. =)

Wahoo, I’m all pumped up to get back on track now! I CAN do it!

Yes you can! And good luck!! XOXO

Jordan, I’m so happy I’ve found you. I researched the snowball/avalanche method through Dave Ramsey but you simplify it so much better on a lifestyle scale (living month to month realistically). My husband and I have been trying to pay down our debt, and what originally looked like ten years (not including our mortgage), has now been significantly lowered to a realistic 2.9 years if we keep this up! We don’t have much in savings because right now we’re living literally paycheck to paycheck, 63% of our monthly income is spent on loans alone (including mortgage+insurance), 21% goes into utilities (power, water, internet) and the other 16% is usually split for groceries, extra payments into debt and our savings account. We are having trouble deciding though – our house is needing a roof replacement; it maybe has another year left in it’s lifespan (we bought this home last year). Should we stop putting extra into our debt in order to try and save for roofing materials? We’re not contracting out, so materials are coming out of our pockets and we need around 9k to do so. Or should we take out another loan?

amazing!

Girl…you are talking some beautiful and honest laungage! I love it and am also slightly intimidated by it! I want to be you! But for real. I want to have the finance shiz down. And I know with your program I can make it happen!