Overspending happens to the best of us. Luckily for you, we've got some tried and true ways to help you bounce back when the inevitable happens. Not only that, we're also bringing you some great tips on how to stop overspending for good! Buckle up, buttercup, things are about to get wild and crazy. 😉

I may be extremely frugal. My husband and I may be pretty disciplined. We may be used to living on a very strict budget. And the simple fact that we pulled ourselves out of incredible debt and a scary financial situation might even give us an A+ in lessons learned in the school of the Hard Knocks. But… I still overspend sometimes. Gasp! Crash! Glass breaks! Tires screech!

*Note: When you click the links in this post, we may receive a commission at no extra cost to you.

Whaaaat?? It's true! How is it that I still mess up even though I have plenty of tools (and lessons learned) to keep me on the straight and narrow? Simple. I'm human. We all overspend at some point or another. I don't know ANYONE who can be absolutely perfect with their spending, 100% of the time, 365 days a year, for their entire lives.

I'm sorry, but I just don't think it's possible! Life happens. Stuff happens. Impulses happen. Poor judgement happens. Fun times MUST happen. Whatever it is, once in a while spending too much just. plain. happens. The real secret to financial success is not as much about avoiding overspending as it is to learn how to recover successfully once you do so. To clarify, don't misunderstand me here… Of course I'm not encouraging you to overspend and certainly not encouraging you to justify doing so. I simply want to give you the tools to help you recover when the inevitable (overspending, that is)…happens. So let's get to it!

HOW TO GET BACK ON TRACK

Okay, so you've just overspent the budget. If it's just by a little bit, then you should be able to cut back on something and that'll help you bounce back to normal. But what about when you really go over and you're not sure how you're going to get back on track after overspending?

It's simple, really. Think of it this way…

THE DIET PRINCIPLE

Over time, I've come to think about budgeting and finances like a diet. Let's say you're trying to lose weight. Whether it's 5, 10, or 100 pounds, it's the same. You watch what you eat, count calories, and make a conscious effort to eat less. But let's say your friends throw you a birthday party and make you a gorgeous birthday cake. When they serve the cake, what do you do?

Do you go without? Sure, that would help you stick to your diet. But what if you really, really, reeeeeeally want it? Or what if you should eat it to not offend your friends? What then? Is your diet completely ruined forever?

No! You simply find a way to make up for it. Maybe you run a little longer the next day. Maybe you skip dessert the next night. Eat a salad for dinner. When you eat more calories than you should, you simply balance out your calories throughout the week to make up for it.

For the average person, it's not realistic to think that you won't eat dessert for the rest of your life. Sure, it can be done. But really, is that practical? And most importantly…is that the kind of life you want? I say…eat the dang cake!

Don't eat it every day, and certainly don't eat the whole cake…but for heaven's sake, live a little! You just have to accept the fact that if you “eat the cake,” you must sacrifice something somewhere else. You can't have your cake and eat it too, after all! 🙂 Once you wrap your mind around this “Diet Principle,” it makes budgeting SO MUCH easier! It's about consistently changing numbers around to make it all equal out at the end of the month.

BALANCE YOUR SPENDING

The people I know who are healthiest, fittest, strongest, and most importantly happiest, are the ones that have learned to live with balance in their lives. If they want cake, they eat cake. BUT…they know the consequences of eating the cake and do so wisely and sparingly. And then, when they do eat the cake, they make up for it somewhere else. It's all about give and take.

Now, keep in mind, I'm not ACTUALLY talking about weight loss here. But in your mind, if you replace the word “diet” for budget and “calories” for dollars, then it works just the same for finances. Whoa, lightbulb! If your finances are in poor shape, then you might need to completely “skip the cake.” Just like those who are trying to lose lots of weight quickly and effectively. But once that “hard-core diet” time is over, you have to learn how to live with food. The trick is to make good choices 95% of the time, and to learn to effectively make up for the other 5% the rest of the time.

HOW TO FIX OVERSPENDING

So, you ate the cake overspent. How do you fix it? Do these few simple things and you'll be back in your normal spending routine in no time!

SPENDING FREEZE

I do this quite often. Let's say we have a “bad week” and I go over budget on groceries. I will literally FREEZE my spending that next week. I'll make a conscious effort to avoid spending any money for a few days, half the week, or even the entire week to make up for it.

This is NOT impossible! It's amazing what you can do when you put your mind to it. You may have to say NO to tough things (a great sale, lunch with the girls, morning coffee at the drive through…) but you chose to “eat the cake,” so you chose to pay the price somewhere else!

If you go WAY over budget, you might need to have a serious freeze, for two weeks or longer… however long it takes to make up for the overspending. Other than absolute necessities, NO spending, no matter what!

For meals, I simply dig through my pantry and freezer and only cook with things I have on-hand (hello, shelf cooking). No grocery trips allowed!

CHECK YOUR MINDSET

You need to step back and assess whether you're truly motivated to succeed or not. You can't think, “Oh, it's okay for me to buy this even though I'm over budget. I'll just figure it out later… it'll work itself out.” That defeats the purpose of a budget! If you're going to do it, do it right. Don't set yourself up to fail! The “Diet Principle” is to help you be realistic about your diet, not to help you cheat on it. “Overeating” may feel good for a time, but are the lasting effects worth it?

REASSESS YOUR BUDGET

Let's be real, here. If you are constantly, consistently going over budget (and you're really, actually, truly trying not to), then your budget might just need to be upped. Be reasonable, but be realistic. Watch your budget for 3 months before making any changes so you give it a fair shot. BUT – if you up your budget on something, that means you will have LESS budget for something else. Give and take, people!

AVOID OVERSPENDING AGAIN

As you know, I am a big believer in credit cards. I love them for the security, benefits, and the digital tracking. BUT, overspending with cards can be waaaaaay too easy. If you are easily tempted to go over with your credit cards, then consider using a prepaid card until you can get it under control. They give you all the safety and tracking perks of a card and you can automatically load money on the cards. But when it's gone, it's gone! You can also take it old school and use cash until you get your budget back to normal.

FIND EXTRA WAYS TO MAKE THAT MONEY BACK

Another way to help bounce back after overspending is to think outside the box and find ways to “make that money back.” Here are just a few of the ways that you can do that:

- Return Items – If you went a little bit too crazy at the store, return what you don't need! There's no shame in returning things and most of the time, the stores don't care as long as you have your receipt and the tags are still on it.

- Sell Things – Have some stuff lying around the house that you don't use anymore? Or maybe some things that you do use, but you really need the cash? Sell them! Facebook Marketplace is the perfect place to do that. Get scrappy, people. We sold our couches and sat on the floor and lawn chairs in our living room when we were strapped for cash.

- Get a Side Job – Where there's a will, there's a way! We have lots of ideas on ways to make money from home that you can start doing right now.

- Use Rakuten – If you shop online, and have to shop online (not just want to), be sure to use Rakuten every time you do! It's so simple to use and you get paid to shop at the retailers that you would've been shopping at anyways. Use THIS link and first-time users get $10 back on your first $25 spent. Free money? Yes, please!

You might not have thought it was possible, but you really can bounce back quickly after overspending with all of those tips!

HOW TO STOP OVERSPENDING OVER AND OVER

Is overspending a continual problem in your house? If your immediate answer isn't no, then we've got a few things to do that will help you stop overspending!

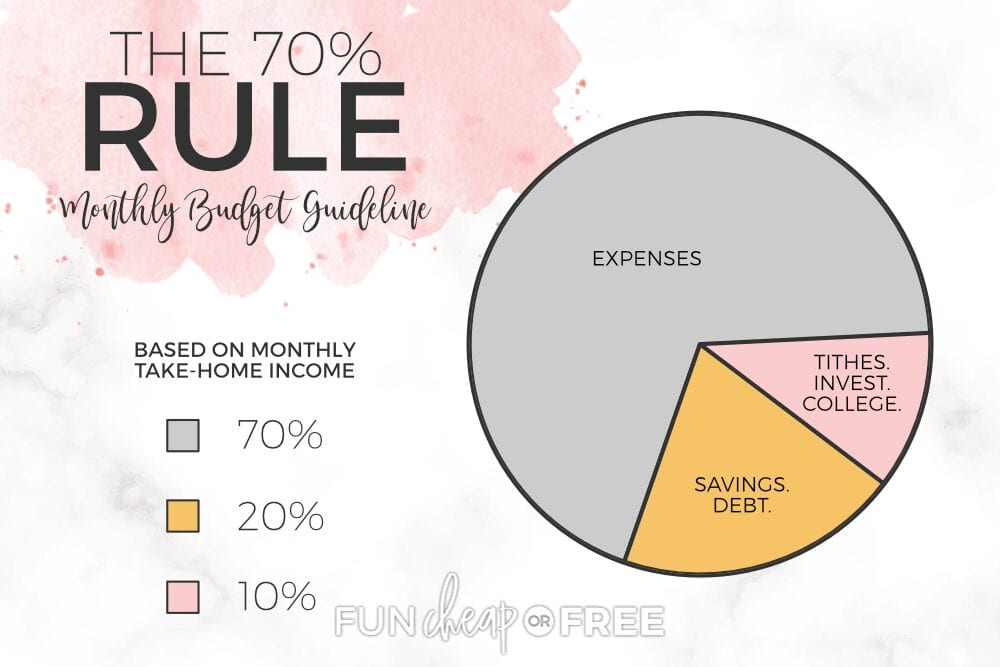

STICK TO THE 70% RULE

First of all, figure out what your take-home income is that's actually hitting your bank account each month. Once you have that figured out, keep your spending to 70% of that! That includes all monthly expenses, such as mortgage, utilities, bills, groceries, hair cuts, fun money, etc. Then, 20% will go towards debt/savings and 10% goes towards tithing or investing.

FIND YOUR WHY

Why do you want to keep your budget under control? You need to come together as a family and figure out why you want to get your spending under control. Let's take it back to the “Diet Principle” for a minute. Why are you wanting to diet? To lose weight, get healthy, or because all the cool kids are doing it? Chances are, you have a lot higher possibility of reaching your dieting goals if it's for a specific purpose rather than because it sounded like a fun idea.

It's the same for your finances! You won't be able to stop overspending until you find your why, set financial goals, and find the reason to get it under control. Maybe it's to become debt-free so you can get out from under that constant pressure. Or you want to buy a house and need to save all the money you can before you start looking. It could even be as simple as wanting to go on a dream family vacation! Find your why and you'll be on your way to sticking to your budget.

TRACK YOUR BUDGET TO KEEP FROM OVERSPENDING

Is part of your overspending problem due to the fact that you're having a hard time tracking everything? Boy howdy, do we have the perfect solution for you! Start using my super easy envelope budgeting method and never wonder where your money is going again. It's so easy to keep track of and it keeps from making your budget over complicated.

For all those techies out there, check out Mint! It'll track all of your spending for you right on your phone. I live and breathe the envelope budgeting method, but my hubby prefers Mint. You gotta do what works best for you to help keep you from overspending!

GET ON THE SAME PAGE

There's no way that you and your spouse will both be able to stop overspending if you're not on the same page! You need to sit down together, have a money date, and discuss how you both need to stop overspending money. I promise, this will work! Even for those spouses who like spending money and you just want them to stop already…

So there you go! I hope you see that being financially secure is all about learning to stay balanced. What are your tried and true ways to bounce back after overspending? Let us know in the comments!

Need even more help getting your budget and finances in order? Budget Boot Camp is your answer! I put my heart and soul into this fun video program to help people just like you. Why? Because there was nothing like it out there!

So fun! I'm so sure you'll love it that I offer a 100% money-back guarantee. Plus, use the code FCFBLOG for 10% off at checkout because why not??

Looking for more greatness from Fun Cheap or Free?

- Wondering where to even start with budgeting? We've got you covered!

- Do you have an HSA? Learn all about them and why you should have one.

- Teach your kids why saving money is so important and the proper way to save their money to reach their goals!

Now, get out there and eat some cake! The literal kind 🙂

These are great tips. I’m constantly moving money around to make my money work for me so although I may be overspending here, I am probably taking it from somewhere else and we are fine!

mostly we all spending money on shopping and we can’t stop it but after reading this blog, I got some best ideas to avoid it. This blog is very helpful for all audiences to save money. Keep posting your ideas.

When I’m on a money freeze, I actually leave my debit and credit cards at home. I only take one card with me if I anticipate having to get gas. I’m pretty good at resisting temptation online at home, but if you aren’t, here’s a tip I saw once: put your card in a tray, fill the tray with water, and put it in the freezer. You’ll have to thaw out your card to use it, so you’re forced to wait on the purchase. It’s a literal money freeze! Talk about frozen assets! (*rimshot*) Thank you! I’ll be here all week folks!

Those are great tips! Thank you for sharing!!